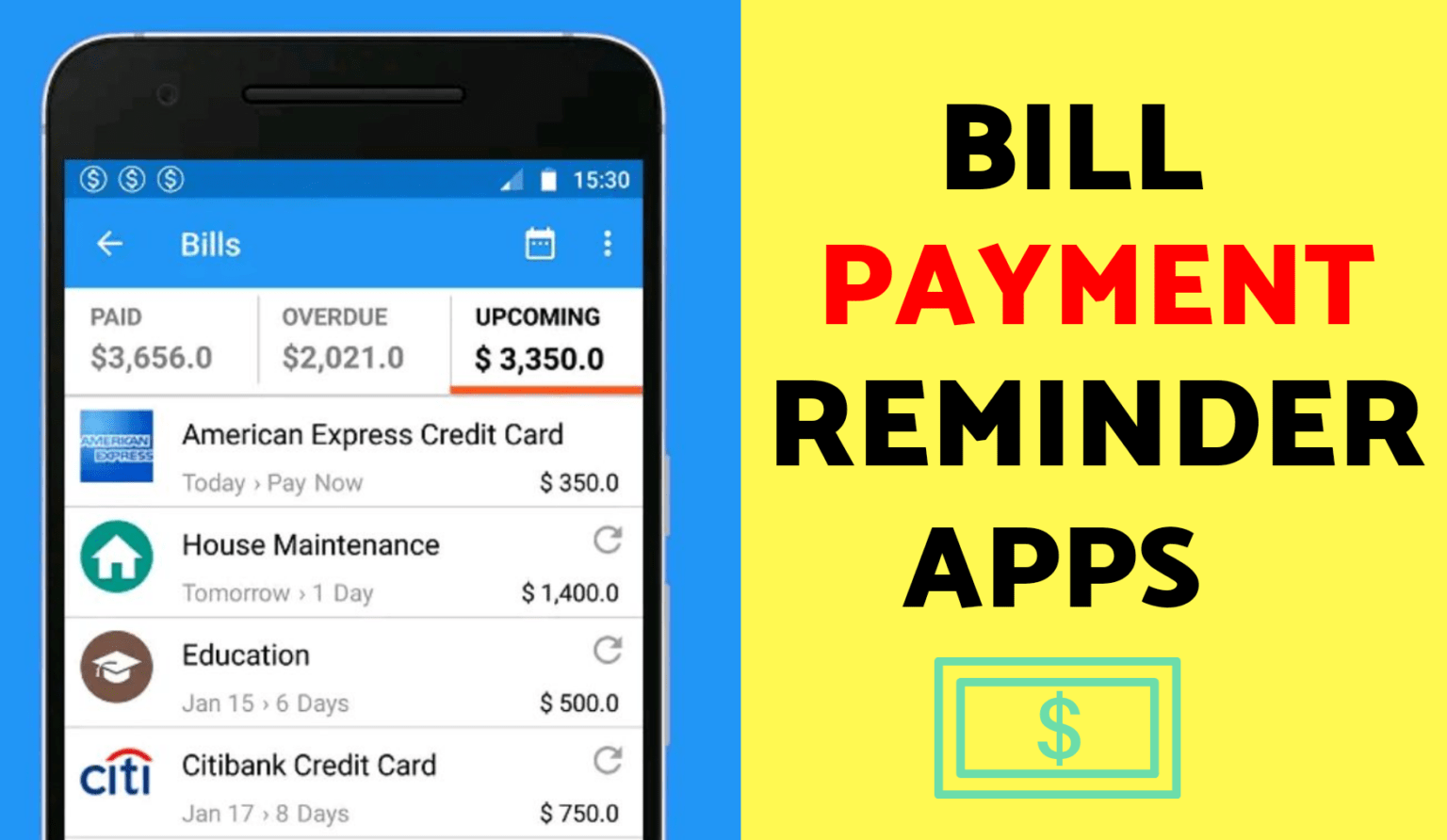

Paying bills on time can be a hassle Thankfully, there are many great bill pay apps for Android that can help make the process smooth and hassle-free In this article, I’ll go over my top picks for the best bill pay apps available on the Google Play Store in 2023.

What to Look for in a Bill Pay App

When choosing a bill pay app for your Android device, there are a few key features to consider

-

Automatic syncing and reminders – The app should automatically sync with accounts and send payment reminders/notifications so you never miss a due date

-

Payment options: Look for a number of ways to pay, such as credit and debit cards, bank transfers, PayPal, and more.

-

Tools for making a budget: Apps that help you keep track of your spending and stick to a budget are helpful.

-

Receipt management – Being able to scan and store receipts in the app creates organization.

-

Security – Ensure the app has proper encryption and other security measures to protect your data.

The 7 Best Bill Pay Apps for Android

Based on user reviews and my own testing, these are my picks for the top 7 bill pay apps available on the Google Play Store:

1. Cushion

Cushion is my #1 choice for Android. It automatically organizes your bills in one place and helps build your credit score. I like how it turns recurring bills into credit building opportunities.

Key features:

-

Consolidates bills and BNPL payments

-

Syncs with Google Calendar

-

Builds credit history

-

Virtual Cushion Card for payments

2. Prism Bills & Money

Prism Bills & Money helps you effortlessly manage bills and budgets. It provides reminders, tracks spending, and offers intuitive charts.

Key features:

-

Customizable reminders

-

Budget tracker

-

Charts for analyzing spending

-

Receipt scanner

-

Passcode protection

3. Bill Reminder & Tracker

This easy to use app allows you to manually enter bills for tracking. You can customize reminders and view payment history.

Key features:

-

Manual bill entry

-

Payment tracking

-

Custom reminders

-

Cloud sync across devices

-

Passcode and fingerprint unlock

4. BillManager

BillManager makes managing utility bills, subscriptions, and other expenses a breeze. It offers calendars, graphs, and reports for at-a-glance tracking.

Key features:

-

Automatic bill reminders

-

Visual calendars and graphs

-

Scheduled and recurring payments

-

detailed reports

-

Cloud backup available

5. Bills Monitor & Finance Tracker

As the name suggests, this app helps you stay on top of bills while also tracking finances. It boasts flexibility for managing different payment frequencies.

Key features:

-

Flexible billing frequencies

-

Notifications and reminders

-

Charts and graphs

-

Track income and expenses

-

Sync between devices

6. Buddy Bill Reminder and Calendar

Buddy Bill Reminder provides a user-friendly calendar view of upcoming bills. It also includes budgeting features and receipt management.

Key features:

-

Calendar view

-

Recurring bill scheduling

-

Budget tracker

-

Cloud sync

-

Receipt scanner

7. Money Lover

Money Lover excels at expense tracking and budgeting. But it also offers bill reminders and instant payment notifications.

Key features:

-

Bill and income reminders

-

Instant payment notifications

-

Robust expense tracking

-

Budgeting tools

-

Charts and reports

Get Organized with the Right Bill Pay App

Juggling bills without a proper system leads to late payments, stress, and fees. But the right bill pay app streamlines the process and provides organization. I recommend giving Cushion a try for its automatic syncing, reminders, credit building opportunities, and ease of use. Prism Bills & Money is also an excellent choice.

Look for an Android bill pay app that syncs with your accounts, sends alerts, and helps track expenses. Find one with features that fit your preferences to stay on top of payments each month. Your wallet and peace of mind will thank you!

Bill Tracker Pro

Best Features:

- Custom Recurring Bills and Income: Allows for detailed scheduling of payment obligations and income, including custom intervals.

- Payment Reminders and Notifications: Sends alerts directly to your device, complete with rich push notifications including a monthly bill bar chart.

- Comprehensive Accounts Management: Tracks account balances over time, providing insights into financial trends and helping users manage their money more effectively.

BillTrackerPro offers a robust platform for logging and monitoring spending across various categories, thereby providing valuable insights into where money is being allocated. With features that enable the creation of recurring bills and income streams, BillTrackerPro simplifies financial obligations management by sending timely reminders and push notifications to prevent late payments.

The app’s calendar view and detailed charts visually represent financial commitments and spending patterns, aiding users in making informed budgeting decisions. Additionally, synchronizing data across devices and securing app access with biometric authentication enhances user convenience and security.

| Pros | Cons |

|

Bill Tracker Pro might require a subscription to access all new features |

Managing bills and finances can be daunting, but with the help of the best bill reminder app, it doesn’t have to be. The best bill reminder app provides features like sending multiple reminders before the due date, organizing bills by categories, displaying payment history, and tracking expenses. These features help you manage bills efficiently and avoid late payments. Ultimately, the choice comes down to understanding what is the best bill reminder app to use that aligns with your specific needs and preferences.Last Updated on May 05, 2024Found this helpful?Dig deeper into your finances by starting a Free Trial with Cushion.

Written By CushionMar 01 2024Cushion is your go-to app for organizing, paying, and building your credit profile with your existing bills, subscriptions, and Buy Now Pay Later.Disclaimer: The information provided in this website is for educational purposes only and should not be considered as financial advice. Consult with a financial professional for personalized guidance regarding your specific situation.Organize, Pay, and Build Your Credit ProfileConsolidate bills and BNPL payments, effortlessly manage your budget, and avoid overdraft fees. Join Cushion now and build your credit history with the payments youre already making!

The Best Bill Payment Reminder Apps

Best Features:

- Automatic Bill & BNPL Organization: Cushion AI simplifies financial management by automatically finding and organizing your bills and BNPL commitments.

- Credit Building with BNPL Payments: Leveraging BNPL payments as opportunities to build your credit score, Cushion AI extends its benefits beyond mere organization.

- Virtual Cushion Card for Payments: Make seamless payments using a virtual card, which not only consolidates your bills but also aids in building your credit history.

This platform is a game-changer for those seeking to efficiently organize their bills and Buy Now, Pay Later (BNPL) payments. With Cushion, users can have all their recurring payments consolidated in one easy-to-navigate dashboard, granting them complete control over their financial obligations. The service automates the organization of bills by securely connecting to your accounts, ensuring you never miss a payment while offering valuable insights to optimize your budget.Sync Your Bills to Google Calendar with Ease!With just one click, effortlessly sync your bills and never miss a payment due date again. Easily manage bills and track BNPLs — all within your Google Calendar. Simplify your financial life and stay on top of your goals with Cushion.

This platform is a game-changer for those seeking to efficiently organize their bills and Buy Now, Pay Later (BNPL) payments. With Cushion, users can have all their recurring payments consolidated in one easy-to-navigate dashboard, granting them complete control over their financial obligations. The service automates the organization of bills by securely connecting to your accounts, ensuring you never miss a payment while offering valuable insights to optimize your budget.Sync Your Bills to Google Calendar with Ease!With just one click, effortlessly sync your bills and never miss a payment due date again. Easily manage bills and track BNPLs — all within your Google Calendar. Simplify your financial life and stay on top of your goals with Cushion.

An additional feature of the app is the calendar wizard where you can you can sync all your bills to your Google calendar making it the best bill reminder app for iPhone and Android. The app automatically updates your bills to your calendar, making it easier for users. In addition, it updates itself in real-time regardless if that’s a new bill, date change or price change.

| Pros | Cons |

|

Limited access to free plan |

Best Features:

- Advanced Bill Manager: Automatically organizes bills and subscriptions, providing reminders to prevent late payments.

- Budget Planning and Tracking: Offers detailed budgeting tools to manage and track expenses, savings, and financial goals efficiently.

- Family Budget Management: Allows for the creation and management of budgets with family members, fostering a collaborative approach to financial planning.

TimelyBills centralizes bill management, subscription tracking, and budgeting in one user-friendly platform. It helps users avoid late payments, thus improving their credit scores and saving money on late fees. The app’s integration with Google and Outlook calendars ensures users receive timely reminders for their bill due dates directly in their preferred calendar. Additionally, TimelyBills provides tools for budget planning, tracking debts, and setting financial goals.

| Pros | Cons |

|

|

Best Features:

- Customized Reminders: Tailor notification settings to receive reminders up to 7 days in advance, ensuring timely payments.

- Shared Bill Reminder: Facilitates shared responsibility for common bills, ensuring everyone involved is notified.

- Calendar View & Weekly Reports: Offers a comprehensive view of financial commitments and weekly summaries to help users plan ahead.

BillOut offers diverse range of features, including personalized notifications, multiple payment frequencies, and a shared bill reminder option. It caters to a wide array of user needs, making it an adaptable tool for managing personal finances. Additionally, its privacy-centric approach, requiring no bank connections and minimal personal information for signup, positions the app as a secure and straightforward solution for bill management.

| Pros | Cons |

|

|

Best Features:

- Forecast View & Amount to Save: Projects future bill payments and savings requirements, aiding in financial planning.

- Intelligent Estimated Amount Due: Utilizes bill type, payment history, and seasonal trends to accurately estimate variable bill amounts.

- Monthly History & Annual Reports: Offers detailed insights into monthly and yearly spending, allowing for better financial oversight and planning.

Chronicle reminds users of upcoming payments and also meticulously tracks payment history, providing a solid record of transactions. For Mac users, the free version supports up to five bills, while Chronicle Pro offers an expanded suite of features, including unlimited bill tracking and advanced forecasting tools.

| Pros | Cons |

|

|