Paying your monthly bills can feel like a burden, especially when it comes to utilities like electricity that we rely on daily. We all want to find ways to make bill payment more convenient and hassle-free. One option that comes to mind is using a credit card to pay your electric bill. But is this a smart idea or not? In this detailed guide, I will walk you through everything you need to know about paying your electric bill with a credit card.

How Paying Electric Bill With Credit Card Works

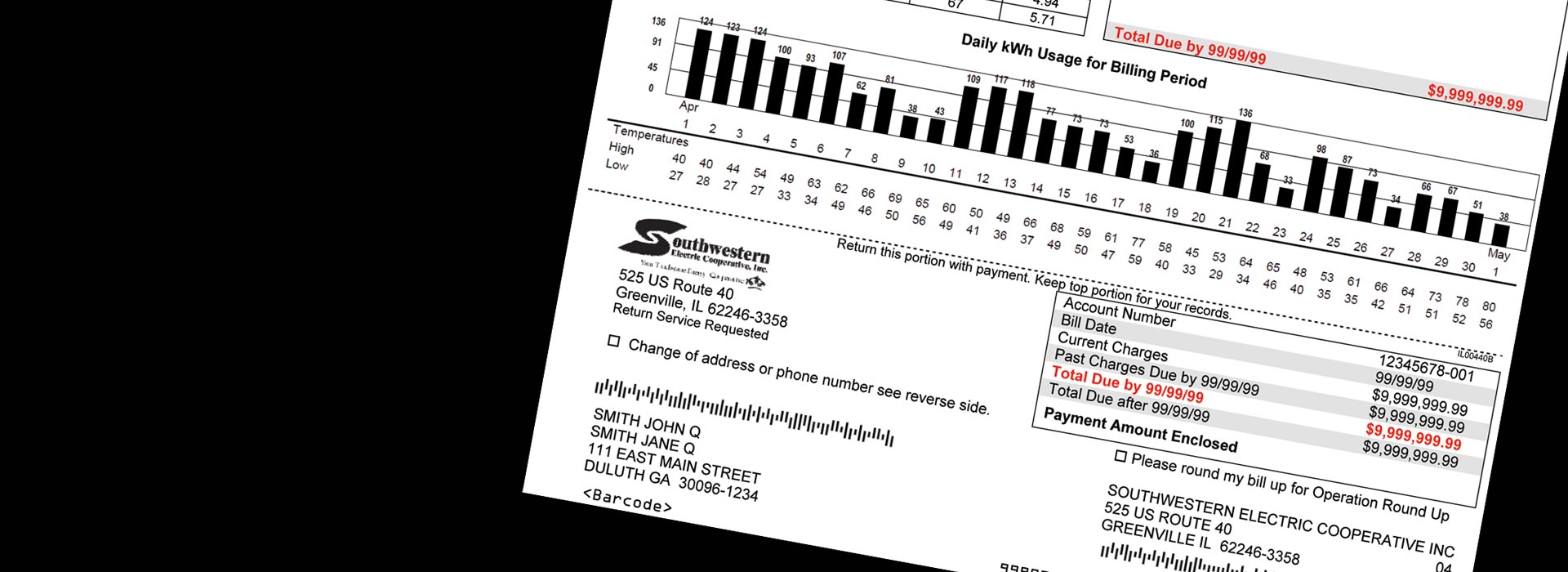

Most electric companies allow customers to pay their monthly bills directly with a credit card either online, over the phone, or in person. Some utilities may charge a convenience fee for credit card payments typically around 2-3% of the total bill amount.

When you use a credit card to pay your electric bill the charge will appear on your next credit card statement. As with any credit card purchase you will have the option to pay the balance in full or make minimum payments over time. If you don’t pay off the balance right away, interest charges will start accumulating based on your card’s APR.

One thing to note is that the electric company does not report your payment history to the credit bureaus. So paying your electric bill with a credit card will not directly help build your credit score. However, it can still be a smart way to earn rewards if you pay off the balance promptly.

Pros of Paying Electric Bill With a Credit Card

Here are some potential benefits of using a credit card to cover your electric expenses:

-

Earn rewards: Many credit cards offer robust rewards on all purchases. For instance, you could get 1-5% back in cash back or points/miles to redeem for gift cards, travel, and more. If you spend $150-$200 on electricity each month, that’s up to $600 or more in annual rewards just for paying a recurring bill.

-

Convenience: Paying with a credit card means you don’t have to mail checks or worry about your checking account balance. The payment happens automatically each month.

-

Buyer protection: Credit cards provide stronger buyer protection than debit cards or bank accounts. If you ever need to dispute a suspicious electric bill charge, you can do so easily with your credit card company.

-

Build credit: While electric companies don’t report payments to credit bureaus, putting routine expenses on a card and paying on time demonstrates responsible usage. This can strengthen your credit over time.

-

Coverage during emergencies: If you face an emergency expense and don’t have enough cash on hand, a credit card can provide access to funds right away so you can cover necessities.

Cons of Paying Electric Bill With a Credit Card

On the other hand, here are some potential drawbacks to keep in mind:

-

Interest charges: If you carry a balance month-to-month, interest charges can quickly outweigh any rewards earned. This may cost more than paying the bill directly from your bank account.

-

Credit utilization: Putting large electric bills on a card can increase your credit utilization ratio, which can lower your credit score if too high. Try to keep utility charges under 10-30% of your total credit limit.

-

Convenience fees: As mentioned earlier, some electric companies tack on a 2-3% fee for credit card payments. Crunch the numbers to see if the fee negates your rewards earnings.

-

Late fees: While autopay helps avoid late electric payments, a credit card billing dispute or insufficient funds could still potentially result in late fees.

-

Prepayment required: Some electric providers require prepaying for services. In these cases, credit cards likely cannot be used for the prepaid amounts.

-

Budgeting difficulties: It may be harder to track electric expenses paid via credit card vs. monitoring payments made directly through your checking account.

Tips for Paying Electric Bill With a Credit Card

If you decide to go the credit card route for paying utility bills, here are some tips to make the most of it:

-

Pick a card that aligns with your spending habits and offers the best rewards value. Cashback cards are simplest, while travel cards can provide higher returns.

-

Set up autopay through your electric company to have the bill automatically charged to your card each month. Just be sure the payment date aligns with your credit card due date.

-

Pay the balance in full each month to avoid interest charges. Set payment reminders if needed.

-

Consider dividing electric payments across multiple cards to manage credit utilization.

-

Call the electric company first to learn about any convenience fees. Make sure the fees don’t outweigh rewards.

-

Monitor your statements regularly to check for any erroneous utility charges. Dispute promptly if found.

Alternatives to Paying Electric Bill With Credit Card

If you are wary of using credit cards for electric bills, here are a couple alternatives to consider:

-

Enroll in bill pay through your bank to have checks automatically mailed to the electric company around your due date. Just ensure your account has enough funds.

-

Sign up for auto-debit payments from your checking account instead of autopay with a credit card. This avoids interest while still offering convenience.

-

Consider an** energy discount program** like Budget Billing that lets you pay a fixed amount each month to better manage costs.

-

Investigate financial assistance programs from your electric provider if expenses are difficult to handle some months. You may qualify for discounted rates.

Which Credit Cards Are Best for Paying Electric Bills?

If you do want to maximize rewards on electricity payments, here are some of the best credit cards to consider using:

-

Wells Fargo Active Cash® Card – Earns unlimited 2% cash rewards on all purchases with no annual fee.

-

Citi® Double Cash Card – Also earns 2% back, 1% when you buy and 1% when you pay it off.

-

Chase Freedom Unlimited® – Earns 1.5% cash back on all purchases and has a sign-up bonus offer.

-

Bank of America® Customized Cash Rewards credit card – Choose 3% cash back category, including utilities.

-

Capital One SavorOne Cash Rewards Credit Card – 3% cashback on groceries, 2% at grocery stores (includes many utility bills).

Be sure to review the fees and terms for any card you are considering. Aim for one that maximizes rewards value and fits your budget and spending.

The Bottom Line

Paying your electric bill with a credit card can certainly provide convenience, rewards, buyer protection, and other benefits if managed wisely. But interest charges, fees, and credit impacts need to be weighed carefully before opting in. Consider your financial situation, spending habits, and the card terms to make the most informed decision. If you do proceed, be diligent about paying off balances each month.

Looking for new ways to accumulate credit card points and rewards?

Paying your monthly bills seems like a great way to earn more rewards. But is it wise to pay your bills with credit cards?

Not all bills are created equal, so you’ll need to evaluate each to determine which ones make sense to pay with a credit card. But first, here’s a quick look at the pros and cons of paying bills with plastic.

- Accrue rewards or points

- Automatic payments that save time and help prevent late fees

- Convenience of no check writing

- Easier expense tracking with everything on one statement

- Can mean additional time to pay

- Can help meet credit card sign-up bonus requirement

- Possible fees

- Increased debt

- Additional interest if balance is not paid in full

- Credit utilization could go up, which could affect credit scores

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you’re able to adhere to two rules.

- Always pay your statement balance in full and on time each month.

- Avoid putting bills on a credit card because you can’t afford to pay them with cash.

If you’re having trouble paying your bills, a credit card could buy you a little time. But routinely using your credit card to pay bills you can’t afford could end up costing you a lot in interest and making your situation worse. On the other hand, if you’re paying routine bills that are within your budget, using a credit card has benefits.

So which bills can you pay with a credit card? And which bills will charge an extra fee if you pay with a card? Let’s look at which types of bills make the most sense to pay by credit card.

As the highest monthly expense for most people, mortgages look like an easy way to achieve that credit card sign-up bonus or accumulate significant points.

Sadly, virtually no mortgage servicers will allow credit card payments. And they have a good reason: Lenders don’t want to bear the credit card fees for processing the payments.

If you’re lucky enough to find a mortgage servicer that will allow you to pay your mortgage with a credit card, be prepared to pay a convenience fee that will likely exceed the benefits you’re hoping to get.

If you don’t mind a fee, third-party services such as Plastiq might be a good option for you. For a standard 2.9% fee, the company charges your credit card and sends a check to your mortgage lender (or anyone else you might want to pay). Before using this type of service, you’ll have to calculate if the fee is worth the rewards.

If you’re renting instead of paying a mortgage, you might still have a hard time finding a landlord who will accept something other than a check or cash for your monthly rent payment.

If you’re lucky enough to rent from a company with more sophisticated bookkeeping, consider using your credit card to pay your rent, especially if there’s no fee for the convenience.

Even with landlords that accept only cash or checks, you could still use a service like Plastiq or look for a credit card that allows you to pay rent through its own portal. None of these alternatives comes without a price — like convenience charges, interest or fees — but you get to decide whether the benefits outweigh the rewards.

Auto lenders, like mortgage lenders, aren’t likely to accept credit card payments. They, too, want to avoid the processing fees.

There’s a way to use a credit card to pay off your car loan, but it requires some serious financial discipline. If you find a credit card offer with a 0% introductory annual percentage rate for balance transfers, you may be able to transfer your car loan to the credit card. But before you jump on this idea, there are caveats.

This option only makes sense if you choose a card with a 0% introductory APR that applies to balance transfers. Also, you’ll need to pay off the balance before the rate goes up after the introductory period. Otherwise you’ll be paying interest on the remaining debt on the credit card, and the credit card will likely have a higher interest rate than the original auto loan.

There are other downsides. For example, you may not be able to transfer the entire car loan to a balance transfer card. And depending on the card, you may be charged a balance transfer fee. Also, there will likely be a negative impact on your credit as transferring a large balance will increase your credit utilization.

Given all the caveats, paying your car payment with a credit card isn’t generally the most practical option. You’ll have to consider the downsides and determine if it makes sense in your case.

CJU- LEARN HOW TO USE CREDIT CARDS TO PAY YOUR BILLS

Should you pay your electric bill with a credit card?

If your electric company charges you $5.85 per transaction to pay your monthly bill with a credit card, that means you’d pay $70.20 per year just in fees. Along with your other utility bills, you could end up paying a hundred dollars or more in fees by opting to use a credit card as your payment method.

Should you pay utility bills with a credit card?

If there are no extra fees or if the rewards are greater than the fees, you should consider paying utility bills with a credit card. You could be earning lots of bonus points on purchases you’re making anyway!

Should I use my credit card to pay my bills?

You can also earn reward points in the process, if your credit card offers that benefit. Here are some pros and cons of using your credit card to set up automatic payments on monthly bills: Paying bills and utilities on a credit card helps you

Which bills can be paid using a credit card?

You can pay some bills using a credit card. Charging your bills may help streamline your bill-pay process, and you might even earn rewards for your spending. However, you’ll need to pay off your credit card balance in full each month to avoid paying interest. Here are some things to consider about using your credit card to pay bills.