Medicare Part B is a vital component of the Medicare program, providing essential medical coverage for a wide range of services and expenses. Understanding what falls under Part B’s umbrella is crucial for individuals to make informed decisions about their healthcare and budget accordingly. In this comprehensive guide, we’ll delve into the various expenses covered by Medicare Part B, shedding light on the program’s scope and empowering you to navigate the intricate world of Medicare with confidence.

The Essence of Medicare Part B

Medicare Part B, also known as Medical Insurance, is designed to cover medically necessary services and preventive care for individuals enrolled in the program. Unlike Medicare Part A, which primarily covers hospital-related expenses, Part B focuses on outpatient services, physician visits, and other essential medical needs.

Expenses Covered by Medicare Part B

Medicare Part B offers a comprehensive range of coverage, encompassing a multitude of medical services and expenses. Here’s a breakdown of some of the key expenses covered under this part of the program:

Physician Services

- Doctor visits, including annual wellness visits and consultations

- Outpatient medical and surgical services

- Certain preventive services, such as cancer screenings and immunizations

Outpatient Care

- Services received at a hospital’s outpatient department, including observation services

- Ambulatory surgical center services

- Partial hospitalization for mental health and substance abuse treatment

Diagnostic Tests and Procedures

- X-rays, MRIs, CT scans, and other diagnostic imaging tests

- Laboratory tests and blood work

- Radiation therapy and chemotherapy treatments

Medical Equipment and Supplies

- Durable medical equipment (DME), such as wheelchairs, walkers, and hospital beds

- Prosthetic devices and artificial limbs

- Certain medical supplies, including surgical dressings and splints

Mental Health Services

- Outpatient mental health services, including visits with psychiatrists, psychologists, and clinical social workers

- Partial hospitalization for mental health treatment

Preventive Services

- Annual wellness visits and preventive care screenings

- Certain vaccinations, such as the flu shot and pneumococcal shot

- Counseling services for smoking cessation and alcohol misuse

Ambulance Services

- Emergency ground ambulance transportation to a hospital or skilled nursing facility

- Air ambulance transportation in certain circumstances

Limited Outpatient Prescription Drugs

- Certain outpatient prescription drugs administered in a physician’s office or hospital outpatient setting

- Oral anti-cancer drugs and immunosuppressive medications (in certain cases)

It’s important to note that while Medicare Part B covers a wide range of services, there may be deductibles, copayments, and coinsurance amounts that beneficiaries are responsible for paying. Additionally, some services may require prior authorization or have specific coverage criteria.

Key Considerations

When it comes to Medicare Part B coverage, it’s essential to keep a few key considerations in mind:

-

Coordination with Other Insurance: If you have additional insurance coverage, such as a Medicare Supplement (Medigap) plan or employer-sponsored health insurance, it may help cover some of the out-of-pocket costs associated with Part B services.

-

Provider Acceptance: To ensure full coverage under Part B, it’s crucial to receive services from healthcare providers who accept Medicare assignment. This means they agree to accept Medicare’s approved amount as full payment for covered services.

-

Preventive Services: Medicare Part B places a strong emphasis on preventive care, covering a wide range of screenings and services aimed at early detection and prevention of health issues.

-

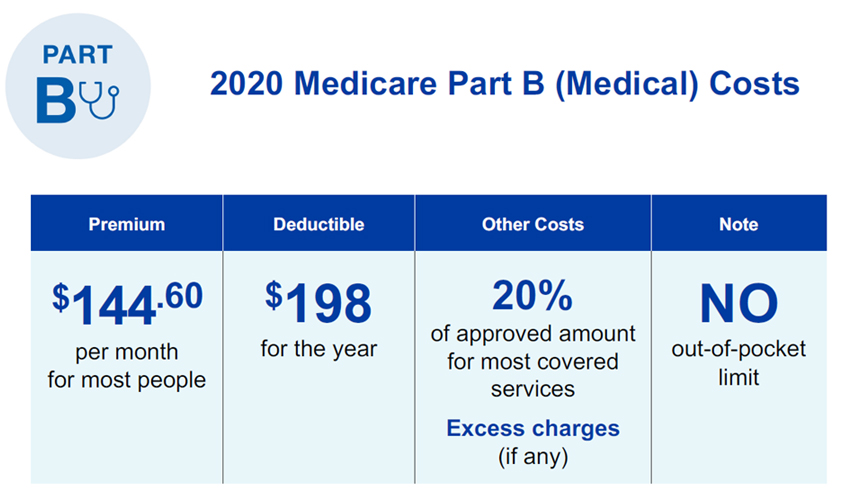

Enrollment and Premiums: Individuals must enroll in Medicare Part B and pay a monthly premium, which is typically deducted from their Social Security benefits or billed directly if they don’t receive Social Security.

By understanding the various expenses covered by Medicare Part B, you can make informed decisions about your healthcare needs and ensure you receive the appropriate coverage and support. Stay informed, plan ahead, and take advantage of the comprehensive benefits offered by this essential component of the Medicare program.

How Do You Pay the Part B Deductible?

FAQ

What expenses will Medicare Part B pay for?

What services are paid by Medicare Part B quizlet?

Which of the following expenses are not covered by Medicare Part A and Part B?

What does Medicare Part B bill for?