Effortlessly Manage Your Farmers Insurance Bill: A Comprehensive Guide

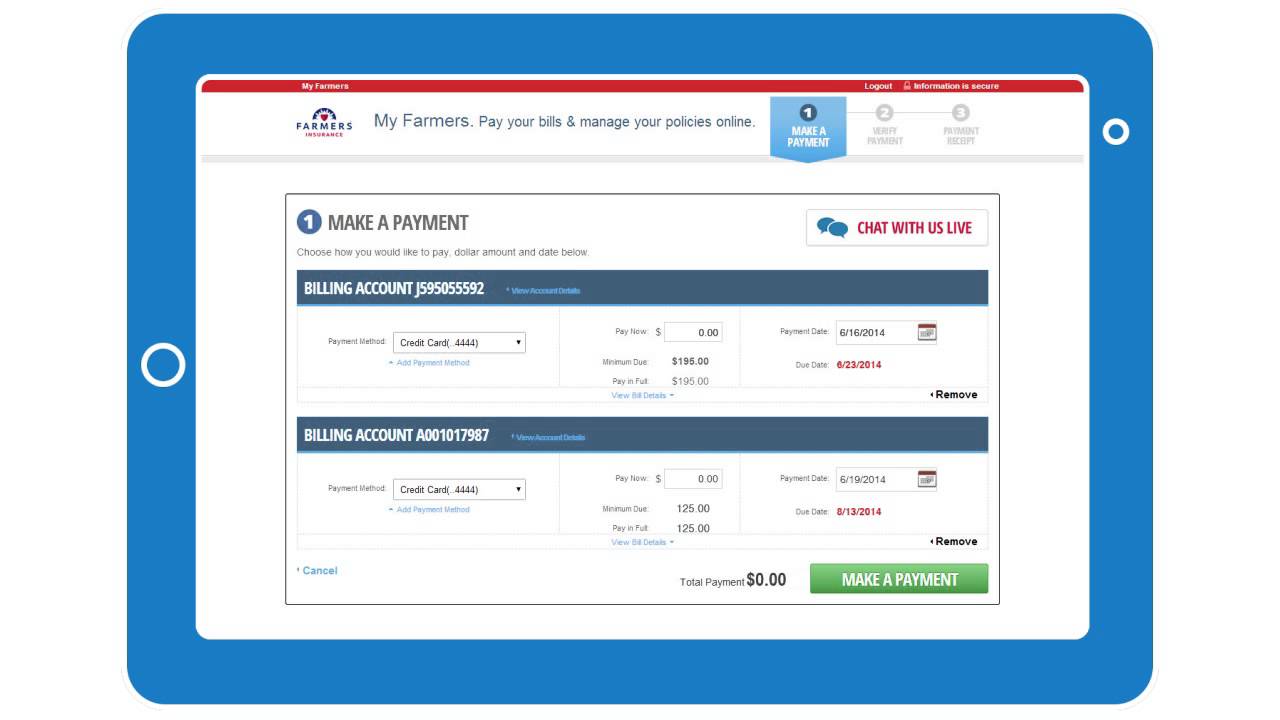

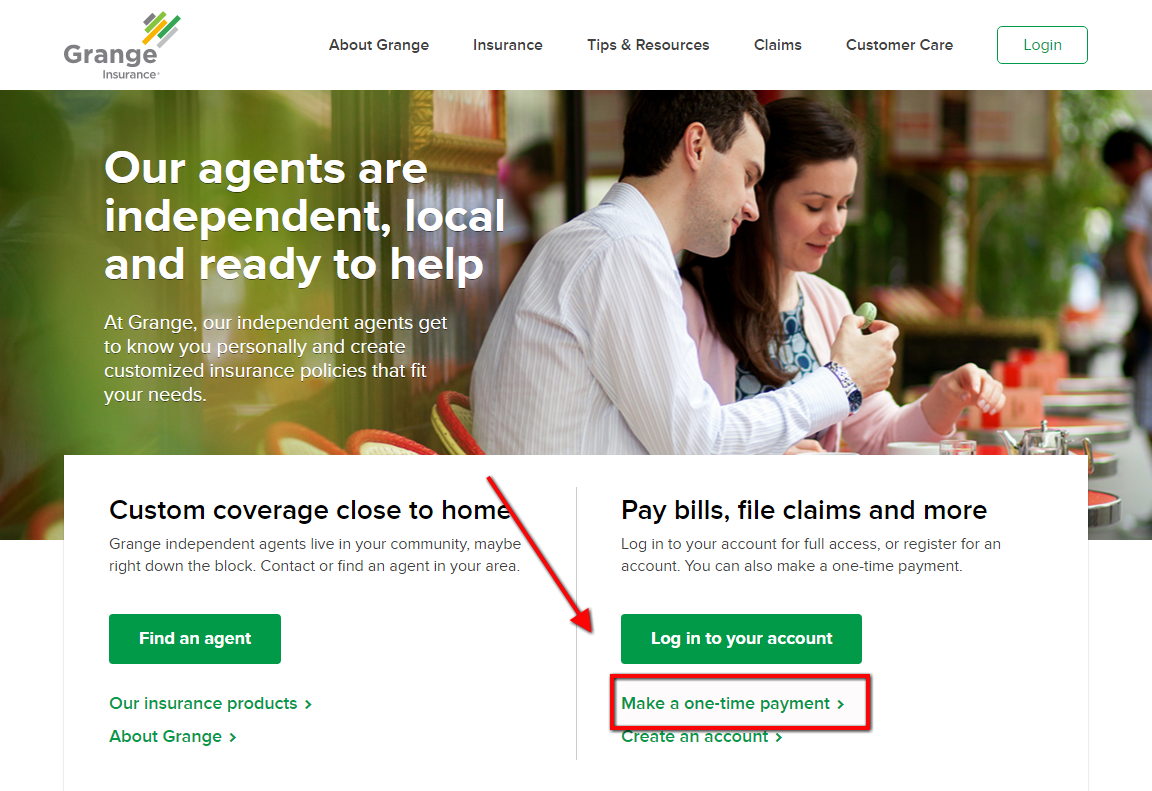

Are you a Farmers Insurance policyholder searching for a hassle-free way to pay your insurance bill? Look no further! In this comprehensive article, we’ll guide you through the simple process of paying your Farmers Insurance bill, ensuring that your coverage remains active and providing you with peace of mind. Why Paying Your Insurance Bill Matters … Read more