As you navigate the world of Medicare, choosing the right supplemental plan can be a daunting task. With so many options available, it’s essential to find a plan that aligns with your healthcare needs and budget. One company that stands out in the Medicare Supplement (Medigap) market is UnitedHealthcare. In this article, we’ll explore the best UnitedHealthcare supplemental plans and help you make an informed decision.

Understanding Medicare Supplement Plans

Before we dive into the specifics of UnitedHealthcare’s offerings, let’s quickly review what Medicare Supplement plans are. These plans, also known as Medigap, are designed to fill the gaps in Original Medicare coverage (Parts A and B). They help cover out-of-pocket costs such as deductibles, coinsurance, and copayments that Medicare doesn’t pay for.

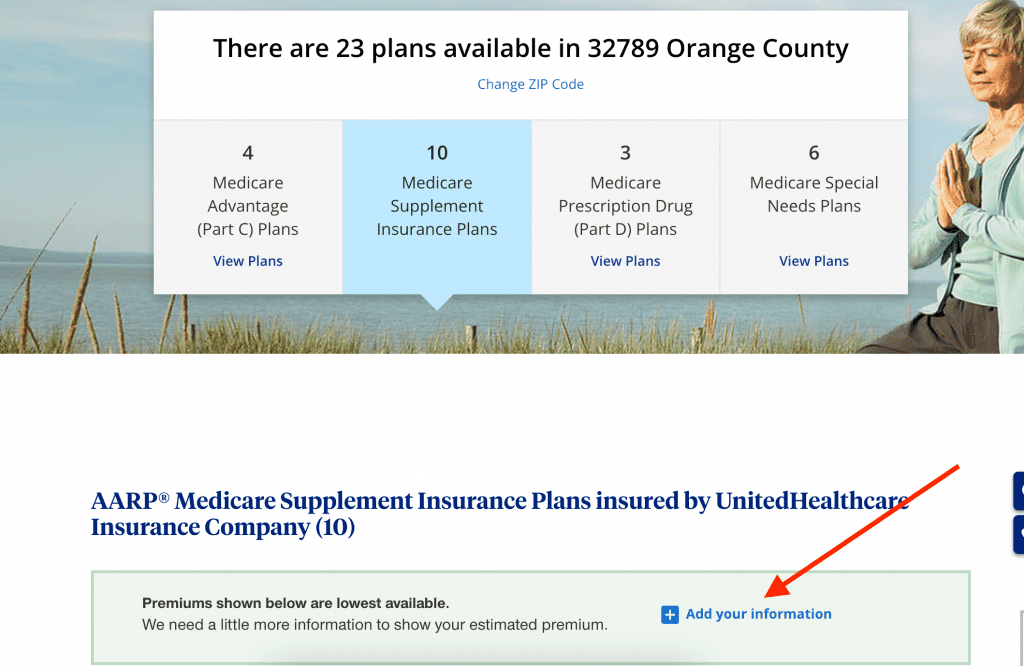

Medicare Supplement plans are standardized by the federal government and are offered by private insurance companies like UnitedHealthcare. There are currently 10 different plan types, each providing a unique set of benefits (Plans A, B, D, G, K, L, M, and N).

UnitedHealthcare’s Medicare Supplement Offerings

UnitedHealthcare is the exclusive provider of Medicare Supplement plans through AARP, one of the largest nonprofit organizations dedicated to empowering Americans aged 50 and older. Here are some of the popular UnitedHealthcare Medicare Supplement plans:

-

Plan G: This is one of the most comprehensive and popular plans offered by UnitedHealthcare. It covers Part A coinsurance and hospital costs, Part B coinsurance or copayments, blood (first three pints), Part A hospice care coinsurance or copayment, skilled nursing facility care coinsurance, and foreign travel emergency care.

-

Plan N: This plan is a cost-effective option that includes similar benefits to Plan G, but with copayments for some office visits and emergency room visits that don’t result in inpatient admission.

-

High-Deductible Plan G: As the name suggests, this plan has a higher deductible than the standard Plan G, but it also comes with lower monthly premiums. It’s a great option for relatively healthy individuals who want comprehensive coverage at a lower cost.

-

Plan F: This plan is only available to individuals who were eligible for Medicare before January 1, 2020. It offers the most comprehensive coverage, including Part B excess charges, which are not covered by most other plans.

While these are some of the most popular options, UnitedHealthcare offers a range of plans to cater to different needs and budgets.

Factors to Consider When Choosing a UnitedHealthcare Supplemental Plan

When selecting the best UnitedHealthcare supplemental plan, consider the following factors:

-

Coverage Needs: Evaluate your healthcare requirements and choose a plan that covers the services you’re likely to need, such as frequent doctor visits, hospital stays, or foreign travel.

-

Budget: Compare the monthly premiums and out-of-pocket costs (deductibles, copayments, coinsurance) of different plans to find one that fits your budget.

-

Additional Benefits: UnitedHealthcare offers additional perks for AARP members, such as discounts on dental, vision, and hearing care, as well as access to fitness programs and brain health resources.

-

Provider Network: While Medicare Supplement plans allow you to see any provider that accepts Medicare, UnitedHealthcare’s network can be useful if you prefer to stay within a specific healthcare system.

-

Convenience: If you prefer to have all your coverage under one umbrella, consider bundling your Medicare Supplement plan with a UnitedHealthcare Medicare Part D prescription drug plan.

Making the Right Choice

Choosing the best UnitedHealthcare supplemental plan ultimately comes down to your individual needs, preferences, and budget. It’s essential to carefully review the coverage details, costs, and additional benefits offered by each plan before making a decision.

If you’re unsure about which plan is right for you, consider seeking guidance from a licensed insurance agent or a representative from your State Health Insurance Assistance Program (SHIP). They can provide unbiased advice and help you navigate the complexities of Medicare and supplemental insurance options.

Remember, the right Medicare Supplement plan can provide peace of mind and financial security, ensuring that you have access to the healthcare services you need without breaking the bank.

AARP Medicare Supplement Plans | Medigap Plan G the Best?

FAQ

Which is the best known supplemental plan?

What is the highest rated Medicare Supplement company?

Is UnitedHealthcare through AARP a good?

What is the most cost effective Medicare Supplement?