PayPal has become one of the most popular online payment methods in recent years As an online payment processor, PayPal allows users to send, receive, and request money from others quickly and securely One common question many PayPal users have is whether they can use a credit card to pay their PayPal bill or outstanding balance. In this comprehensive guide, we’ll cover everything you need to know about paying your PayPal bill with a credit card.

An Overview of Paying PayPal Bills

PayPal offers users several different options for funding payments sent from their PayPal account This includes linking bank accounts, debit cards, PayPal Cash or PayPal Cash Plus balances, and credit cards When you send money to another PayPal user, the default funding source used will be your PayPal balance. If there are insufficient funds, it will use your linked bank account or debit card.

PayPal also allows users to pay recurring bills from service providers through its Bill Pay feature. Bills like utilities phone bills subscriptions, and more can be linked to your PayPal account for easy automated payments. PayPal will pull funds from your chosen funding source to pay these bills when they are due.

Now when it comes to paying your PayPal bill or outstanding balance owed, the options are slightly different. PayPal will not automatically pull funds from linked credit cards to cover outstanding balances. However, you can manually make a payment towards your PayPal balance using a linked credit card. Here’s what you need to know.

Can I Use a Credit Card to Pay My PayPal Bill?

The short answer is yes, you can pay your PayPal bill or balance owed with a linked credit card. PayPal allows users to link Visa, Mastercard, American Express, Discover, and other major credit card brands to their PayPal account. As long as you have a credit card on file, you can make manual payments to clear your PayPal balance using that card.

It’s important to understand that this is a manual process, not an automated one. PayPal will not automatically charge your credit card as the primary funding source for payments or outstanding balances without your authorization. You need to manually initiate a transfer from the linked credit card to pay your PayPal bill.

Here are some key things to keep in mind:

-

You must have an existing credit card linked to your PayPal account to use this option. Adding a new card will require verification and take 1-2 days to process.

-

PayPal does not charge a fee for paying your balance with a credit card. However, your credit card issuer may treat it as a cash advance or charge a cash advance fee. Check with your credit card company.

-

PayPal will process the payment as a regular credit card purchase, not a cash advance. It will show up on your credit card statement as a charge from PayPal.

-

There are no limits on how much of your PayPal balance you can pay with a credit card, as long as your credit limit allows it.

-

You can make multiple partial payments over time using a credit card to clear your full PayPal balance owed.

-

Payments are typically processed quickly, allowing you to pay your PayPal bill within minutes with an instant credit card transfer.

Overall, using a credit card to pay off your PayPal bill can be a convenient funding option. Just keep the above factors in mind.

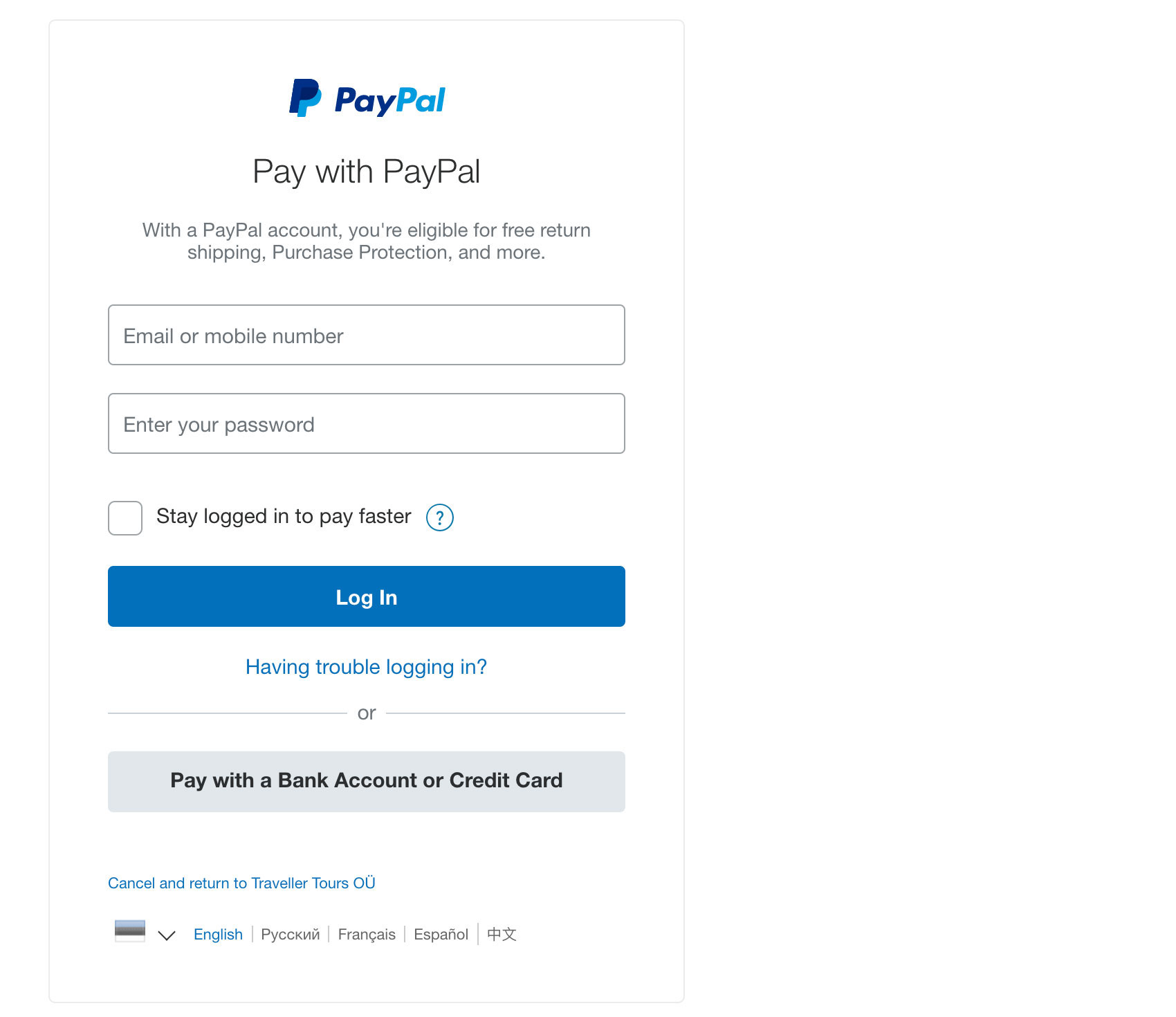

Step-By-Step Guide on How To Pay a PayPal Bill With a Credit Card

Paying your PayPal bill or balance owed with a linked credit card is easy to do through the PayPal website or mobile app. Here is a step-by-step walkthrough:

On the PayPal Website:

-

Log into your PayPal account at paypal.com and visit your Account Overview page.

-

Click on the “Transfer Money” option.

-

In the “Transfer Money” popup, choose the credit card you want to transfer funds from.

-

Enter the amount you wish to transfer towards your PayPal balance. You can make a partial payment or pay the full amount owed.

-

Confirm the details and click “Transfer Now”.

The money will be immediately credited to your PayPal balance, paying down your outstanding bill. The credit card payment will also show as pending or processed on your card.

Through the PayPal Mobile App:

-

Open the PayPal app and tap on your profile icon in the bottom right.

-

Tap “Transfer Money” from the menu.

-

Select your credit card as the payment method.

-

Enter the amount to pay your PayPal bill.

-

Review and confirm the transfer details.

-

Tap “Transfer Now”.

That’s all there is to it! Within seconds, your PayPal balance will reflect the credit card payment made. It’s a fast and easy way to pay your PayPal obligations from a credit card with just a few taps.

Key Benefits of Paying Your PayPal Bill With a Credit Card

Using a credit card to pay your PayPal balance offers several potential benefits:

-

Earn rewards: Many credit cards offer cash back, points, or miles rewards on purchases. Paying your PayPal bill can help you earn additional rewards.

-

Utilize credit: Paying with a credit card allows you to pay your PayPal obligations while also preserving funds in your bank account. This can help manage cash flow.

-

Build credit history: Responsibly making purchases with a credit card and paying them off helps establish a positive credit payment history.

-

Enjoy purchase protections: Credit cards provide certain protections like extended warranties, fraud protection, and purchase insurance which you won’t get using direct bank transfers.

-

Access to credit: In a pinch, you can use your available credit limit to pay off your PayPal balance, rather than waiting for a bank transfer.

As long as you pay your credit card bill responsibly by the due date, using a card to pay PayPal bills can make good financial sense. Taking advantage of rewards and benefits is a smart play.

Potential Downsides to Be Aware of

While paying your PayPal balance with a credit card can be beneficial, there are some potential downsides to consider:

-

Cash advance fees: Some credit card issuers may treat a PayPal payment as a cash advance and charge costly fees. This is rarer today but still a possibility.

-

Credit utilization: Using more of your available credit limit can negatively impact your credit score if not managed properly.

-

Interest charges: You’ll incur interest on the credit card balance if you cannot pay it off in full by the next statement due date. This can diminish any rewards earned.

-

Overspending: The ease of paying with credit could lead to overspending beyond your means and accumulating credit card debt. Financial discipline is key.

-

Credit locks: Repeatedly paying your PayPal balance with different credit cards could trigger fraud alerts and lead to accounts being temporarily locked.

The main risk boils down to overspending and winding up in credit card debt. As long as you carefully manage your credit card balances and avoid carrying over a revolving balance, you can minimize any potential pitfalls.

Tips for Successfully Paying Your PayPal Bill With a Credit Card

Follow these tips to smoothly pay your PayPal obligations using a linked credit card:

-

Verify rewards policies: Check that your credit card issuer does not treat PayPal payments as a cash advance or restrict earning rewards on them.

-

Mind your limits: Know your credit limit and be cautious not to overutilize your available credit. Using over 30% of your limit can impact your credit score.

-

Automate for discipline: Set up autopay of your credit card statement balance each month to avoid interest charges. Manually pay your PayPal bill.

-

Track balances: Regularly log in to PayPal and your credit card account to check pending activity and current balances. Avoid surprises.

-

Notify bank of travel: If paying your PayPal bill from a new IP address, proactively alert your credit card company of your travel plans to prevent lockouts.

-

Pay on time: Set payment reminders and pay your credit card statement balance on time each month to avoid finance fees and credit score damage.

-

Use primary card: Stick to one primary credit card for PayPal payments rather than constantly rotating different ones to avoid locks.

Following responsible practices will allow you to pay your PayPal obligations with a credit card while minimizing risks and fees.

Alternatives to Paying PayPal With a Credit Card

While credit cards offer a viable option, there are other ways you can pay off your PayPal balance:

-

Bank account transfer: Link a checking or savings account to seamlessly transfer funds from your bank to PayPal balance for no fees.

-

PayPal Cash: Fund your PayPal Cash balance using a debit card, bank transfer or at retail locations. Use PayPal Cash to pay your bill.

-

PayPal Cash Plus: With Cash Plus, you can obtain a PayPal debit card funded by your PayPal balance and use it like any other debit card.

-

Bill Me Later: PayPal’s Bill Me Later

What debit or credit cards can I use with PayPal?

You can use the following cards, including prepaid cards:

Can You Use PayPal to Pay Your Credit Card Bill?

Should I pay my bills through PayPal bill pay?

Paying your bills through PayPal Bill Pay is a great way to avoid incurring credit card fees when paying for bills. When you use a credit card with a generous sign-up bonus, you can earn a significant amount of points when using PayPal Bill Pay to pay your bills.

Can I pay a credit card with PayPal?

You cannot pay a credit card with PayPal directly, but you can transfer money from your PayPal balance to your bank account and then make a credit card payment with that money.

Can I use PayPal bill pay without a credit card?

Yes, you can still use PayPal Bill Pay without a credit card. You can make payments through PayPal Bill Pay if you have a linked bank account or debit card. This option is particularly helpful for those who prefer not to use credit cards or do not have one. How secure is PayPal Bill Pay?

How do I add a credit card to my PayPal Bill Pay account?

To add a credit card as a payment method to your PayPal Bill Pay account, follow these steps: Log in to your PayPal account. Select “Link a Card or Bank.” Verify the link by following the instructions provided by PayPal.