These days, fewer people are writing checks to pay their bills. Instead, they are turning to convenient online payment methods through apps and websites. One popular option is PayPal, which allows users to securely link accounts, schedule payments, and manage bills all in one place.

But can you really use PayPal to pay bills? How does it work? What are the benefits? In this comprehensive guide, we’ll explain everything you need to know about paying bills with PayPal.

Overview: Paying Bills Through PayPal

PayPal offers a bill pay service that lets you link your regular bill payments like utilities, subscriptions, loans, and more. You can then quickly pay those bills through your PayPal account.

Here’s a quick rundown of how it works:

-

Link your billers by searching for their name or account number

-

Connect PayPal to your bank account or cards to fund payments.

-

For each biller, enter your account number, set up scheduled payments, and confirm billing amounts.

-

When it’s time to pay, just log into your PayPal account and send money to the connected biller.

-

PayPal debits your funding source and delivers payment to the biller on your behalf

It takes just a few minutes to set up each biller. After that, you can pay all your bills in seconds right through PayPal.

What Bills Can You Pay Through PayPal?

PayPal allows users to pay a wide variety of bills, including:

-

Utilities – electricity, gas, water, etc.

-

Telecommunications – phone, cable, internet etc.

-

Insurance – auto, health, home, life, etc.

-

Government – taxes, vehicle registration, etc.

-

Financial Accounts – credit cards, loans, mortgages

-

Entertainment – streaming services, subscriptions, memberships

-

Rent/HOA payments

-

And more! Any company or service with an account number can likely be paid.

As long as the recipient accepts electronic payments, you can use PayPal to pay your bill.

The Benefits of Paying Bills Through PayPal

Using PayPal to manage and pay your bills offers many helpful benefits:

Convenience

PayPal provides one dashboard to view, schedule, and pay all your bills. No more logging into multiple accounts.

Speed

Payments process instantly, so bills get paid faster than by check. No more waiting for checks to be delivered by mail.

Organization

You can view past payments and upcoming due dates all in one place, helping you stay organized.

Automatic Payments

You can set up recurring payments to have bills paid automatically each month on their due date.

Mobile Access

In addition to web, you can pay bills from PayPal’s mobile app for payments on-the-go.

Payment Notifications

Get emailed confirmations every time you send a payment so you know it was received.

Security

PayPal keeps your financial information private when making payments. Only your email/phone is shared.

Rewards

You can still earn credit card rewards by using linked cards to pay through PayPal.

Step-by-Step Guide to Paying Bills Through PayPal

Ready to start using PayPal to pay your bills? Follow these steps:

Step 1: Sign Up for a PayPal Account

If you don’t have one already, visit PayPal.com to sign up for a free personal account. This allows you to send and receive money.

Step 2: Link Your Bank Account or Cards

In your PayPal account settings, connect your bank account or debit/credit cards. These funding sources will be used to pay your bills.

Step 3: Search for Billers

From the PayPal dashboard, click “Pay Bills” and search for the companies you want to pay. Enter identifying details like account numbers.

Step 4: Set Up Payments

For each biller, enter your account number and set up scheduled payments, autopay dates, and payment amounts.

Step 5: Pay Your Bills

When it’s time to pay a bill, just log into PayPal, select the biller, confirm details, and send the money. So easy!

And that’s it – you’re now ready to pay bills seamlessly through PayPal. Give it a try today!

Tips for Managing PayPal Bill Pay

Once you start using PayPal for bills, here are some tips to get the most out of it:

-

Set up email notifications for payment confirmations and reminders.

-

Use auto-pay for any fixed recurring payments to have them paid on time automatically.

-

Schedule payments for a future date if needed for non-recurring bills.

-

If you linked a credit card, leave enough time for rewards points to post before the due date.

-

Monitor your account regularly to catch any errors quickly.

-

Contact PayPal support if you have any setup issues or payment questions.

-

Consider going paperless – many companies let you receive eBills directly within PayPal.

PayPal Bill Pay vs. Bank Bill Pay

Banks also commonly offer bill pay services. So how does PayPal compare to traditional bank bill pay?

PayPal offers greater convenience by consolidating all your bills in one place regardless of your bank. However, bank bill pay may provide tighter integration with your accounts.

Both options provide the essentials like scheduled payments and bill organization. PayPal also offers added features like mobile apps, payment notifications, and expanded biller options.

Ultimately, PayPal gives you more flexibility and convenience, while banks suit users who want maximum integration with their existing accounts.

The Bottom Line

Paying bills through PayPal is fast, convenient, and secure. With just a few clicks, you can schedule and manage payments to almost any company or service right through your PayPal account.

So ditch the envelopes and stamps – sign up for PayPal bill pay to simplify and organize your monthly bills!

Why is my payment method not available?

Sorry to hear your payment method isn’t available for your current purchase. It could be due to our security system not allowing the payment, or the payment method being unavailable in your region. We always look to improve the checkout experience and hope to offer that payment method to you in the future.

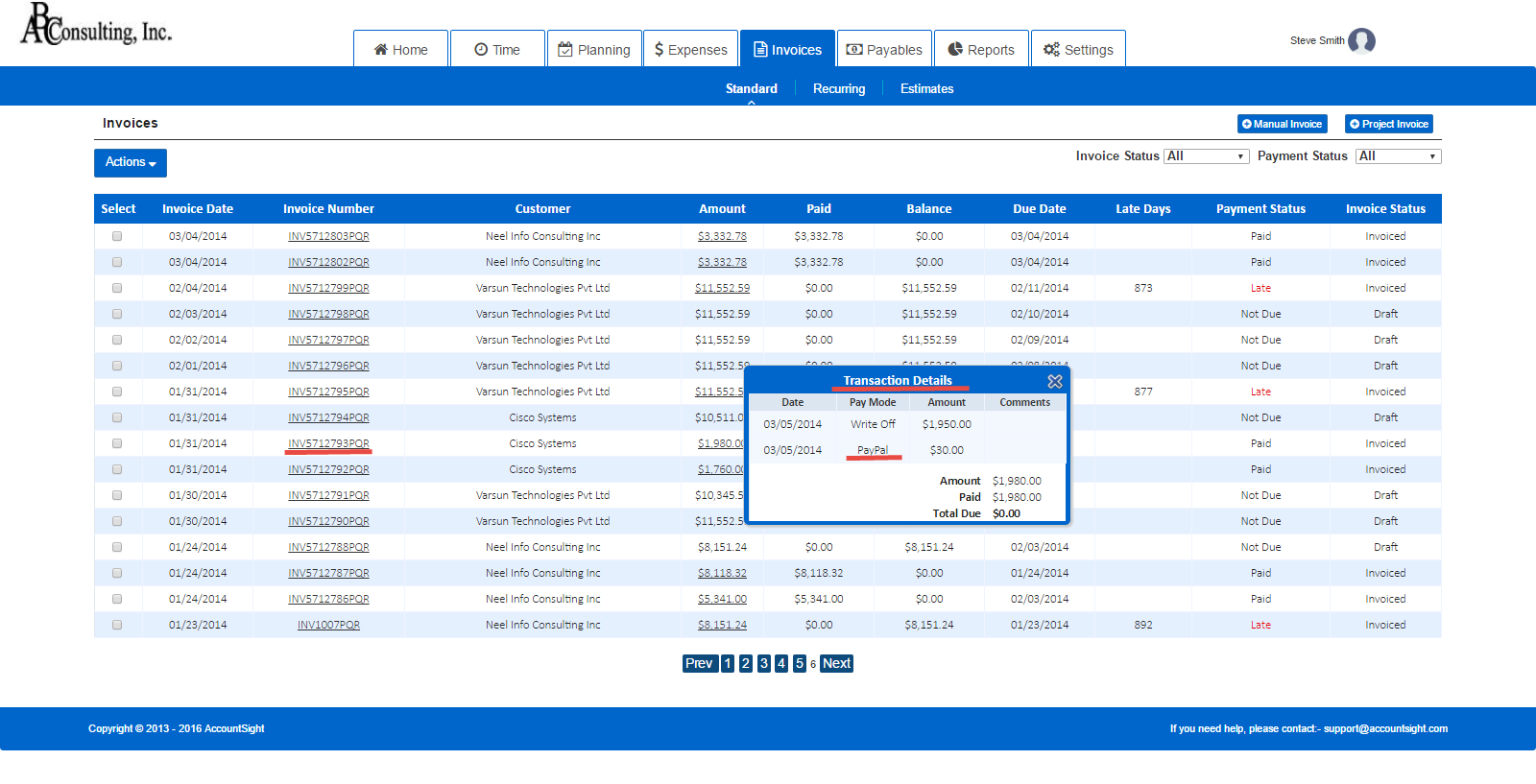

What payment methods can I use to pay an invoice?

PayPal is working to offer your favorite payment methods in one checkout experience. When you pay an invoice, you’ll have the option to use payment methods available in your PayPal Wallet or additional payment methods. Not all payment methods are available in every market. You’ll see the options available to you during checkout.

Within your PayPal Wallet, you can use the following payment methods:

- Bank accounts

- Credit and Debit Cards

- PayPal Credit

- Pay Later

- PayPal Balance

Payment methods within your PayPal wallet are covered by PayPal Purchase Protection.

Payment methods outside of the PayPal Wallet include:

- Venmo

- Apple Pay

- Credit and Debit Cards

If you have an issue with the payment and used a payment method outside of the PayPal Wallet, please work directly with the merchant or contact your payment method for assistance.

How To Pay Bills with Paypal – Full Guide 2024

How can I pay a bill using PayPal?

To pay a bill using PayPal, select PayPal as your payment method and log in to confirm the payment. If the provider does not accept PayPal, apply for the PayPal debit card, activate it on the PayPal website, and enter the number as a payment method. The PayPal Bill Pay feature is available in the PayPal mobile app.

Why should I pay my bills with PayPal?

Overall, paying bills with PayPal offers a streamlined and secure experience. With a few simple clicks, you can manage your bill payments, choose your preferred payment method, and ensure that your bills are paid on time. One of the great features of PayPal is the ability to easily manage recurring payments.

Can I link a bill to PayPal?

Yes. With PayPal, you can link, pay, and manage your bills from the PayPal app or the PayPal website. For more information on Bill Pay, please see our user agreement. To link a bill, go to your Dashboard, click ‘More’ near the top right of the screen, and then click ‘Pay your bills’. Search for your biller.

What is PayPal bill pay?

PayPal Bill Pay is a bill pay service offered through the PayPal platform that allows credit card payments to many billers (including utility companies, property tax entities, HOAs, etc) without an associated fee. Why use PayPal BillPay? Many biller’s charge a fee for credit card payments.