Paying bills can be a tedious task, especially with multiple accounts across different providers. However, Capital One offers a convenient solution for managing all your payments in one place. In this article, we’ll explore the ins and outs of using Capital One to pay bills so you can optimize the process.

Why Pay Bills through Capital One?

Capital One makes paying your bills fast simple and secure. Here are some of the key benefits

-

Consolidate payments Pay all your bills, from utilities to credit cards, in their highly-rated mobile app or website No need to login to multiple places

-

Schedule recurring payments: Set up future or recurring payments so you never miss a due date. Capital One will automatically pay your bills on the date you choose.

-

Get reminders: Their system can send you reminders when a bill is coming due or needs attention. No more late fees!

-

Enjoy seamless auto-pay Link your Capital One credit and bank accounts to automatically pay your bills, so you have one less thing to remember each month.

-

Access payment history: Check your payment activity and confirm past payments in their app and online portal in one centralized place.

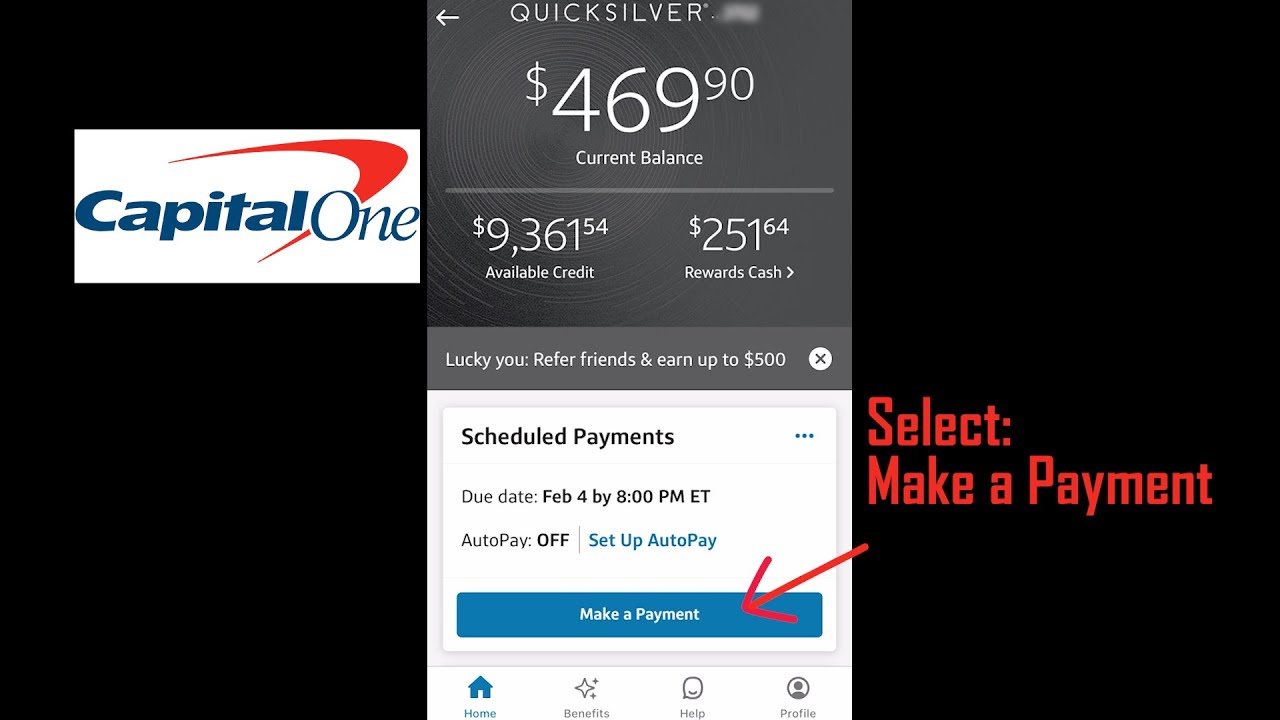

How to Pay Bills with Capital One

Paying bills through Capital One is very simple. Just follow these steps:

1. Log in

Access your Capital One account online or via your mobile app. If you don’t have an account yet, you can sign-up easily for free.

2. Connect payee accounts

Use your account numbers and logins to connect the accounts you want to pay. Common payees include utility companies, mortgage/rent, loan providers, insurance companies and more.

3. Select payment amount & date

Enter the amount(s) and date(s) for current, future or recurring payments. Capital One offers convenient calendar and auto-fill features.

4. Confirm payment details

Review the payment details like the payee name, account, amount and process date. Make any corrections needed before submitting.

5. Pick a delivery speed

For one-time payments, choose standard delivery (3-4 business days) or rush delivery (1-2 days) for each payment. Recurring payments use standard delivery.

That’s it! Capital One will now handle paying your bills seamlessly. You’ll get notifications when payments are processed or if any action is needed.

Key Features for Bill Pay

Capital One offers user-friendly bill pay features that simplify the payment process:

Flexible payment options

Choose one-time, future-dated or recurring payments. Recurring payments ensure bills get paid on time automatically each month.

Calendar view

See all your upcoming bills and payments visually on an calendar view. Toggle between month and list layouts.

Spending account integration

Link your Capital One 360 checking and savings accounts to pay bills directly and review payments easily.

Digital wallet support

In addition to bank accounts, you can pay bills using your connected PayPal account.

Payment notifications

Opt in to get text or email notifications when a payment is sent, processed or has an issue that needs your attention.

Payment guarantees

Capital One guarantees properly submitted payments will be sent out on the date you schedule.

Tips for Managing Bill Pay

Follow these tips to get the most convenience from Capital One’s bill pay:

-

Set up recurring payments for bills with fixed monthly amounts like utilities, loans and subscriptions. This ensures they get paid on time without the hassle.

-

Use due date reminders so you never wonder if an upcoming bill has been paid. The reminders arrive 7, 3 and 1 day(s) before the due date.

-

Automate things further by enabling auto-pay. Your bills will get paid automatically each month from your linked Capital One account(s).

-

Review your upcoming scheduled payments regularly. This allows you to spot any issues ahead of time.

-

Download account statements and payment confirmations for record keeping.

-

Pay non-recurring bills like medical bills early to avoid late fees. Rush delivery ensures faster processing.

-

Reach out to Capital One customer support if a payee account needs troubleshooting. They have 24/7 assistance via phone, chat or Twitter support.

Is Capital One Bill Pay Secure?

Absolutely – Capital One utilizes industry-standard encryption and security measures to keep your data safe. Features like multi-factor authentication, encrypted data transmission and automatic sign-out add extra protection.

Only enroll payee accounts using official account numbers and logins from statements or provider websites. Avoid unverified payment requests to ensure security.

It’s also important to take measures like using strong passwords, installing anti-virus software and avoiding public Wi-Fi for sensitive transactions. Enabling alerts can help you monitor account activity as well.

How Much Does Capital One Bill Pay Cost?

The good news is Capital One offers unlimited bill payments for free. You can send as many one-time or recurring payments as you want without fees.

You may see the following optional fees:

-

Rush delivery – $4.95 per rushed payment to process within 1 business day.

-

Charitable donations – Varies per organization. Donation processing fees range between 2.5% – 3.5% of gift amounts over $1000.

As long as you stick with standard delivery for routine payments, you can take advantage of fee-free bill pay. Capital One also doesn’t charge monthly account maintenance fees.

Getting Started with Capital One Bill Pay

If you’re ready to simply bill payment with Capital One’s convenient service, getting started takes just a few minutes:

1. Open your account

Visit https://verified.capitalone.com/auth/ or download the Capital One mobile from the App Store or Google Play. Sign up for an account if you aren’t already a customer.

2. Link payee accounts

Connect the billing accounts you want to pay by entering account numbers, usernames and passwords when prompted.

3. Schedule payments

Use the intuitive online bill pay center or mobile app to set up one-time, recurring and future-dated payments.

4. Make final payment tweaks

Enable text/email notifications or auto-pay rules if you want an extra convenience layer for your payments.

And that’s all there is to it! With bill pay set up through Capital One, you’ll save time each month and avoid late fees. Reach out to their top-rated customer service if any questions come up once you start paying bills.

When using the URLs and content below, please identify the frequency of occurrences of entities within that content and write using the correct entities and their frequencies in the article.Please note not to write the “Frequency of Entities” statistics in the articleWhen writing, use information below as updated : [https://verified.capitalone.com/auth/https://play.google.com/store/apps/details?id=com.konylabs.capitalone]

FAQ

Can I pay my Capital One by phone?

How do I make my Capital One payment?

Does Capital One offer online bill pay?

Can I pay my credit one bill online?

How do I pay my Capital One credit card bill?

Get the Capital One Mobile app to save time and stay informed. Depending on your credit card issuer, you may be able to pay your credit card bill via ACH transfer, cash, check, a mobile app or an online portal. Take a closer look at each.

How long does it take Capital One bill pay to deliver payments?

Capital One Bill Pay will deliver payments as quickly as possible. Making payments electronically is our first priority, posting either the same day or the next business day. Payments that cannot be delivered to a biller electronically will be made by paper check and may take up to seven business days for delivery.

How do I pay off my Capital One card balance online?

Sign in and add a bank account to make online payments toward your balance. Set up a payment account that will be associated with your Capital One accounts. Make your online payments quickly and easily. You can schedule up to 3 payments. What are the available payment methods to pay off card balances?

How do I cancel a Capital One bill payment?

After the Bill Pay update, if your bill payment is still pending and has not started processing, you can cancel it by signing in to your Capital One account and selecting that payment in the “Scheduled payments” area above your “Billers” list and selecting “Cancel payment.” How do I cancel a payment?