Having your Bank of America Bill Pay service suddenly inactivated can be frustrating and disruptive As I learned firsthand, this unfortunate situation leaves you scrambling to get payments out on time In this comprehensive guide, I’ll explain what Bill Pay inactivation is, why it happens, and most importantly – how to get your critical payments flowing again ASAP if you ever find yourself in this spot.

What is Bill Pay Inactivation?

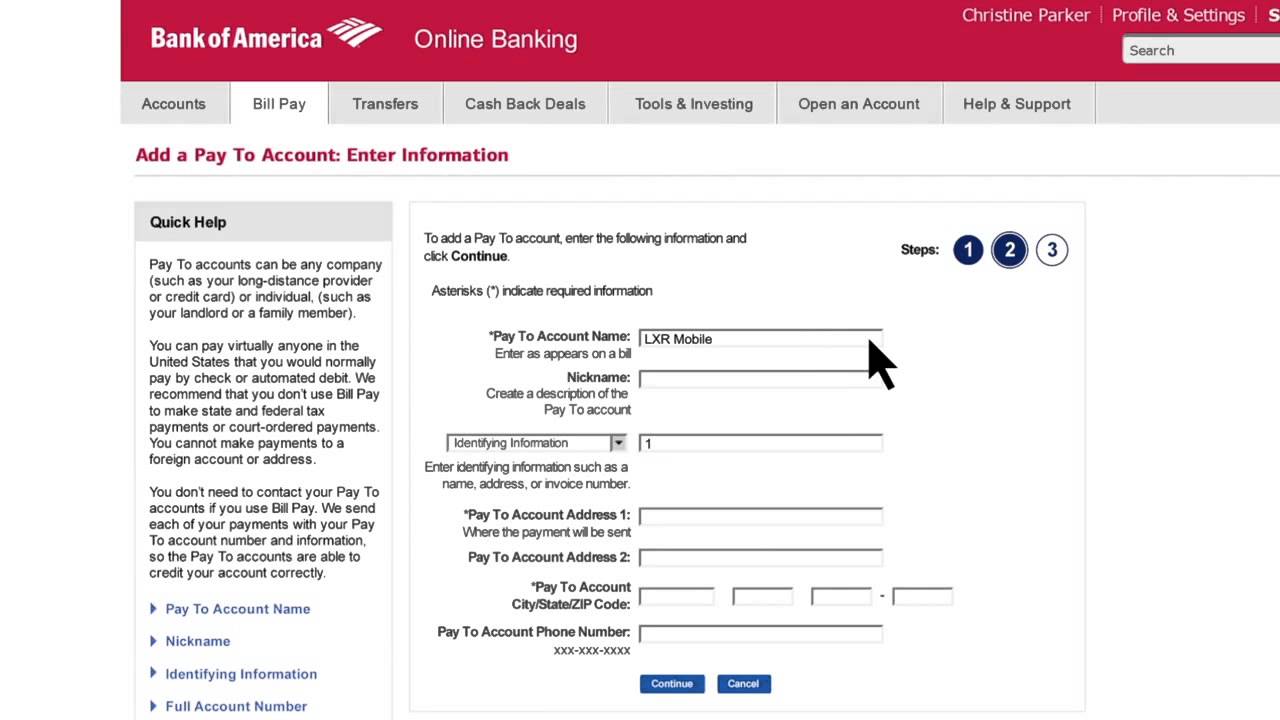

Bill Pay is Bank of America’s online bill payment service that lets you schedule one-time or recurring payments to companies and individuals. It can be used to pay everything from your monthly utilities and insurance bills to sending money to friends and family.

Inactivation refers to Bank of America disabling your access to use Bill Pay. When this occurs, all your upcoming scheduled payments are canceled. You’ll get an email saying your Bill Pay service has been inactivated and any pending payments deleted.

This means you can no longer log in to pay bills through Bill Pay until the inactivation is resolved Having this vital service halted without warning is incredibly disruptive

Why Would Bank of America Inactivate Bill Pay?

There are a few key reasons Bank of America might suddenly inactivate your Bill Pay:

-

Account issues – If your bank account becomes overdrawn or is flagged for potential fraud, Bill Pay may be frozen as a precaution.

-

Information needed – You may be asked to provide updated personal information for identity verification purposes. Failing to do so can trigger Bill Pay inactivation.

-

Inactivity – Not using your Bill Pay service for an extended period can cause Bank of America to disable it.

-

Mistake – In rare cases, your Bill Pay could be inactivated incorrectly by accident. Computer glitches happen.

Regardless of the reason, having your Bill Pay deactivated without warning is massively disruptive and stressful.

How to Reactivate Inactivated Bill Pay

If you receive that dreaded “your Bill Pay has been inactivated” email, stay calm and take these steps:

1. Contact Bank of America customer service immediately. Explain that your Bill Pay was suddenly inactivated and ask why. Be prepared to answer security questions or provide any requested info.

2. Request reactivation of Bill Pay. Emphasize that you rely on Bill Pay for critical payments and need service restored ASAP. Ask for a timeline.

3. Inquire about pending payments. Find out if any payments were returned or rejected during the blackout period. You may need to contact payees.

4. Update your payment details. Once Bill Pay is reactivated, double check all your payee info, accounts, and scheduled payments are intact.

5. Consider switching banks. If Bank of America can’t provide a satisfying explanation and resolution, it may be time to take your business elsewhere.

Having your Bill Pay unexpectedly deactivated is not something any bank should do lightly to a customer. Don’t hesitate to push back or threaten to leave if they can’t promptly fix the issue.

Alternative Bill Payment Options

While you work to get your Bill Pay reactivated, you need backup options to keep critical payments flowing on time. Here are some alternatives to avoid late fees and service disruptions:

-

Pay directly on company websites – Many major utilities and service providers allow you to pay your bill directly on their website using your bank account or card information. Setup can take just minutes.

-

Use your bank’s online banking – Your bank likely allows you to pay bills directly from your account even without Bill Pay. Just add payees in online banking and schedule one-time or recurring payments.

-

Mail checks – Old school but reliable. Get paper checks out in the mail well in advance of due dates.

-

Pay in-person – Visit local providers like utility companies in person to make one-time payments by cash, check, or card until you regain Bill Pay access.

-

Use money transfer apps – Apps like Zelle, PayPal, Venmo, or CashApp can be used in a pinch to pay other people and businesses electronically.

With a combination of these options, you can hopefully avoid major disruptions while resolving your Bill Pay inactivation issues with Bank of America.

Could It Be Intentional?

As frustrating as accidentally losing access to Bill Pay may be, I did wonder whether my inactivation was actually deliberate on Bank of America’s part. Here are some reasons why banks might intentionally deactivate services like Bill Pay for certain customers:

- To increase fees from services like wire transfers or checks

- To push customers toward “upgraded” accounts with monthly fees

- Retaliation for not meeting minimum balance or activity requirements

- To prompt customers to call so they can make sales pitches

- To eventually close accounts they deem unprofitable

While there is no proof of intentional foul play, it does make you think twice about the true motivations behind your bank’s actions.

Preparing for Potential Bill Pay Disruptions

To avoid panic if your Bill Pay is ever deactivated, take the following precautionary steps:

- Maintain an alternative payment account as backup.

- Keep payee contact info, account numbers, and mailing addresses handy.

- Sign up for paperless billing and keep PDF copies to reference.

- Review account terms to understand what can trigger service suspensions.

- Download Bill Pay history for your records before issues arise.

Monitoring your account closely is also key – don’t ignore vague emails or account notifications. Being prepared reduces stress if the worst happens.

Weighing Whether to Leave Bank of America

If Bank of America drops the ball on communicating and reactivating your Bill Pay, it may be time to reevaluate your relationship. Consider these factors when deciding whether to take your business elsewhere:

- How long have you been a customer? Is there loyalty on both sides?

- How often do you rely on Bill Pay for key payments?

- What value do you get from Bank of America services?

- Does alternate payment access resolve most issues for you?

- How responsive and caring was customer service through the problem?

- How easy is it to switch banks and move bill payments?

Every situation is unique. But losing access to a critical service unexpectedly should make any customer question whether the bank truly has their back.

Key Takeaways on Bill Pay Inactivation

Having your Bank of America Bill Pay deactivated without notice is incredibly disruptive and concerning. By understanding common causes, reactivation steps, and alternative payment options, you can limit the headaches if it happens to you. But the ordeal should prompt serious reflection on whether you can trust your bank long-term. Losing loyalty and trust is difficult to regain.

Warning: Automatic Bill Pay

FAQ

What is the meaning of Bill Pay services?

How does a bill paying service work?

Can you stop a Bill Pay check?