In the ever-evolving landscape of life insurance, one option stands out for its simplicity and affordability: the 20-year guaranteed level term life insurance policy. This type of coverage has gained popularity among individuals seeking protection for a specific period while enjoying locked-in rates and predictable premiums. Let’s dive into the intricacies of this insurance product and explore its advantages and considerations.

What is a 20-Year Guaranteed Level Term Life Insurance Policy?

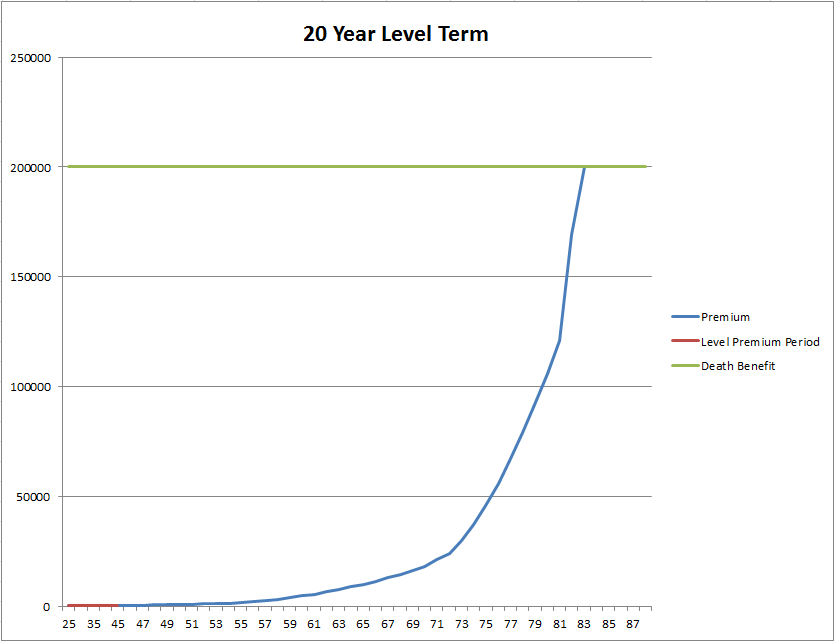

A 20-year guaranteed level term life insurance policy is a type of temporary life insurance that provides coverage for a fixed period of 20 years. During this term, your premiums remain level, meaning they won’t increase regardless of any changes in your age, health status, or other factors. If you pass away while the policy is in force, your designated beneficiaries will receive a predetermined death benefit payout.

The key components of a 20-year guaranteed level term life insurance policy are:

-

Fixed Term: The coverage period is set for 20 years, after which the policy expires, and you’ll need to renew or purchase a new policy if you still require life insurance.

-

Level Premiums: Your monthly or annual premium payments remain the same throughout the 20-year term, providing you with predictable costs and budgeting convenience.

-

Death Benefit: If you pass away during the 20-year term, your beneficiaries will receive a tax-free lump sum payment, known as the death benefit, which can be used to cover expenses such as outstanding debts, mortgages, education costs, or everyday living expenses.

-

No Cash Value: Unlike permanent life insurance policies, term life insurance does not accumulate cash value, making it a more affordable option for those seeking pure death benefit protection.

Advantages of a 20-Year Guaranteed Level Term Life Insurance Policy

This type of life insurance policy offers several attractive advantages, including:

-

Affordability: Term life insurance is generally the most cost-effective way to obtain substantial life insurance coverage, especially for younger individuals in good health. The premiums for a 20-year guaranteed level term policy are typically lower than those of permanent life insurance policies with comparable death benefits.

-

Fixed Costs: With level premiums locked in for 20 years, you can budget and plan your expenses effectively, without worrying about unexpected premium increases during the term.

-

Flexibility: A 20-year term life insurance policy provides coverage for a specific period, aligning with common financial obligations such as mortgages, educational costs, or income replacement needs. If your coverage needs change after the 20-year term, you can reevaluate your options and make adjustments accordingly.

-

Simplicity: Term life insurance policies are straightforward, making them easier to understand and manage compared to some permanent life insurance products with cash value components or additional riders.

Considerations for a 20-Year Guaranteed Level Term Life Insurance Policy

While a 20-year guaranteed level term life insurance policy offers attractive benefits, it’s essential to consider the following factors:

-

Coverage Expiration: At the end of the 20-year term, your coverage will expire unless you choose to renew or purchase a new policy. Renewal options may be limited or expensive, especially if your health has declined since the initial policy purchase.

-

No Cash Value Accumulation: Term life insurance policies do not build up cash value, which can be an advantage for those seeking pure death benefit protection but may be a drawback for those looking for potential investment growth or a source of funds in retirement.

-

Age and Health Considerations: The younger and healthier you are when you purchase a 20-year guaranteed level term life insurance policy, the more affordable your premiums will be. As you age or experience health changes, obtaining a new policy after the 20-year term may be costlier or more challenging.

-

Coverage Needs Assessment: It’s crucial to carefully assess your life insurance coverage needs and ensure that a 20-year term aligns with your financial goals and obligations. If your coverage needs extend beyond 20 years, you may want to consider a longer term or permanent life insurance policy.

Is a 20-Year Guaranteed Level Term Life Insurance Policy Right for You?

A 20-year guaranteed level term life insurance policy can be an excellent choice for individuals seeking affordable and predictable life insurance coverage for a specific period. It’s particularly well-suited for those with temporary financial obligations, such as:

- Young families with mortgages and educational expenses for children

- Individuals with outstanding debts or loans that need to be covered for a set period

- Business owners seeking to protect their company’s assets or provide coverage for key employees

However, if you anticipate needing life insurance coverage beyond 20 years or are interested in accumulating cash value for potential retirement income or other needs, a permanent life insurance policy like whole life or universal life may be a better fit.

Ultimately, the decision to choose a 20-year guaranteed level term life insurance policy should be based on a thorough assessment of your unique financial situation, goals, and risk tolerance. Consulting with a qualified insurance professional can help you navigate the various options and ensure that you select the coverage that best aligns with your needs and budget.

20 Year Term Life Insurance Policy Review – Your Questions Answered!

FAQ

What is the meaning of 20 year term?

What happens at the end of a 20 term life insurance policy?

What is guaranteed level term?

What does 20 year payment life mean?