When it comes to retirement planning, diversification is key. While traditional investment vehicles like IRAs and 401(k)s are widely popular, you may have wondered if there’s a way to incorporate life insurance into your retirement strategy. The answer is a resounding yes, but with some caveats. In this comprehensive guide, we’ll explore the intricacies of combining life insurance and IRAs, unlocking a world of potential tax advantages and legacy planning opportunities.

The Tax-Advantaged Allure of Qualified Plans

Qualified retirement plans, such as 401(k)s and certain defined benefit plans, offer a unique opportunity to purchase life insurance using pre-tax dollars. This means you can pay your life insurance premiums without first being taxed on the money, potentially saving you a significant amount in the long run.

Within these qualified plans, there are two primary options for incorporating life insurance:

-

Defined Contribution Plans: These include 401(k)s and profit-sharing plans. If you opt for a whole life insurance policy, the premium must be less than 50% of your total contributions to the plan. For universal life insurance, the premium limit is capped at 25% of your contributions.

-

Defined Benefit Plans: In these pension-style plans, the life insurance coverage must be considered “incidental,” meaning the death benefit can’t exceed 100 times your expected monthly retirement benefit.

It’s important to note that strict rules govern the inclusion of life insurance in qualified plans, and these plans can be complex and costly to administer. However, if your employer offers such a plan, it could be an attractive option to consider.

The IRA Conundrum: Separating Fact from Fiction

Now, let’s address the burning question: Can you directly purchase life insurance within an Individual Retirement Account (IRA)? The short answer is no. IRAs, whether traditional or Roth, are not designed to hold life insurance policies directly.

However, there is a workaround that allows you to use IRA funds to purchase life insurance indirectly. The catch? You’ll need to take a taxable distribution from your IRA first.

Here’s how it works:

-

Withdraw from Your IRA: You can withdraw funds from your traditional IRA, but you’ll need to pay income tax on the distribution. If you’re under the age of 59½, you may also face an early withdrawal penalty unless you qualify for an exception.

-

Use the Withdrawn Funds: With the after-tax funds from your IRA withdrawal, you can now purchase a life insurance policy outside of your retirement account.

It’s important to note that this strategy may not be suitable for everyone, as it involves paying taxes upfront and potentially incurring early withdrawal penalties. Additionally, you’ll be removing funds from your tax-advantaged retirement account, which could impact your long-term savings goals.

The Roth IRA Alternative: A Tax-Free Solution?

If you have a Roth IRA, you may have a more tax-efficient option for using your retirement funds to purchase life insurance. With a Roth IRA, you can withdraw your original contributions (but not the earnings) at any time, without incurring taxes or penalties.

This means you could potentially use the contributed funds from your Roth IRA to purchase a life insurance policy without immediate tax consequences. However, as with traditional IRAs, you cannot hold the life insurance policy directly within the Roth IRA.

Navigating the Complexities: Seek Professional Guidance

Combining life insurance and retirement planning can be a intricate endeavor, with numerous rules, regulations, and tax implications to consider. It’s crucial to seek guidance from qualified professionals, such as financial advisors, tax experts, and insurance specialists, before making any significant decisions.

These professionals can help you evaluate your unique circumstances, weigh the pros and cons of different strategies, and ensure that you remain compliant with all applicable laws and regulations.

The Bottom Line: Diversify and Protect

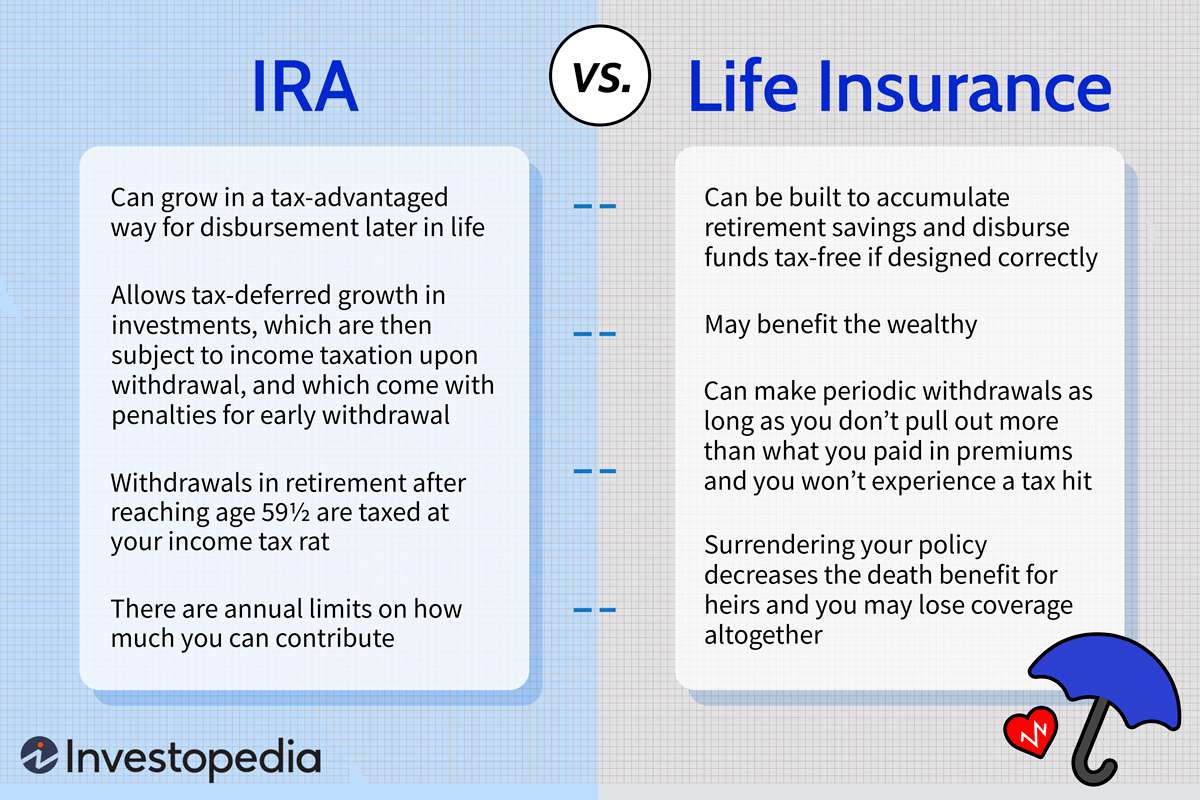

While traditional retirement accounts like IRAs and 401(k)s should undoubtedly form the core of your retirement strategy, incorporating life insurance can offer additional benefits and protections. Whether it’s through a qualified plan or by using funds from your IRA, life insurance can provide a tax-advantaged way to leave a legacy for your loved ones, supplement your retirement income, or even protect your assets from potential creditors.

As with any financial decision, it’s essential to carefully consider your goals, risk tolerance, and overall financial situation before determining if combining life insurance and retirement accounts is the right move for you. With the proper guidance and a well-crafted plan, you can maximize the potential benefits and ensure a secure, diversified retirement.

Life insurance vs Roth IRA for investing

FAQ

Can I own life insurance in an IRA?

Can you roll whole life insurance into an IRA?

Can you use life insurance as a retirement plan?

Is it better to have life insurance or Roth IRA?