Paying your credit card bill is an important part of maintaining good credit and avoiding late fees For many American Express cardholders, paying online or through the Amex app is quick and convenient However, some people may prefer to pay their bill in person. So is it possible to pay an American Express bill in person?

The short answer is it depends. American Express does not have physical bank branches, so you cannot simply walk into an Amex location and hand over a payment. However, if your Amex card is issued through a partner bank, you may be able to pay at that bank’s branches

We’ll talk about when and how to pay an American Express bill in person in this article. We’ll cover:

- Paying at a partner bank branch

- Sending a check by mail

- Why Amex doesn’t have branches

- Online and mobile payment options

When Can You Pay an Amex Bill In Person?

Some AmEx cards are given to customers directly by American Express, while others are given out by partner banks.

If your American Express card is issued directly by Amex, there is no way to pay your bill in person. Amex does not have any physical branch locations. Your only options are to pay online, through the mobile app, by phone, or by mailing a check or money order.

If an AmEx partner bank gave you the card, you might be able to pay at branches of that bank. Banks that currently issue American Express cards include:

- Wells Fargo

- BB&T

- USAA

- PenFed

To confirm if your Amex card is issued by a partner bank, check your monthly statement or call the number on the back of your card.

So for partner-issued Amex cards, heading to your bank’s local branch is a convenient way to make an in-person payment. Just be sure to bring your monthly statement so the teller knows exactly how much to charge your account.

Sending a Check by Mail

Even if your American Express card is issued directly by Amex, you can still make an “in-person” payment by mailing a check or money order.

To pay by mail, write the payment amount on a check or money order (do not mail cash) and send it to:

American Express

P.O. Box 650448

Dallas, TX 75265-0448

Be sure to include your full account number and the payment due date on the check memo line. Mail your payment at least 5-7 days before the due date to ensure it arrives on time.

Why Doesn’t Amex Have Physical Branches?

American Express is a bit unique among major credit card companies in that it does not operate any bank branches. This dates back to the origins of Amex as a travel services company rather than a bank.

When Amex first started issuing credit cards in the 1950s, they partnered with local banks who handled issuing cards and managing accounts. Amex focused on branding, marketing, and merchant network development.

Over time, Amex brought more account servicing in-house. But to this day, they still partner with banks for card issuing and do not have retail bank branches. Amex relies on online account management, customer service centers, and mobile apps for customer payment and support.

So while you cannot walk into an Amex-owned branch, partner bank branches fill that role for co-branded and partner-issued American Express cards.

Online and Mobile Payment Options

For directly-issued American Express cards, paying online or via the Amex mobile app is quick and easy:

-

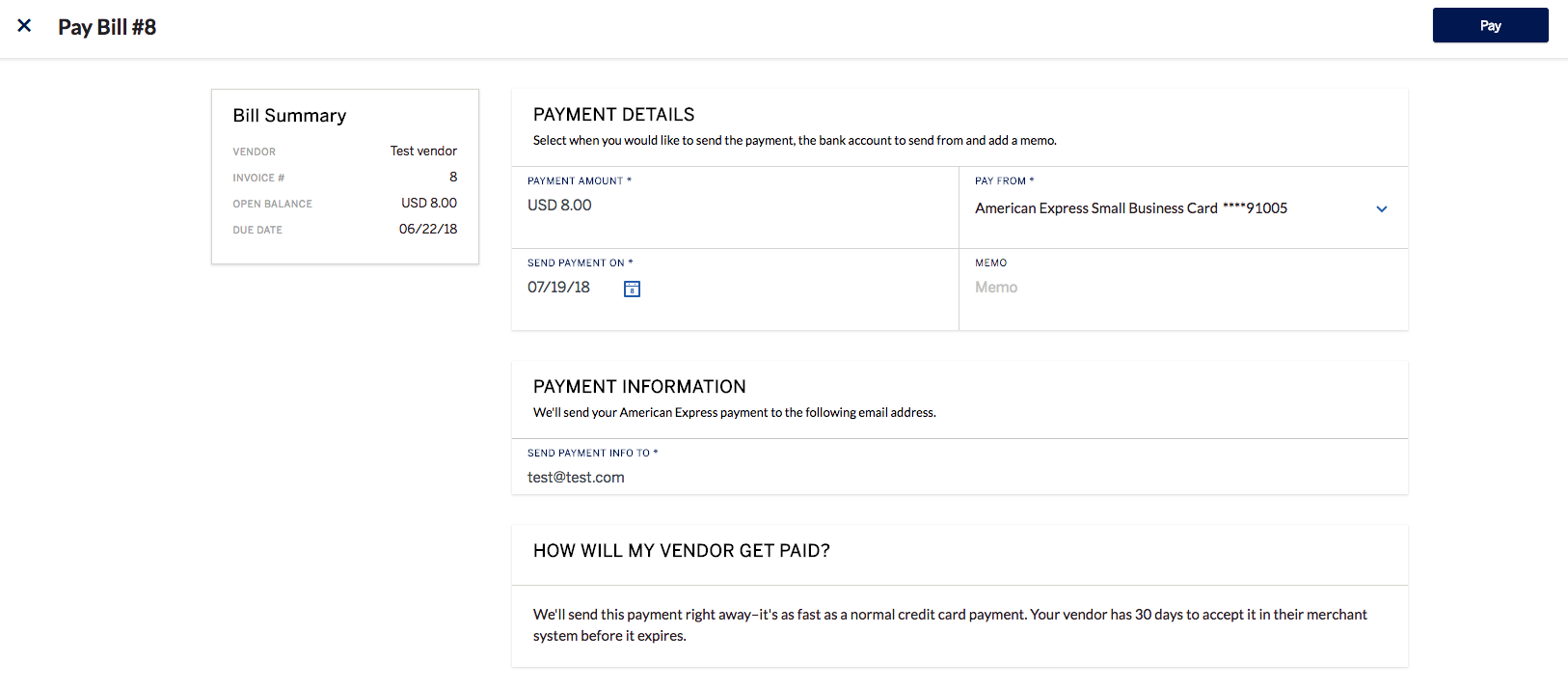

Online account access – Log into your account at americanexpress.com and click on “Make a Payment”. Select your bank account, enter the payment amount, and submit.

-

Amex mobile app – Download the app, log in, and tap on “Pay Bill”. Pick the amount and submit your payment.

-

Customer service – Call the number on the back of your Amex card and make a payment via automated system or live agent.

-

Automatic payments – Set up recurring monthly payments from your bank account so you never miss a payment.

The Amex mobile app also allows you to track rewards points, view statements, set notifications, and more. So it’s a useful tool for managing your account on the go.

Should You Sign Up For Autopay?

One of the best ways to avoid late fees and missed payments with any credit card is to enroll in autopay. This automatically pays at least your minimum due each month directly from your bank account.

With American Express autopay, you can choose to pay:

- The minimum amount due

- The full statement balance

- A fixed amount of your choice

If the fixed amount you select is less than the minimum due, American Express will charge the minimum amount instead.

To get started, log into your Amex account and navigate to “Autopay” under the “Payment” menu. Follow the steps to link your bank account and confirm your autopay settings.

Avoid Late Fees and Keep Your Account in Good Standing

No matter how you choose to pay your bill – online, through the app, by mail, or in person – the key is making your payment on or before the monthly due date. This will help you avoid late fees and other penalties that can hurt your credit score.

American Express charges a fee of up to $40 for late payments on credit cards and up to $39 on charge cards. Late payments may also result in a penalty APR, meaning a higher interest rate on any balances you carry.

So review your statement carefully each month and note the payment due date. Set a reminder on your calendar, phone, or another app so you don’t forget. And consider enrolling in autopay as a backup plan.

Check Out Amex’s Payment Resources

If you need help understanding your American Express statement or how to make a payment, check out Amex’s official account management guides:

Their step-by-step articles walk you through the entire payment process, from checking your balance to setting up autopay.

Key Takeaways

-

You can only pay an Amex bill in person if your card is issued through a partner bank. Amex itself does not have physical branches.

-

Check your monthly statement or call customer service to confirm who issued your American Express card.

-

If it’s partner-issued, visit that bank’s local branch to make a payment. Bring your statement to provide the amount due.

-

For directly-issued Amex cards, you’ll need to pay online, via the mobile app, by phone, or by mailing a check.

-

Consider enrolling in autopay to avoid late fees caused by forgetting a payment due date.

Knowing when and how you can pay an American Express bill in person gives you flexible options to keep your account in good standing. With a few planning tips, you can avoid fees and demonstrate responsible credit usage.

Avoid missed payments with AutoPay

AutoPay lets you schedule payments that will automatically debit from your bank account each month. That means AutoPay enrollment may help you avoid missing your Payment Due Date and incurring late fees*. You can easily enroll in AutoPay online. Keep in mind, only the Primary Card Member can enroll in AutoPay.

To enroll in AutoPay, simply open your Amex® App. If you dont have the Amex® App, you can easily download it in the app store. You can also enroll in AutoPay online. Log into your account with your username and password, navigate to the “Payment” section, and select “Start AutoPay.”.

*Card Members who enrolled in Autopay prior to 10/23/2020, and opted to pay a specific dollar amount, may still incur a late fee if such specified dollar amount is less than the Minimum Payment Due and the difference is not paid by the Payment Due Date.

Decide which type of scheduled payment is right for you

You can customize your AutoPay amount to fit your needs. You’ll need to pay at least the Minimum Payment Due each month.

Minimum Payment Due The amount you need to pay each month to keep your account in good standing.

Total New Balance Your Statement Balance, including payments made and credits received.

Adjusted Balance Your Total Balance, including Plan It or Pay Over Time payments.

Other Amount AutoPay will debit a fixed amount of your choice each month.

If this Other Amount is less than the minimum amount that is due in any billing period, American Express will increase the debited amount to the minimum amount due for that billing period.

The Amex App: How to Pay with Bank Transfer

FAQ

Can I pay my American Express bill in person?

Does American Express have a physical office?

Can you pay people on Amex?

Can I pay an Amex bill over the phone?