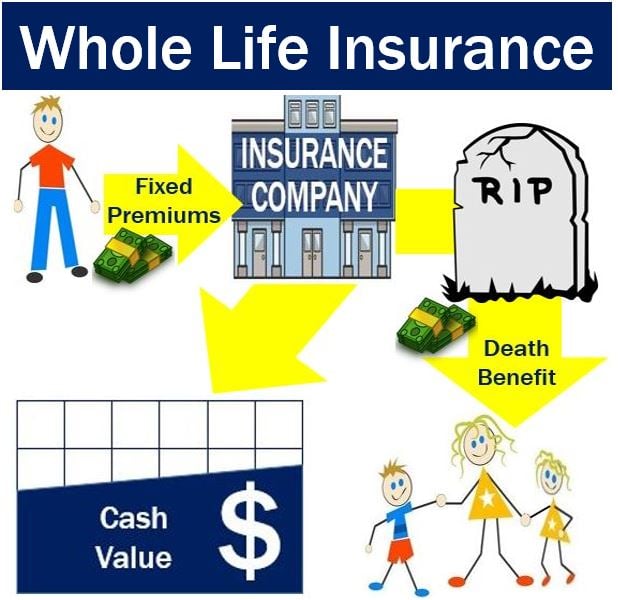

When it comes to life insurance, few options offer the level of permanence and security that whole life insurance provides. Unlike term life insurance policies that expire after a set number of years, whole life insurance is designed to be a lifelong companion, providing coverage for as long as you live. But how exactly does this work? In this comprehensive guide, we’ll unravel the mysteries surrounding the duration of whole life insurance policies and help you understand what to expect from this unique form of coverage.

A Policy That Lasts a Lifetime (Literally)

The defining characteristic of whole life insurance is its ability to provide coverage for the entirety of your life, as long as you continue to pay the premiums. Unlike term life insurance policies that have a fixed expiration date, whole life insurance policies remain in force indefinitely, offering uninterrupted protection for your loved ones.

This feature is particularly valuable for individuals who want to ensure their family’s financial security, regardless of how long they live. With whole life insurance, you don’t have to worry about your policy expiring or having to reapply for coverage at an older age, when premiums are typically higher.

The Age 100 Endowment

While whole life insurance policies are designed to provide coverage for your entire life, most policies have a built-in endowment feature that kicks in once you reach a specific age, typically 100 years old. At this point, the policy is considered “matured,” and the insurance company will pay out the full death benefit amount to you, the policyholder.

This endowment feature serves as a safety net, ensuring that you receive the full value of your policy, even if you outlive the average life expectancy. It’s essential to note that once the policy matures and the death benefit is paid out, the coverage aspect of the whole life insurance policy comes to an end.

The 121-Year Maturation Age: A New Trend

In recent years, some insurance companies have started offering whole life insurance policies with a longer maturation age of 121 years. This extended maturation period acknowledges the increasing life expectancy rates and provides policyholders with the assurance that their coverage will remain in effect for an even more extended period.

With a 121-year maturation age, policyholders can enjoy the benefits of their whole life insurance policy for an additional two decades beyond the traditional age 100 endowment. This added flexibility can be particularly valuable for individuals who have a family history of longevity or those who wish to extend their coverage as far into the future as possible.

What Happens After Maturation?

Once your whole life insurance policy matures, either at age 100 or 121, you have several options to consider:

-

Receive the Cash Value: Most insurance companies will pay out the cash value of the policy to you in a lump sum. This cash value represents the accumulated savings component of your policy, which has been growing over the years through premium payments and interest earnings.

-

Convert to an Annuity: Some insurers may allow you to convert the cash value of your matured whole life insurance policy into an annuity. This option can provide you with a steady stream of income for the remainder of your life, potentially supplementing your retirement savings.

-

Continue Coverage: In rare cases, insurance companies may offer the option to continue your whole life insurance coverage beyond the maturation age, typically by paying additional premiums. However, this option is not widely available and may come with additional restrictions or limitations.

Regardless of the option you choose, it’s essential to consult with your insurance provider and financial advisor well in advance of your policy’s maturation date. This will allow you to make informed decisions and ensure a smooth transition once your whole life insurance policy reaches its endowment.

The Importance of Timely Premium Payments

While whole life insurance policies are designed to provide lifelong coverage, it’s crucial to understand that this protection is contingent upon timely premium payments. If you fail to pay the required premiums, your policy may lapse, and you could lose the coverage and accumulated cash value.

To avoid any interruptions in your coverage, it’s essential to prioritize premium payments and ensure that they are made on time, every time. Many insurance companies offer various payment options, such as automatic bank drafts or online bill payment, to streamline the process and minimize the risk of missed payments.

Conclusion

Whole life insurance stands out as a unique and valuable option in the world of life insurance, offering a level of permanence and security that few other policies can match. With its ability to provide coverage for your entire life and the built-in endowment feature, whole life insurance offers peace of mind knowing that your loved ones will be financially protected, no matter how long you live.

Whether you choose a policy with a maturation age of 100 or the more extended 121-year option, whole life insurance serves as a lifelong companion, adapting to your changing needs and circumstances. By understanding the nuances of how these policies work and the options available after maturation, you can make informed decisions and ensure that your whole life insurance policy remains a valuable asset throughout your journey.

How To Use Whole Life Insurance To GET RICH In 2023 (Become Your Own Bank) | Wealth Nation

FAQ

How long do you pay on a whole life policy?

Does whole life insurance last a lifetime?

At what age does whole life insurance expire?

Does a whole life policy ever get paid off?