As a Bluebird cardholder, you likely appreciate the convenience of being able to pay bills directly from your prepaid account. However, technology can be frustrating when things don’t work as expected. If you’ve tried to use the Bluebird online bill pay feature but experienced issues, this comprehensive troubleshooting guide will help you get to the bottom of what’s going wrong.

Overview of Paying Bills with Bluebird

Bluebird by American Express offers account holders the ability to easily pay bills right from their prepaid card account To use the bill pay feature, you first need to have money loaded onto your Bluebird card.

Once funded, you can use the Bluebird online account portal or mobile app to securely pay companies or individuals. Bluebird will either send an electronic payment or physical check on your behalf directly to the payee.

There are no fees for bill pay with Bluebird as long as you schedule the payment at least 5 days before the due date, Same-day or next-day “Rush Delivery” payments do incur a fee

Why Bluebird Bill Pay Might Not Be Working

Despite how convenient Bluebird bill pay can be, there are times when you might run into issues that prevent payments from going through as expected. Here are some of the most common reasons why Bluebird bill pay fails:

-

Insufficient Funds – If your Bluebird card does not have enough money when it’s time for the scheduled payment, the transaction will fail. Always check your balance beforehand.

-

Accidental Duplicate Payments – Paying the same bill twice in one month is an easy mistake that can cause payments to be rejected.

-

Wrong Payee Information – An incorrect account number or details entered for the payee means the payment can’t process accurately.

-

Temporary Service Disruption – Like any technology, Bluebird may experience downtime that results in bill pay failures.

-

Card is Frozen or Suspended – If your card is frozen due to suspected fraud or other reasons, bill pay transactions won’t go through.

-

Recently Changed Payee Details – If the payee recently changed names, account numbers, addresses or other info, payments could fail until updated.

-

Scheduled During Outage – If a scheduled bill payment coincides with any Bluebird outages or disruptions, it may not fully process.

Troubleshooting Bluebird Bill Pay Step-by-Step

If you’ve tried to use Bluebird bill pay but the payment didn’t complete successfully, don’t panic. Here is a step-by-step troubleshooting guide to help identify and resolve the problem:

Step 1: Check Bluebird Service Status

First go to Downdetector.com/status/bluebird and see if others are reporting widespread problems and outages. If so, try again later when service is restored.

Step 2: Review Any Error Messages

Carefully read any error notifications you see when the bill pay fails. These indicate why it was rejected. Insufficient funds, duplicate payment, and invalid payee details are commonly cited errors.

Step 3: Log Into Your Bluebird Account

Access your account dashboard through the Bluebird website or mobile app. Check if the attempted payment is listed under “Pending Transactions” or “Failed Transactions” to determine its status.

Step 4: Verify Your Balance

While logged into your account, confirm your current Bluebird balance is sufficient to cover the full payment amount + fees. Transfer funds quickly if needed.

Step 5: Double Check Payee Details

Ensure you accurately entered the correct name, address, account number, phone number and payment amount for the payee. Compare to recent bills or statements from the vendor.

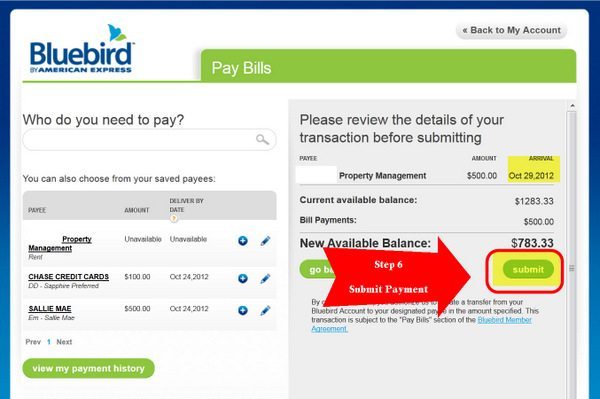

Step 6: Contact Bluebird Support

If the steps above don’t resolve your issue, reach out to Bluebird customer service by phone or chat for additional troubleshooting help. Ask them to trace the failed payment and identify the problem.

Step 7: Arrange an Alternative Payment

If needed, use another payment method such as paying directly through your payee’s website or mailing a physical check. Notify your payee there was an issue with the Bluebird payment.

Best Practices to Avoid Bluebird Bill Pay Problems

Following these tips will help prevent problems and errors with Bluebird bill payment in the future:

-

Clearly enter payee details – Account numbers, spellings of names/companies, addresses all matter!

-

Check your balance before scheduling payments to ensure sufficient funds

-

Only schedule a payment once, don’t accidentally duplicate it

-

Avoid paying at the last minute in case errors need fixing

-

Sign up for balance alerts to know when more funds are needed

-

Update your payee info directly with them as changes occur

-

Confirm payments show as “Paid” not just “Pending” in your dashboard

-

Routinely check Downdetector for service issues before paying bills

-

Contact support at the first sign of trouble to resolve quickly

What To Do if Your Bluebird Card is Suspended

If Bluebird detects potential fraudulent activity on your card, they may freeze your account until the issue can be investigated. Unfortunately, this prevents any bill payments from going through. Here’s what to do if your card is suspended:

-

Call or email Bluebird support immediately to explain the situation and request account reinstatement.

-

Access your account to view any messages about the suspension and why it occurred.

-

Review recent account activity to look for anything suspicious or unauthorized.

-

Change your log-in password if it appears compromised.

-

Arrange alternative bill payment through another source in the meantime.

-

If reinstated, update your card info with any payees that were declined.

-

Sign up for alerts to be notified if your card is ever suspended again.

Having your Bluebird prepaid account suddenly frozen can disrupt bill pay, but their fraud prevention protocols keep your money secure. Work quickly with their team to reverse erroneous suspensions.

Reliable Bill Payment Starts with Understanding Errors

As you can see, Bluebird bill pay errors can happen for a wide variety of reasons. But a bit of preparation and quick troubleshooting when issues arise goes a long way.

Use this guide to identify problems with Bluebird bill payment and resolve them efficiently. Just follow the step-by-step checklist and consult Bluebird’s excellent customer support if needed. With a few best practices, you can keep using the convenience of Bluebird bill pay worry-free. Paying bills should be simple, not stressful!

Bluebird bank Bill-pay sent || Bluebird bank card decline p2p problem solve

FAQ

How long does Bluebird bill pay take?

How do I speak to a live person at Bluebird?

What bank is associated with Bluebird?

What is the maximum amount you can put on a Bluebird card?

How does Bluebird pay bill work?

The Bluebird Pay Bill feature is a great way to earn miles and points for bills which usually don’t earn miles and points! But schedule your payment at least 6 days in advance of the due date. There is no option to schedule recurring or automatic payments which is very inconvenient.

Is Bluebird a prepaid debit card?

Bluebird is a prepaid debit card that is offered by American Express (AmEx) and Walmart. This chart shows a view of problem reports submitted in the past 24 hours compared to the typical volume of reports by time of day. It is common for some problems to be reported throughout the day.

Is downdetector Bluebird a prepaid debit card?

Current problems and outages | Downdetector Bluebird is a prepaid debit card that is offered by American Express (AmEx) and Walmart. This chart shows a view of problem reports submitted in the past 24 hours compared to the typical volume of reports by time of day.

Is there a fee to use Bluebird bill pay?

There is NO fee for using Bluebird Bill Pay. You then use your Bluebird card to pay for Rent, Mortgage, Credit Card Bills, Utilities, College Tuition, Payments to contractors, etc. Bluebird offers 2 options to pay your bills via their “ Pay Bills ” system. The first way is to look up the name of the business whom you want to pay.