Paying your monthly mortgage bill is an essential part of homeownership. For most homeowners, making that payment on time each month is a top priority. Chase Mortgage makes paying your mortgage bill easy and convenient through multiple options, including by phone. In this comprehensive guide, we’ll provide everything you need to know about paying your Chase Mortgage bill by phone.

Overview of Paying by Phone

Paying your Chase Mortgage by phone is one of the quickest and easiest ways to make sure your payment gets to Chase on time each month. With a simple phone call, you can pay your mortgage bill from the comfort of your home without having to mail a check or log in online.

Here’s a quick rundown of how paying your Chase Mortgage by phone works

-

Call the Automated Number You’ll call Chase’s automated mortgage bill pay phone number at 1-833-PayChase (1-833-729-2427) This automated system is available 24/7

-

Provide Account Details: The automated system will ask you to enter your account details, including your pay-from account’s routing and transit numbers. Have these handy when you call.

-

Confirm Payment Details: You’ll be able to confirm the payment details before the payment is processed.

-

Receive Confirmation Number: Once your mortgage payment is complete, you’ll receive a confirmation number for your records.

Paying by phone is fast, taking just a few minutes from start to finish. Chase’s automated system is available anytime you need to make a payment, day or night.

Benefits of Paying Your Mortgage Bill by Phone

Paying your Chase Mortgage by phone offers several benefits that make it a convenient option for many homeowners:

Quick and Easy – With just a phone call, you can pay your bill in minutes without having to leave home. The automated system is simple to use.

24/7 Availability – Chase’s bill pay line is open 24 hours a day, 7 days a week. You can make a payment anytime.

Payment Tracking – You’ll receive a confirmation number after the payment is complete so you can easily track your payment.

No Late Fees – Paying quickly by phone helps avoid late mortgage payments and those pesky late fees.

Flexibility – You can pay from any phone. And you can pay from any bank account simply by having your account details handy.

Paying by phone offers unbeatable convenience for homeowners looking for a fast, simple way to pay their Chase Mortgage on time each month.

Step-by-Step Guide to Paying by Phone

Paying your Chase Mortgage by phone only takes a few minutes. Here is a step-by-step guide to make paying by phone even easier:

Step 1: Call 1-833-PayChase (1-833-729-2427)

This is Chase’s automated mortgage bill pay number. Program it into your phone to save time each month. The automated system is available 24 hours a day, so you can call anytime.

When prompted, select the option for mortgage payments.

Step 2: Enter Your Chase Mortgage Account Number

The automated system will ask for your 10-digit Chase Mortgage account number. Enter this number using your phone’s keypad.

Having your account number handy speeds up the process. But even if you don’t have it, you can enter your Social Security number to access your account.

Step 3: Enter Details for Your Pay-From Account

Next, you’ll need to provide the account details for the bank account that you want to make the payment from. This is called your pay-from account.

You’ll need to enter the routing number and account number for your pay-from account. Have these handy when you call.

You can pay your Chase Mortgage from a checking or savings account at Chase or any other bank. Just make sure you have the account details ready.

Step 4: Confirm Payment Details

The automated system will recap your payment details and give you the amount of your mortgage payment. Listen carefully and confirm that all details are correct.

If anything is inaccurate, just say “no” or press 2 and you can re-enter the details.

Step 5: Receive Your Confirmation Number

After you confirm that the payment details are correct, the automated system will quickly process your payment. You’ll receive a confirmation number when the payment is complete.

Be sure to write down the confirmation number or save it in your phone. This is your proof that the payment was made and can help you track payments.

And that’s it! In just a few minutes you can pay your Chase Mortgage bill with ease.

Tips for Paying Your Mortgage by Phone

Follow these tips for smooth, successful payments when paying your Chase Mortgage by phone:

-

Call Early in the Day – Call early in the day to beat the late afternoon rush. Calling when many others are paying helps ensure no long hold times.

-

Save Time – Program the Chase bill pay number into your phone contacts so it’s readily available anytime you need to pay your mortgage.

-

Have Account Details Handy – Keep your account and routing numbers in an easy-to-access place so you don’t have to hunt for them when paying by phone.

-

Note the Confirmation Number – Be sure to write down the confirmation number you receive after paying. This provides peace of mind that your payment went through.

-

Check Online – Log into your Chase account online a day or two after paying by phone to confirm the payment went through on time.

Following these tips will help phone payments go smoothly and avoid any errors or issues in processing your mortgage payment.

Payment Questions Answered

Paying your mortgage by phone is fairly straightforward. But you may still have some questions about payments:

Does Chase offer an automated bill pay service?

Yes, Chase offers an automated system specifically for mortgage payments. Just call 1-833-PayChase anytime you need to pay your mortgage bill.

Can I use automated bill pay for other Chase accounts?

No, the 1-833-PayChase number is for Chase Mortgage payments only. For other Chase accounts, you’ll need to call the number on your statement.

When will my phone payment be applied to my account?

Chase posts phone payments to your account on the same day if received by 7:30 pm ET. Allow 2-3 business days for payments to be reflected in your account online.

Will I be charged a fee for paying by phone?

No, Chase does not charge a fee for paying your mortgage by phone using the automated system. It is a free service.

What if I don’t have my account number handy?

No worries. The automated system allows you to access your account by entering just your Social Security number if you don’t have your mortgage account number.

Paying your Chase Mortgage by phone is an easy process with many benefits. Use this comprehensive guide to make phone payments quickly and conveniently each month. Just call 1-833-PayChase anytime you need to pay your mortgage bill.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages wont work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

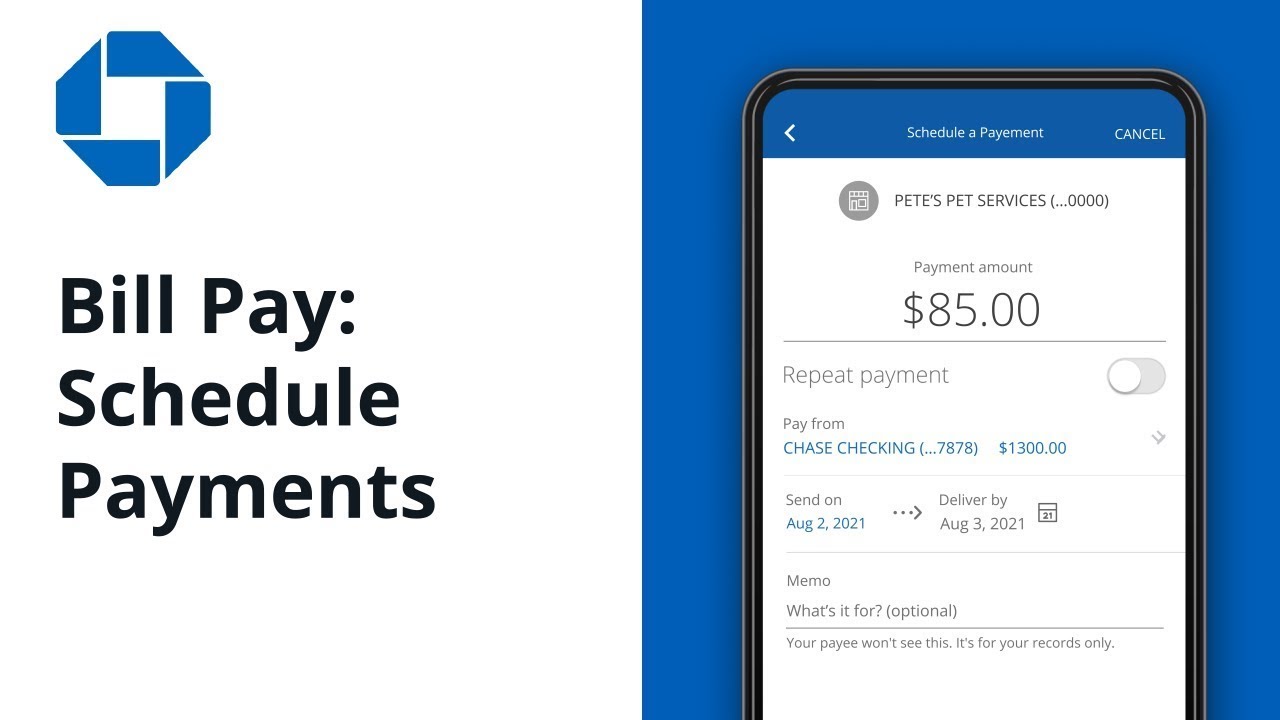

Yes, you can make a payment from a deposit account at Chase or another bank. You can set up either one through chase.com or on the Chase Mobile® app

Sign in at chase.com, choose your mortgage or home equity account and choose “Set up” located under “Amount due”.

- For a mortgage account, you can choose “Monthly,” “Twice a month” or “Every two weeks”.

- Home equity accounts can be paid monthly.

You don’t need to remember or worry about missing a payment.

If you set up automatic payments with Chase, we will automatically update your payment amount after any changes due to escrow (taxes and insurance) or changes in your interest rate.

For mortgages: We will withdraw another payment automatically even if you’ve made a payment through a branch, online, mail or phone. We would apply this automatic payment to the next payment that’s due.

For home equity loans and lines of credit: We wont withdraw another payment automatically if you’ve made a payment through a branch, online, mail or phone.

Call us at 1-833-PayChase (1-833-729-2427).

You can make these additional one-time payments on chase.com or the Chase Mobile® app. With the automatic payments program, you can also have additional principal added into each payment.

Sign into your chase.com account and follow these steps:

- From your mortgage loan account, choose Pay Mortgage

- Choose the Principal/escrow/fee only option

- Enter the shortage amount you want to pay in the Additional escrow/shortage and choose Pay this bill

Youll see your payment reflected online within three days. If youre signed up for flexible payments, youll be able to see your payment online in “unapplied” funds. Once you have made all of your payments for the next full monthly installment, well post your payment.

Generally, yes, as long as you’re current with your mortgage and you haven’t given us other instructions.

We’ll post your payment today if we receive it by 7:30 PM ET.

You should see your payment online within three business days. You may be charged a late fee if you don’t make a full payment by the end of your grace period.

The amount of interest you pay monthly on a mortgage is determined by your interest rate and the remaining principal balance. We use the last month’s principal balance to calculate the amount of interest due. We apply the rest of your payment to principal and escrow as needed.

No, as long as you make it within grace period.

Your feedback is important to us. Will you take a few moments to answer some quick questions?

Can I pay my Chase Mortgage by phone?

FAQ

Can I pay my mortgage over the phone?

What number is 1 800 242 7338?

What is the number for 1 877 242 7372?