As you navigate the complexities of the Medicare system, it’s crucial to understand the limitations and restrictions that come with your coverage. While Medicare provides a vital safety net for millions of Americans, it’s not an unlimited resource. In this comprehensive guide, we’ll explore the lifetime limits imposed by Medicare, helping you plan and prepare for potential out-of-pocket expenses.

The Concept of Medically Necessary Services

Medicare covers a wide range of healthcare services, but there’s a caveat – they must be deemed “medically necessary.” The Centers for Medicare & Medicaid Services (CMS) defines medically necessary services as those required to diagnose, treat, or prevent an illness, injury, disease, or associated symptoms, and meet accepted standards of medical practice.

As long as the healthcare services you receive are covered by Medicare and considered medically necessary, you can utilize them without facing coverage limits on your benefits. However, it’s essential to be aware of specific services that exceed Medicare-approved usage limits.

Services with Lifetime Limits

While Medicare provides extensive coverage, there are certain services that have lifetime limits or caps on the number of days or visits covered. Understanding these limits can help you plan and budget for potential out-of-pocket expenses.

1. Inpatient Hospital Care

Medicare Part A covers inpatient hospital care, but there are limits to this coverage:

- Benefit Period: For each benefit period (a period of consecutive days during which you’re admitted and discharged from a hospital or skilled nursing facility), Medicare covers up to 90 days of inpatient hospital care.

- Lifetime Reserve Days: If you need to stay in the hospital for more than 90 days, you have the option to use your 60 lifetime reserve days. However, once these reserve days are exhausted, you’ll be responsible for all costs associated with your hospital stay.

2. Psychiatric Hospital Stays

Medicare imposes a lifetime limit of 190 days for inpatient care in a freestanding psychiatric hospital. However, this limit does not apply to mental health treatment received as an inpatient in a general hospital.

3. Skilled Nursing Facility Care

For Medicare to cover skilled nursing facility care, you must meet certain criteria, including being formally admitted to the hospital with a doctor’s order. Even then, there are limits to the coverage provided:

- Days 1-20: Medicare covers the full cost.

- Days 21-100: You’ll be responsible for a daily coinsurance amount ($200.00 in 2023).

- Beyond 100 days: You’ll be responsible for all costs associated with your skilled nursing facility stay.

4. Therapy Services

While Medicare no longer limits the amount of coverage for medically necessary speech-language pathology services, physical therapy, and occupational therapy as an outpatient, you’ll still be responsible for a portion of the costs. Typically, you’ll pay 20% of the Medicare-approved amount for these therapy services once you’ve met your Part B deductible for the year.

Strategies to Mitigate Lifetime Limit Impacts

While Medicare’s lifetime limits can be concerning, there are strategies you can employ to mitigate their impact and ensure you have adequate coverage for your healthcare needs.

1. Explore Medicare Supplement Insurance (Medigap)

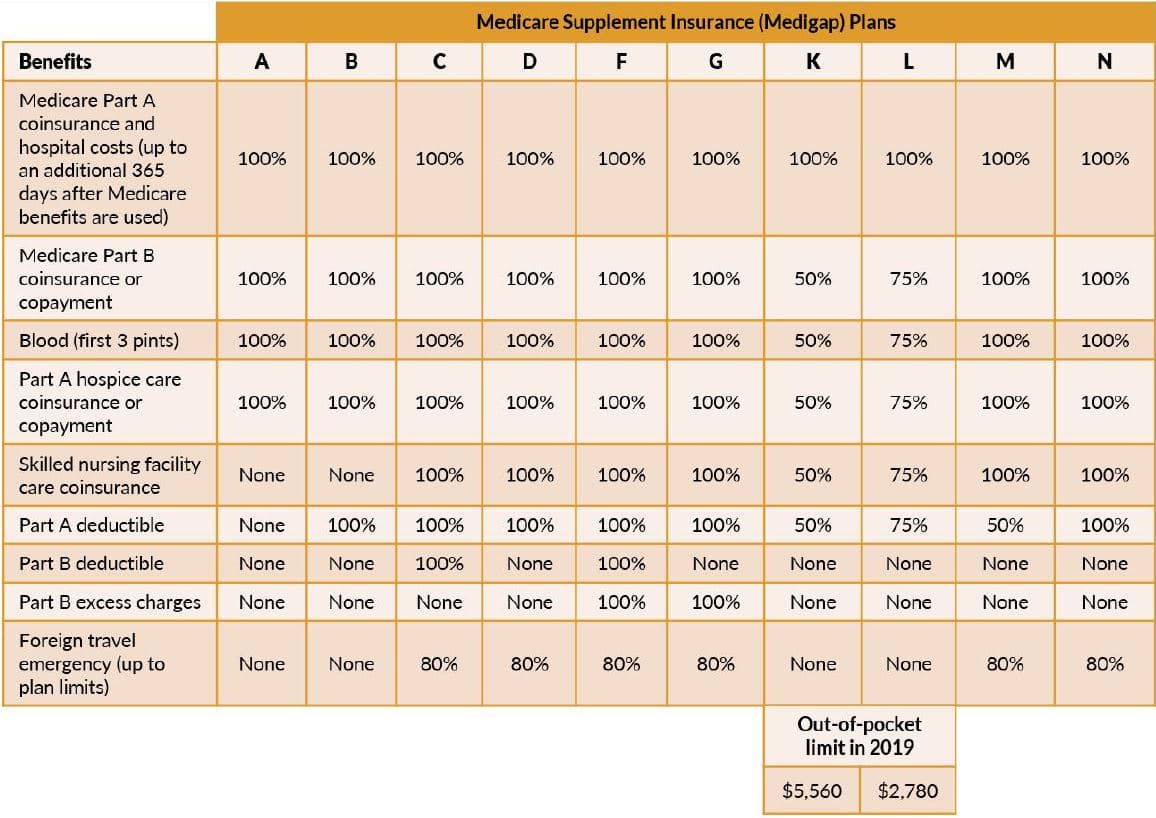

Medicare Supplement Insurance, also known as Medigap, is a private insurance policy designed to fill the gaps left by Original Medicare (Parts A and B). Medigap policies can help cover some of the out-of-pocket costs associated with Medicare’s lifetime limits, such as coinsurance and deductibles.

2. Consider Medicare Advantage Plans

Medicare Advantage plans, offered by private insurance companies, provide an alternative to Original Medicare. These plans often include additional benefits, such as prescription drug coverage, vision and dental care, and even fitness programs. Some Medicare Advantage plans may also offer more comprehensive coverage for services with lifetime limits under Original Medicare.

3. Utilize Long-Term Care Insurance

For those concerned about the costs of extended stays in skilled nursing facilities or long-term care facilities, long-term care insurance can be a valuable investment. These policies can help cover the costs associated with long-term care services that may exceed Medicare’s coverage limits.

4. Plan and Save for Out-of-Pocket Expenses

While it’s impossible to predict your future healthcare needs, it’s always wise to plan and save for potential out-of-pocket expenses. Setting aside funds in a dedicated healthcare savings account or building an emergency fund can help you better manage the costs associated with services that may exceed Medicare’s lifetime limits.

Conclusion

Understanding Medicare’s lifetime limits is crucial for effective healthcare planning and budgeting. While Medicare provides comprehensive coverage for many healthcare services, it’s essential to be aware of the services that have usage limits or caps. By exploring supplemental insurance options, considering alternative Medicare plans, and proactively planning for potential out-of-pocket expenses, you can ensure that you have the necessary resources to navigate these limits and maintain access to quality healthcare throughout your golden years.

Medicare Income Limits for 2023 | How Much Income is Too Much?

FAQ

What is Medicare lifetime limit?

Does Medicare have a maximum?

What is the cap for Medicare?

Can your Medicare benefits run out?