Bank of America offers a convenient bill pay service that allows customers to pay bills online or through their mobile app. While most billers accept electronic payments, some still require good old fashioned paper checks. This article explains how Bank of America’s bill pay handles payments to companies not set up for digital transactions.

Overview of Bank of America Bill Pay

Bank of America’s bill pay platform enables customers to easily manage recurring payments or schedule one-time payments to thousands of billers. Key features include:

-

Pay utility bills, cable, phone, rent, credit cards, insurance, subscriptions and more

-

Schedule future-dated payments up to a year in advance

-

Set up automatic recurring payments

-

Make same-day electronic payments to participating billers

-

Pay using checking or savings accounts

-

Access via online banking or mobile app

-

No fee for standard digital payments

Sending Paper Checks Through Bill Pay

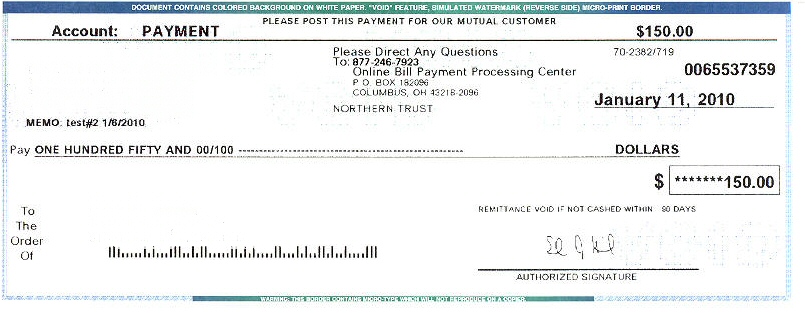

While Bank of America bill pay primarily uses electronic transfers, they can also mail paper checks when necessary.

Reasons Bank of America may send a physical check:

-

The biller does not accept electronic payments

-

You requested a check payment

-

The payment amount exceeds the biller’s limit for digital transactions

-

Bank of America cannot verify the biller’s account information for digital transfers

-

The biller is an individual person rather than a company

How Check Payments Work

Here is the typical process when Bank of America needs to mail a check on your behalf:

-

You schedule the payment through online banking or the mobile app as usual

-

Bank of America prints and mails a check to the biller

-

Funds are deducted from your account once the check is printed (not cashed)

-

The biller receives and deposits the check

-

The check clears through the traditional check processing system

-

The biller receives the money in 3-5 business days after depositing the check

-

You can see images of cleared checks in your statement or online banking activity

With check payments, your account is debited when the check is printed rather than when it is cashed. This prevents non-sufficient funds issues if the biller holds onto the check for an extended period before depositing it.

Costs for Check Payments

There are no fees for standard consumer bill pay. However, Bank of America may charge fees in certain cases:

-

Overnight Check Fee – $15 for expedited overnight check delivery

-

Charitable Donation Check Fee – $1.50 for donations sent by check instead of electronically

-

Foreign Currency Check Fee – $20 for checks issued in a foreign currency

Always double check for any special fees before scheduling check payments. Also, the biller themselves may charge extra fees for receiving paper checks.

Tips for Check Payments

-

Build in extra processing time since checks take longer than electronic transfers

-

Double check the mailing address for the biller

-

Avoid using check payments for time-sensitive bills like rent or utilities

-

Opt for electronic payment if the biller offers it to avoid delays

-

Schedule the payment 5-7 business days before the actual due date

While check writing is fading away, Bank of America’s bill pay service keeps this option available when paying companies lacking digital payment capabilities. Allowing extra time for mailing and check processing ensures these old school payments arrive on time. Carefully reviewing fees for paper checks enables avoiding unnecessary costs as well.

Bank of America -How to Set Up Online Bill Pay

FAQ

Does bank bill pay send a check?

How to cash a bill pay check?

How long does bill pay take to process at Bank of America?

How do I pay a bank of America Bill?

You can even pay other financial institutions using your Bank of America accounts. Once you’re enrolled in Online Banking, you can pay bills using the Mobile Banking app. How to pay a bill After you log in, tap Pay & Transfer and Pay Bills. Add a Company or Person to pay (you can browse names or add a company or individual).

How do I use bank of America mobile banking?

Enter your U.S. mobile number, and we’ll text you a link to download the Bank of America® Mobile Banking app so you can get started. Payments made through Bill Pay with your Bank of America Advantage SafeBalance Banking® account will be withdrawn from your account before delivery to the payee.

Do bank of America credit card payments appear in my account details?

Message and data rates may apply. Payments to your Bank of America credit card account may not appear in your account details immediately, but you’ll receive credit for payments as of the date they’re submitted if scheduled for that day before 11:59 p.m. Eastern. Not all payees are provisioned to accept electronic payments.

How do I make a bank of America credit card payment?

You can make Bank of America credit card payments at our ATMs with only your Bank of America credit card and your check or cash. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. Please note that business credit cards are not supported at this time.