Someone who has had trouble in the past keeping track of bills and payments, I know how important it is to have a system in place. Dates and amounts that are due are so easy to forget, which can lead to late fees, interest charges, and even service interruptions. Because of this, I now use a Bill Pay Excel template to keep track of my money.

In this comprehensive guide, I’ll explain what an Excel bill payment tracker is, the benefits of using one key features to look for and where to find free downloadable templates. I’ll also provide tips for customizing a template to match your specific needs.

Whether you prefer to pay bills manually or use a combination of automated and manual payments, a Bill Pay Excel spreadsheet can be an invaluable tool. Keep reading to learn how implementing one can alleviate stress and save you money when managing finances.

What is a Bill Pay Spreadsheet?

A bill pay spreadsheet is an Excel file that keeps track of everyday payments like

- Rent or mortgage

- Car loans

- Utilities like electricity, gas, water, cable TV

- Insurance such as auto, health, home

- Credit cards

- Subscriptions like gym memberships, music/video streaming

- Cell phone

- Internet

- And any other recurring expenses

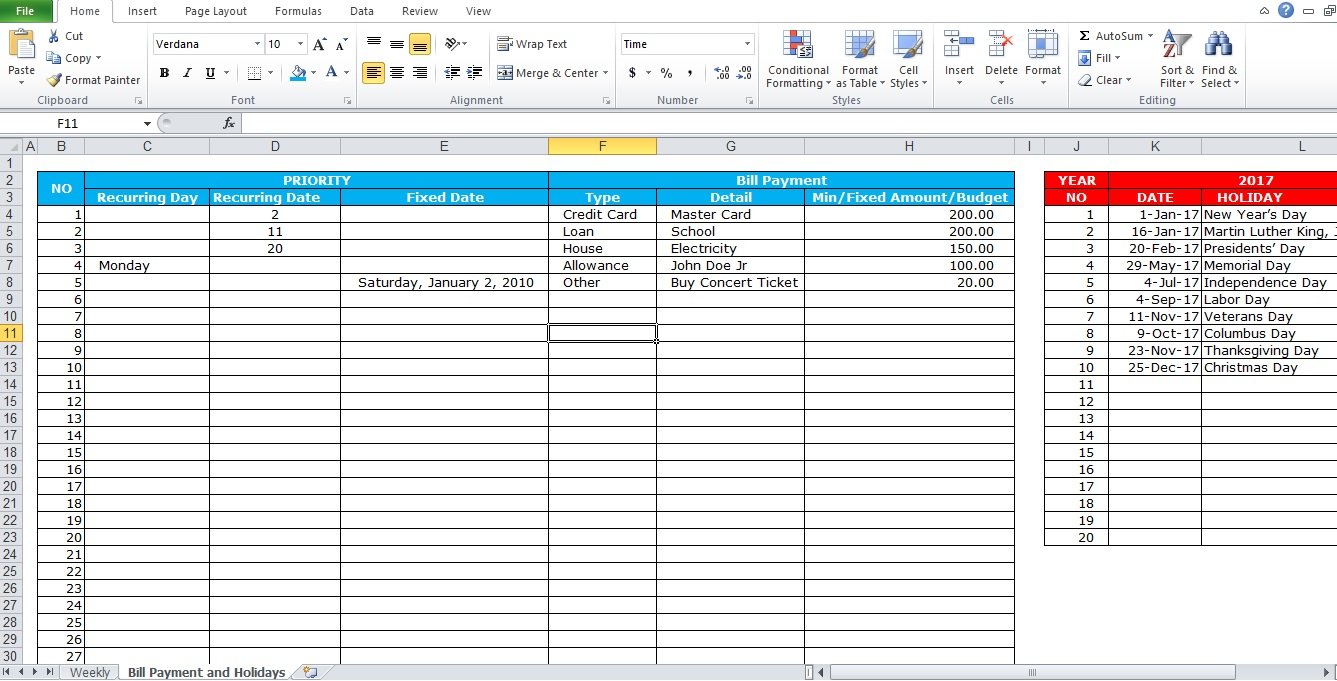

This type of spreadsheet allows you to see all of your bills in one place. You can organize by due date payment amount or frequency (weekly, monthly, quarterly, etc).

Excel bill trackers make it easy to keep track of what you owe and when it’s due. This helps prevent late payments and maintain good credit. A bill organizer template gives you greater control over cash flow as well.

Benefits of Using a Bill Pay Spreadsheet

There are many advantages to tracking bills with a spreadsheet template:

- Avoid late payments – Don’t miss deadlines that lead to penalties and interest.

- Plan for upcoming payments – Know what’s due each week/month to manage cash flow.

- Track payment history – Reference previous balances and payments.

- Manage irregular bills – Keep quarterly or annual bills organized.

- Record auto payments – Note bills paid automatically for better awareness.

- Easy to update – Adjust dates, amounts, status anytime.

- Customizable – Tailor Excel template to your specific needs.

- Share access – Easily collaborate with others.

- Works offline – Manage bills without internet access.

- Visually organized – Charts and tables provide clarity.

Having all your bills mapped out in a customizable spreadsheet keeps everything neatly in one place and improves organization.

Key Features to Look for in a Bill Tracker Template

The more useful attributes a Bill Pay Excel template includes, the easier it will be to stay on top of your finances. Handy features include:

- Due dates – Notes when each payment is due.

- Past balances – Records what you previously owed.

- Payment amounts – Clearly states what you need to pay.

- Interest rates – Shows APR on loans/credit cards to prioritize.

- Projected payments – Calculates upcoming monthly payment totals.

- Custom categories – Groups bills (utilities, loans, subscriptions, etc).

- Status tracking – Marks bills as paid, pending, past due, etc.

- Auto calculation – Sums totals and balances automatically.

- Charts/graphs – Visual tools to digest the data.

- Printable – Easy to print physical copies.

The right template will have the proper organizational structure and formulas built in to take the work out of managing payments.

Where to Find Free Bill Organizer Excel Templates

Many free Bill Pay Excel templates are available online to download and customize. Here are some top resources:

- Vertex42 – Simple, printable bill tracker template.

- Tiller – Feature-rich template works with Tiller Money Feeds.

- Microsoft – Flexible monthly budget tracker adaptable for bills.

- ExcelTemplates – Basic customizable bill payment checklist.

- Google Sheets – Simple starter template to build from.

I recommend browsing the selection to find an Excel bill tracker template that has the right look and features for your needs. The great thing is all of these are free to download and adjust as needed.

Customizing a Template for Your Specific Bills

While there are many good Bill Pay Excel templates available, the best way to stay organized is to customize one to match your personal finances. Here are tips for tailoring a template:

-

Add your real bill information – Populate the template with your real company names, payment amounts, and due dates.

-

Adjust column widths – Make columns wider or narrower so full bill names and amounts fit.

-

Change default text – Replace placeholder names and data with your real info.

-

Modify the layout – Reorganize where certain elements appear on the sheet.

-

Add or remove columns – Adjust which data to include or exclude on your version.

-

Update formulas – Make sure formulas reflect your bills and time periods.

-

Change color scheme – Alter colors to make your template more aesthetically pleasing.

-

Add charts/graphs – Insert visuals if desired to better analyze patterns.

Don’t be afraid to fully adapt a general template to become your specialized Bill Pay Excel spreadsheet. It takes a bit of upfront effort but saves hassle long term.

Tips for Managing Bills with Your Custom Spreadsheet

Once your Excel bill organizer is set up, be sure to use it consistently to maximize its benefits:

-

Update regularly – Add new bills immediately and update status whenever you make payments.

-

Review weekly – Set time every week to look at upcoming due dates.

-

Stay current – Don’t let past due items linger to avoid snowball effect.

-

Scan column totals – Look at projected monthly payouts to plan cash flow.

-

Print monthly – Keep a paper copy to reference when not at your computer.

-

Back up digitally – Save a copy to the cloud in case computer crashes.

-

Share read-only – Let spouse/partner view but not edit to stay on same page.

-

Use mobile – Add Excel app to phone to check on bills when on the go.

Following these tips will ensure your Bill Pay Excel template becomes a tool you utilize frequently and consistently.

A customized Bill Pay Excel spreadsheet is a simple yet powerful way to stay on top of finances and avoid surprises. After dealing with the stress of missed payments and scrambling to cover bills myself, I’ve come to rely on this tool.

The investment of time to set up a Bill Pay Excel spreadsheet pays off exponentially down the road. Not only can it save you money through preventing late fees, it also delivers invaluable peace of mind that your finances are tracked properly.

Budgets don’t have to be boring! Find a customizable design template for your budget and bring some eye—splashing aesthetics to your next budget—based project. From household and personal budgets to banking for business, there’s a budget template for you.

How to Make A Simple Monthly Budget or Bill Tracker In Excel

FAQ

Does Excel have a bill tracker?

Does Excel have an expense template?