Paying bills can be a tedious chore. Between tracking due dates mailing payments and keeping tabs on your account balances, it’s easy for bill pay to become a time-consuming hassle. But what if you could simplify the process and put your credit card rewards to work at the same time? American Express’ bill pay with points feature allows cardholders to seamlessly redeem points for statement credits on eligible purchases. This innovative tool takes the stress out of bill payment and helps you maximize the value of your Amex points.

This article will talk about how American Express bill pay with points works, how to redeem your points, and the main benefits of this option. People with an Amex card who want to simplify their finances should consider bill pay with points. This is a good way to use your points or make paying your bills easier.

How Bill Pay With Points Works

Members of the American Express Membership Rewards program can use their points to get statement credits on certain purchases through the bill pay with points feature. Here’s an overview of how it works:

-

Make a purchase with your eligible American Express card Purchases must be made in the US, or a U,S, territory to qualify,

-

Wait for the charge to post to your account Charges are typically eligible for redemption within 1-2 billing cycles.

-

Log in to your Amex account and select the “Pay with Points” option for the recent eligible purchase.

-

Choose how many points you want to redeem towards the purchase. You can pay the full amount or just a portion with points.

-

Your redeemed points will be immediately deducted from your Membership Rewards balance. Within 48 hours, you’ll see a corresponding statement credit applied to your account.

It’s a simple and straightforward process. American Express will indicate which charges on your statement are eligible for Pay with Points redemption. From there, you simply select the purchase you want to cover and the points are seamlessly converted into a statement credit.

Step-By-Step Guide to Redeeming Points

Ready to put your Amex points to work? Here’s a step-by-step walkthrough of the bill pay with points redemption process:

1. Make a Purchase with Your Eligible Card

First, use your eligible American Express card to make a purchase in the United States or U.S. territory. Everyday spending categories like gas, groceries, dining, travel, and more are all fair game.

2. Wait for the Charge to Post

Give it a billing cycle for the charge to post to your account. You’ll be able to redeem points once the purchase shows up on your Amex statement.

3. Log In to Your Amex Account

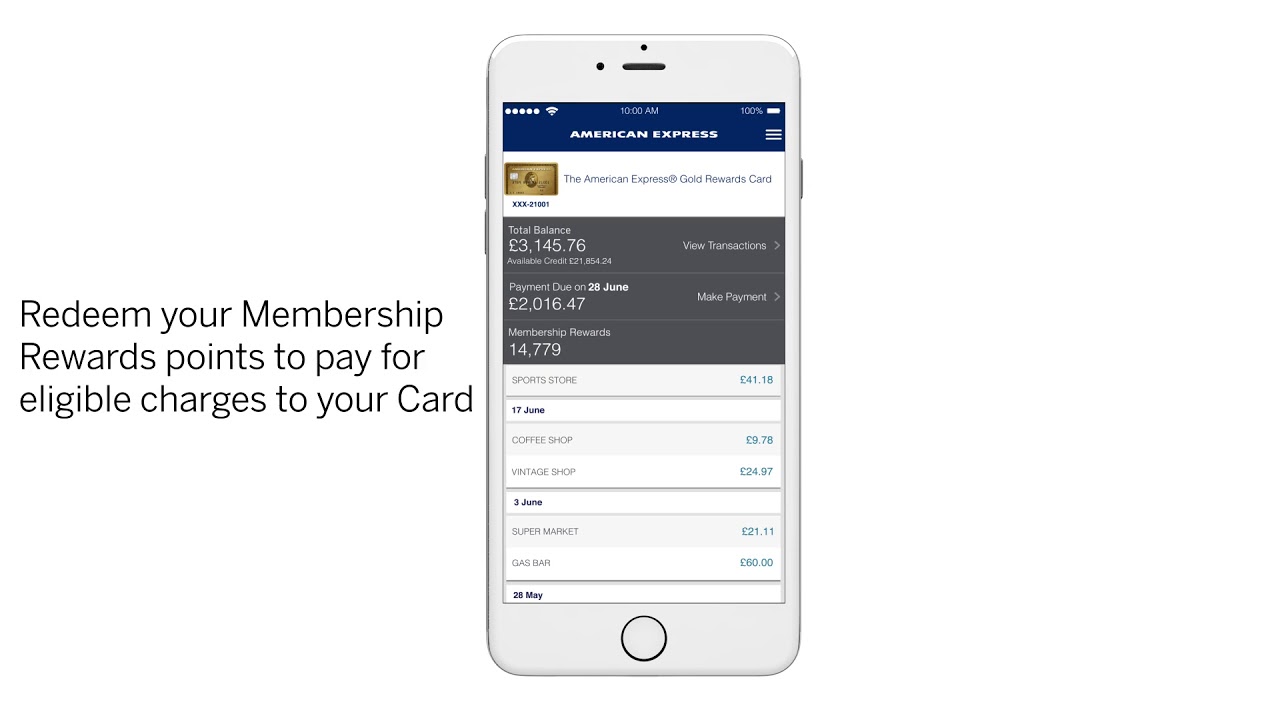

Access your American Express account online or via the mobile app. Navigate to the “Pay with Points” section.

4. Select the Eligible Purchase

Find the recent charge you want to redeem points for. American Express will indicate which charges are eligible.

5. Choose Your Points Redemption Amount

Decide if you want to redeem points for the full purchase amount or just a portion. The minimum is 1,000 points.

6. Complete the Redemption

Confirm your redemption details and complete the points transaction. The points will be immediately deducted from your balance.

7. Get a Statement Credit

Within 48 hours or less, the corresponding statement credit for the redeemed points will be applied to your account.

And that’s it! With just a few clicks, your eligible Amex purchase is paid down or off entirely with your Membership Rewards points.

Key Benefits of Bill Pay With Points

Redeeming points for statement credits through the Pay with Points feature offers a number of valuable benefits:

Puts points to use – Rather than letting points sit idle, you can actively put them to work to offset purchases. This helps maximize the value you get from your Amex card.

Easy point redemption – The seamless statement credit process makes redeeming points simple and hassle-free. No waiting or paperwork required.

Boosts point value – When redeemed for statement credits, American Express points can be worth $.01 each or more, enhancing their baseline value.

Saves money – Your redeemed points reduce what you ultimately pay out of pocket for the purchase. This saves you cash on bills and everyday expenses.

Simplifies bill payment – Paying your charges with points means fewer bills to keep track of and payments to mail. You can consolidate bill payment through your Amex account.

For those looking to maximize the utility of their American Express points, bill pay with points hits the mark on every front.

Which Amex Cards and Purchases Qualify?

While all American Express cards earn Membership Rewards points, not all cards and purchases are eligible for the bill pay with points feature. Here are some key details on requirements for redemption:

-

Eligible cards – The Pay with Points option is limited to regular consumer and OPEN American Express cards. Corporate cards and some other card versions may not qualify.

-

Minimum points – You need at least 1,000 Membership Rewards points in your account to redeem for statement credits.

-

Qualifying purchases – The charge must be made in the U.S. or a territory, fully processed, and not disputed. Fees, cash advances, and some charges may not be eligible.

-

Timing – Charges are typically redeemable within 1-2 billing cycles after posting. Points must be redeemed within 90 days of appearing.

When in doubt, check your Amex account for specifically noted eligible charges. Redemption is limited to those purchases tagged as redeemable for Pay with Points.

Strategic Point Redemption

To take full advantage of the bill pay with points option, be strategic with your redemptions:

-

Target recurring expenses – Look to recurring bills like cell phone plans, gym memberships, insurance payments, etc that you can cover with points each billing cycle.

-

Pay down large purchases – If you used your Amex card for a big-ticket item, redeem points to soften the financial impact.

-

Meet minimum spends – When working toward a welcome points bonus, use bill pay redemptions to offset purchases and reach the minimum spend faster.

-

Maximize value – Estimate the per point value you get from redemptions. Aim to redeem when you can squeeze more than 1 cent per point in value.

With a savvy strategy, you can take full advantage of the bill pay with points feature and get more from your Membership Rewards.

Frequently Asked Questions

If you’re new to American Express bill pay with points, you probably still have some questions. Here are answers to some frequently asked queries:

What types of purchases qualify for redemption? Everyday expenses like dining, groceries, gas, travel, retail shopping, and bills are typically eligible. The purchase must be completed, without disputes, and appear on your statement.

Can additional cardholders on my account redeem points? No, only the primary basic cardholder has access to the bill pay with points tool. Additional cardholders can’t redeem points.

Do points cover the full purchase amount or just a portion? You can choose to cover the entire charge or just a part of it with points. The minimum redemption is 1,000 points.

When will the statement credit from redeemed points post? Credits typically post within 48 hours or less after you redeem points. It may take an extra billing cycle if you redeem after your statement period closes.

Can I redeem points for charges on multiple Amex cards? No, points can only be redeemed for statement credits on the Amex card the purchase was made with. You can’t transfer points or redeem across cards.

Start Streamlining Your Bill Payment

Paying the bills doesn’t have to be a complex chore. With American Express bill pay with points, you can simplify the process and maximize the value of your Membership Rewards. By strategically redeeming points for statement credits, you can knock out bills with your rewards.

If you have an eligible American Express card, take advantage of this feature to streamline your finances. Pay with Points provides an easy way to put your rewards to work and take the hassle out of bill payment. Spend less time and energy worrying about bills and more time enjoying the perks your Amex points can provide.

Please log in What can I redeem for points?

1.000 Membership Rewards points equals 5 dollars credit Here’s how to redeem points: 1. Login to your Account online or via the Amex App 2. Select an eligible item and click