As an iPhone user, you have access to some of the top bill pay apps that make managing and paying your bills quick and easy. With high-quality apps specifically designed for iOS, you can simplify bill organization, get reminders of due dates, securely pay online, and more—all right from your iPhone

In this article I’ll highlight the key features to look for in the best iPhone bill pay apps. I’ll also review my top picks to help you choose the right one for your needs and budget. Let’s dive in!

Main Benefits of Using a Bill Pay App on iPhone

Here are some of the main advantages that bill pay apps for iPhone provide

-

Consolidation – View and manage all your bills in one place instead of digging through paperwork or visiting multiple websites.

-

Organization – Categorical sorting and search makes it easy to find any bill. Some apps sync between iPhone and iPad for access anywhere.

-

Reminders – Never miss a due date again. Get notifications when bills are coming due.

-

Payments – Securely pay bills directly within the app through your bank account, credit card, Apple Pay and more.

-

Reporting: Look at spend summaries, graphs, trends, and other information about how you pay your bills.

-

Accessibility—the information and tools you need to pay your bills are always close at hand on your iPhone.

-

Backup – Data is securely stored and often supports iCloud syncing between devices.

For busy professionals and families juggling multiple bills each month, having a centralized bill pay app on your iPhone can really simplify your finances.

Top Features to Look for in Bill Pay Apps

When evaluating bill pay apps for your iPhone, keep an eye out for these helpful features:

-

Free app – The best apps provide full functionality without any upfront cost.

-

Recurring bills – Easy set up of regular payments like rent, utilities, subscriptions, etc.

-

One-time bills – Pay occasional bills like medical, auto repair, tuition, etc.

-

Reminders – Get notifications when bills are coming due or overdue.

-

Payments – Securely pay directly inside the app via bank transfer, credit/debit card, Apple Pay.

-

Attachment upload – Add bill images, PDFs, documents to keep details handy.

-

Reporting – Charts and graphs to analyze spending and view payment history.

-

Syncing – Seamlessly use the app across iPhone, iPad, desktop.

-

Passcode protection – Secure access to your sensitive financial data.

-

Customer support – Get timely help if any issues arise.

Getting an app with those key features will provide the best overall bill pay experience on your iPhone.

Top 5 Bill Pay Apps for iPhone

Now let’s take a look at my top picks for bill pay apps optimized for iPhone users.

1. Papaya

Papaya is my #1 choice for securely and conveniently paying bills from your iPhone. It’s a free app enabling you to pay any bill type in seconds. I love the clean interface, ease of adding payees, and fast payments.

Key Features:

- Pay bills from bank account, credit/debit card, FSA, HSA

- Works for rent, utilities, loans, insurance, services, government fees

- Send payments in seconds

- Secure encrypted platform

- Receive payment confirmations

- Add multiple payment methods

- Syncs with iPad and Apple Watch

Papaya takes bill pay to the next level with speed and security. It’s an essential download for iPhone users.

2. Bills Organizer & Reminder

As the name suggests, Bills Organizer & Reminder focuses heavily on bill scheduling and reminders. It’s one of the top choices for staying on top of due dates.

Key Features:

- Recurring bill scheduling with reminders

- Overdue reminders to avoid late fees

- Charts summarize spending

- Calendar view of due dates

- Repeating and one-time bills

- Notes section for bill details

- Passcode and Touch ID security

If you need serious help staying organized with bills, this is the go-to iPhone app.

3. Bill Tracker

Bill Tracker stands out for its simplicity in tracking your bills and finances. It makes bill management a breeze.

Key Features:

- Easy bill scheduling

- Notifications when bills are due

- Report summaries of spending

- Passcode protection

- Cloud sync across devices

- Attach photos of bills

- Filter bills by category

- iPhone and Apple Watch compatibility

The clean design and intuitive bill tracking of this app appeal to many iPhone users. It’s one of the most user-friendly money apps.

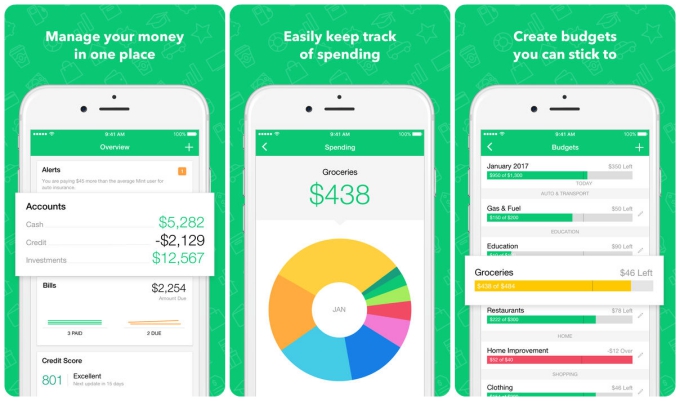

4. Mint Bills

Mint Bills integrates directly with the popular Mint personal finance app. It’s best for existing Mint users.

Key Features:

- View bills from Mint app

- Get bill due reminders

- See cash flow forecasts

- Make bill payments

- Monitor subscriptions

- Alerts for bill increases

- Fully synced with Mint.com

If you already use Mint, its bill pay companion app offers a seamless experience across iPhone and the web.

5. Doxo

Lastly, Doxo provides a full suite of bill pay and money tools for iPhone owners.

Key Features:

- Pay bills with bank account, credit/debit card

- Organize bills from 2,000+ companies

- Snap a photo of any paper bill

- Sync bills across devices

- Receive reminders by text, email, mobile push

- Customer service 7 days a week

Doxo is a versatile option covering bill pay essentials plus extras like customer support. The app integrates directly with companies to fetch your latest bills.

Key Factors in Choosing an iPhone Bill Pay App

All the apps above are excellent choices, but you’ll want to weigh a few factors to decide on the best fit:

-

Bill variety – Some apps support more billers than others. Check if your companies are covered.

-

Reminders – Assess the reminder options (email, text, push, etc.) and flexibility.

-

Payments – See what payment methods are accepted, banks linked, fees charged, etc.

-

Security – Look for encryption, passcodes, Touch ID/Face ID, and other security measures.

-

Customer support – Review ratings and complaints regarding the app’s support channels.

-

Syncing – Determine if the app easily syncs bill data across iPhone, iPad, desktop, etc.

-

Reports – Check if spending charts, graphs, trends and other reporting are robust.

By comparing apps across those aspects, you can zero in on the top contender for your specific billing needs.

Setting Up Your Chosen iPhone Bill Pay App

Once you select your preferred bill pay app in the App Store, follow these steps to get set up:

-

Download and install the app on your iPhone.

-

Upon opening, you’ll need to create an account and accept terms.

-

Enter your basic profile information like name, email, etc.

-

Set a secure passcode for accessing the app.

-

Begin adding your recurring bills with details like payee names, due dates, amounts owed.

-

Connect payment accounts like your bank or credit card for making payments.

-

Enable any reminder or notification options.

-

Review all bills, accounts, and settings to ensure accuracy.

-

Make any upfront bill payments if needed.

That initial setup should get your bill pay app fully functional on your iPhone. Just maintain it by periodically adding new bills, making payments, and reviewing your financial snapshot.

Pay Bills on the Go with Your iPhone

Bill pay apps transform your iPhone into a mobile bill payment command center. You gain control over your finances, avoid late fees, and simplify bill management with just a few taps.

I highly recommend iPhone users check out Papaya, Bills Organizer, Bill Tracker, Mint Bills, Doxo, or any of the other top-rated options covered here. Find the one that best fits your budgeting style and preferences.

With a bill pay assistant right in your pocket, you can stay on top of bills and make payments no matter where you are. It provides convenience, organization, and piece of mind. So download a top-rated bill pay app and make your iPhone the central hub for financial responsibility. Your wallet will thank you!

Whatâs New May 21, 2024

Paying bills is easier than ever. In this version, weve made some improvements and changes for an even faster bill pay experience.

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Location

- Contact Info

- Identifiers

- Usage Data

Best Bill Tracker Apps: iPhone & Android (Which is the Best Bill Tracker App?)

How do mobile payment apps work?

That’s why mobile payment apps have increasingly caught on with consumers. Apple Pay is the default payment method for iPhone, iPad, Apple Watch, and Mac owners. By connecting a credit or debit card through the app, your iPhone or Apple Watch can be used to pay for items at physical stores and at online retailers.

How do I use Apple Pay on my iPhone?

Right on your iPhone. Apple Pay is built into iPhone, Apple Watch, Mac, and iPad. Start by adding your credit or debit card to the Wallet app on your iPhone, and you’ll have the option to add it to your other devices in one easy step. When you want to pay, just double-click, tap, and you’re set.

What mobile payment apps are available?

Over the course of several weeks, we tested out five different mobile payment apps: Apple Pay, Google Pay, Samsung Pay, Venmo (by PayPal) and Cash App (by Block, formerly Square). We tested Apple Pay and Samsung Pay on just their own devices and tested Google Pay, Venmo and Cash App on both Android and iOS.

Where can I use Apple Pay?

Apple Pay is accepted at over 85 percent of retailers in the U.S., so you can likely use it wherever and however you want. If you’re not sure, just ask. Apple Pay works anywhere that takes contactless payments — from vending machines and grocery stores to taxis and subway stations. In apps and online.