Cashing checks at Walmart can be a convenient way to get quick access to funds without having to go to a bank But what types of checks can you cash there? Can you cash a bill pay check from your bank or utility company at Walmart? Let’s take a look at the details

What Is A Bill Pay Check?

A bill pay check is a check issued by a company or bank’s bill pay service to pay a bill or invoice on your behalf For example, many banks offer bill pay services that let you schedule payments to companies or individuals. You provide the payee details, the bank prints and mails a check in the amount you specify

You might also be able to pay your phone, cable, or electricity bill by having the company mail you a check instead of you paying online or sending it yourself. These checks are drawn on the biller’s bank account.

So in essence, a bill pay check is still a regular check, just issued automatically through a bill payment service

Walmart’s Check Cashing Policy

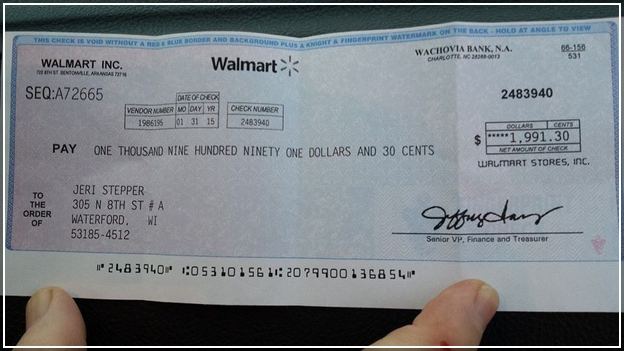

Walmart cashes a variety of check types, though there are some restrictions:

-

Limits: Walmart caps check cashing at $5,000 ($7,500 during tax season).

-

Fees: Checks up to $1,000 cost $4, and checks from $1,000 to $5,000 cost $8.

-

ID required: You must show valid photo ID.

-

Verification: Checks are run through TeleCheck or Certegy for approval.

-

Accepted checks: Payroll, tax refund, government, cashier’s, retirement account, insurance settlement, 401(k) distribution checks.

-

Not accepted: Handwritten checks, money orders (except Western Union and MoneyGram), checks over 180 days old, or made out to someone else.

Notably absent from the “accepted” list are bill pay checks. But there’s still a chance you may be able to cash them at Walmart.

Can You Cash Bill Pay Checks at Walmart?

The short answer is sometimes. While Walmart doesn’t specifically list bill pay checks under accepted check types, they don’t explicitly prohibit them either.

According to Walmart customer service, bill pay checks run through the same electronic verification system as other checks. So whether Walmart cashes them comes down to a case-by-case basis depending on:

-

The check details – Is it a printed check (not handwritten)? Does it have security features? No alterations? Within the 180-day limit?

-

Your ID – Do you have valid photo ID in your name matching the check payee?

-

Verification results – Does the check clear TeleCheck/Certegy’s databases without flags for potential fraud or insufficient funds?

Essentially, if the bill pay check looks legitimate and passes verification, Walmart may cash it. But there’s no guarantee, since the final decision depends on the specific store and staff.

Some other key things to note if trying to cash bill pay checks at Walmart:

-

Call ahead – Before going to the store, call customer service and ask if they cash bill pay checks from your specific biller. This can confirm policies and prevent wasted trips.

-

Bring backup ID/docs – In addition to your photo ID, have documents showing the source of the check (printed bill, account statement, etc.) in case further verification is needed.

-

Start small – When first cashing a bill pay check there, keep amounts under $1,000 until you establish a history cashing them.

-

Weekdays are better – Weekday staff may follow policies more closely than weekends. Avoid Mondays/Fridays when stores are busiest.

-

Try another retailer – If Walmart won’t cash your bill pay check, many grocers and discount stores will. Check their policies too.

-

Deposit into an account – Opening a free checking account provides a reliable way to cash bills pay checks by depositing them instead.

Troubleshooting Rejected Bill Pay Checks

If Walmart rejects your bill pay check, here are some steps to take:

-

Call TeleCheck/Certegy – Ask for details on why the check was declined and what you can do to resolve any issues.

-

Contact the biller – Verify with them the check was legitimately issued and no stop payments were placed.

-

Visit your bank – Your bank may cash checks drawn on their accounts more readily, though non-customers often still can.

-

Cash at the biller’s bank – Similarly, checks from an account there makes acceptance more likely.

-

Split the payment – Try cashing smaller portions at different locations/times if the full amount is getting flagged.

-

Hold the check – Letting older checks season for a couple weeks can sometimes help improve verification odds.

-

Switch billers – If one company’s checks get consistently rejected, pay your bill through another provider.

-

Open an account – Depositing into your own bank account bypasses verification, ensuring you can cash bill pay checks.

Alternatives to Cashing Bill Pay Checks at Walmart

If cashing bill pay checks at Walmart doesn’t work for you, here are some other convenient options:

-

Grocery stores – Many accept various checks. Ask customer service about their policies.

-

Check cashing stores – They specialize in cashing checks and typically have higher limits than retailers.

-

Your bank – Deposit into an account there and then withdraw cash. Useful if you have an account.

-

The check issuer’s bank – Banks readily cash their own checks, even for non-customers.

-

ATMs – Insert checks for cash at ATMs of the issuing bank. Useful in a pinch if you can’t get to a branch.

-

Prepaid debit cards – Some will let you load checks to the card to access funds.

-

Third-party apps – Apps like Ingo Money or Activehours cash checks via a smartphone for a fee.

-

Open a checking account – Allows you to cash any check through deposits. Many have no minimum balance and low or no monthly fees.

The Bottom Line

Walmart may cash bill pay checks, but it depends on the specific check, verification policies, and staff at the time. Your safest options are to open a free checking account to reliably deposit bill pay checks or visit the check issuer’s bank where acceptance likelihood is highest. But with proper ID and documentation, cashing bill pay checks at Walmart is certainly possible, just not guaranteed. Be prepared with backup cashing options in case they reject your bill pay check.

What are the Walmart MoneyCenter hours?

Walmart MoneyCenter hours are 8 a.m. to 8 p.m. Monday through Saturday and 10 a.m. to 6 p.m. on Sunday, according to Walmart.

You can go to any Walmart for money services. If the store doesn’t have a MoneyCenter (or if you go outside of MoneyCenter hours of operation), you can still get money services at the Customer Service desk.

What is the Walmart MoneyCenter?

The Walmart MoneyCenter is an in-store and online alternative to a bank. You can find prepaid debit cards, credit cards, money transfers and cash services. A MoneyCenter is dedicated to providing these money services, but all Walmart stores offer these services, even if there isnt a designated center.

If you use Walmart MoneyCenter because you don’t have a bank account, you might want to consider opening one. Many bank accounts have no monthly fees and provide the same services you get from Walmart — including sending money to friends and family and some money transfers — without fees. And many are available on your phone. (Had a hard time getting a bank account in the past? Check out NerdWallets article on second-chance checking accounts for a possible solution.)

SoFi Checking and Savings

4.60%SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

$0These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.

Betterment Cash Reserve – Paid non-client promotion

5.50%*Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

$0CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.

Marcus by Goldman Sachs High-Yield CD

5.10%5.10% APY (annual percentage yield) as of 04/29/2024

5.05%5.05% Annual Percentage Yield

4.90%Annual Percentage Yields (APY) is subject to change at any time without notice. Offer applies to personal non-IRA accounts only. Fees may reduce earnings. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest in effect at that time. Visit synchronybank.com for current rates, terms and account requirements. Member FDIC.

Marcus by Goldman Sachs High-Yield CD

5.00%5.00% APY (annual percentage yield) as of 04/29/2024

1 yearChecking accounts are used for day-to-day cash deposits and withdrawals.Checking accounts are used for day-to-day cash deposits and withdrawals.

Deposits are FDIC Insured

$0Money market accounts pay rates similar to savings accounts and have some checking features.Money market accounts pay rates similar to savings accounts and have some checking features.

Discover® Money Market Account

Can I cash a cashier’s check at Walmart?

FAQ

Does Walmart cash bill pay checks?

How do I cash a bill pay check?

What is the limit to cash a check at Walmart?

|

Bill pay

|

Consumers can pay bills in Walmart stores with over 20,000 billers available.

|

|

Check cashing

|

Customers can cash personal checks up to $200 and all other checks up to $5,000 for instant cash or have the amount added to a Walmart MoneyCard.

|

Why can’t I cash my check at Walmart?