Paying bills is a necessary chore, but it doesn’t have to be difficult or time-consuming. Curacao Financial’s online bill pay service allows you to easily and securely pay all your bills online with just a few clicks. This convenient solution saves you time, gives you control over payments, and ensures bills are paid on time every time.

The Hassles and Headaches of Traditional Bill Paying

Before online bill payment existed, paying bills meant writing checks, buying money orders, navigating automated phone systems, waiting in line at offices, and meticulously tracking due dates Even with the mailbox right outside, it often seemed bills would get lost in the shuffle. Late fees were common, which meant you ended up spending more money in unnecessary penalties It was an inefficient, frustrating process.

Today, few people want to waste an hour every month on bill paying We lead busy lives and have precious little free time as it is. Dedicating a chunk of time solely to paying bills feels like a poor use of those spare moments. Wouldn’t it be nice if there was an easier way?

The Convenience and Control of Curacao Financial’s Online Bill Pay

This is where Curacao Financial’s online bill pay service provides an ideal solution. With a few clicks at CuracaoFinancial.com, you can quickly handle all monthly bill payments in one central location.

Gone are the days of mailing paper checks and waiting for them to be delivered and processed Online bill pay initiates electronic payments directly from your Curacao Financial account to companies This speeds up delivery of payment significantly.

You have complete control over the process. Set up one-time or recurring payments to happen on the date you choose, that way there are no surprises or last-minute scrambles. Curacao Financial stores your payment information safely, so you don’t have to enter it again and again.

The online bill pay platform is user-friendly and accessible 24/7 from your computer or mobile device. Set up new payees with just an account number and contact info. View payment history and upcoming bills easily. Receive email reminders when payments are due to help stay on top of due dates.

Curacao Financial’s bill pay service allows you to consolidate payments to various recipients. Rather than logging in and out of multiple websites, you take care of everything seamlessly in one place.

Key Benefits of Online Bill Pay with Curacao Financial

-

Saves time – Take care of bills in minutes instead of hours. Avoid trips to offices and waiting in line.

-

Easy to use – User-friendly platform and simple payment setup. Accessible anytime from your devices.

-

Flexible scheduling—choose specific payment dates that work with your needs and due dates

-

Reminders – Get email notifications when bills are due to avoid late fees.

-

Secure storage – Payment info is saved for future use so you don’t have to re-enter.

-

Payment tracking – Check status of pending and processed payments. View history.

-

One location – Consolidate bill pay instead of signing into multiple sites.

-

Money saving – Avoid late charges by paying on time.

-

24/7 access – Take care of bills on your schedule, day or night.

With online bill pay, you don’t have to rearrange your life around paying bills. Bills get paid accurately and on time every month with practically no effort on your part. It brings simplicity and automation to what used to be a mundane task.

How Does Curacao Financial’s Online Bill Pay Work?

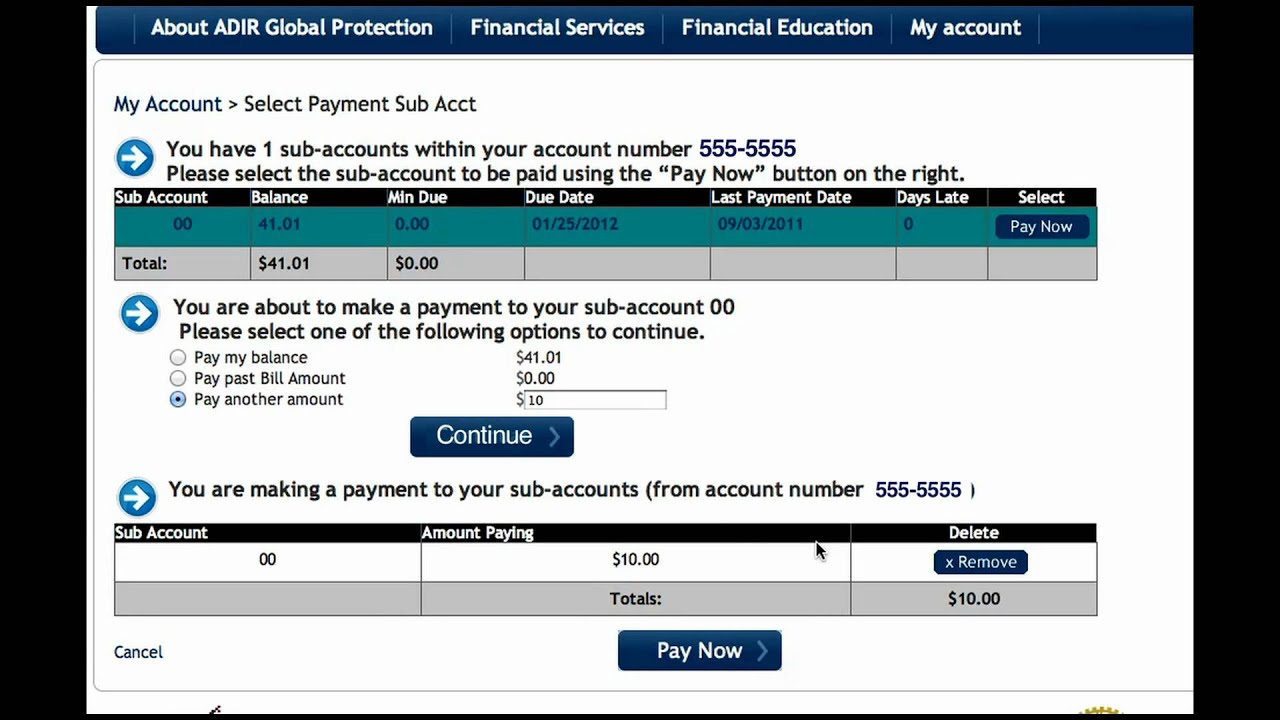

Using Curacao Financial’s online bill pay service is straightforward. Follow these steps to get started:

-

Sign up – Existing customers can log into online banking and access bill pay. New customers can open a Curacao Financial account easily online or at a local branch.

-

Add payees – Search for companies you want to pay or add them manually using account numbers. Enter contact information and select frequency of payments.

-

Choose payment amount & date – Specify dollar amount and what day of the month payment should be initiated.

-

Confirm and submit – Verify payment details before submitting to payees on scheduled dates.

-

Receive notifications – Get email reminders when bills are coming due and confirmations when payments are processed.

-

Track activity – Check payment history and pending transactions within online bill pay. Monitor status.

Once set up, bills practically pay themselves each month. Log in occasionally to add new payees or adjust payment dates/amounts as needed. The process is designed for user-friendliness.

Curacao Financial pulls payment amounts directly from your checking account on the dates you authorize. Payments are delivered to payees electronically through secure banking channels. Funds arrive quicker than by check.

Bill Pay Any Time, Anywhere with Mobile Access

Curacao Financial also offers mobile bill pay access from iOS and Android smartphones and tablets. This gives you the freedom to handle bills from anywhere, even when you’re on the go. Rather than waiting until you’re at a computer, take care of payments in line at the store, during your commute, or from your couch.

The mobile app provides the same capabilities as the online platform. Schedule one-time and recurring payments, add payees, view recent payment history, receive bill reminders, and more. Whether using the mobile app or online bill pay website, you enjoy a consistent, convenient experience.

Bill Payment Security Is a Top Priority

With any online financial activity, security is a major concern. Curacao Financial employs advanced measures to keep your information protected. Payment data is encrypted both in transit and storage. Strict verification protocols confirm user identity. Account activity is closely monitored to identify any suspicious transactions.

Curacao Financial utilizes multi-factor authentication for logging into accounts, requiring your password plus an additional step like a verification code. This prevents unauthorized access even if someone obtains your password. The website and mobile app are fully compliant with all applicable cybersecurity regulations and standards.

Pay a Wide Range of Bills with Flexible Options

Curacao Financial’s bill pay service lets you consolidate payments for:

- Credit cards

- Utilities – electricity, gas, water, cable, internet

- Mortgage and rent

- Auto loans and insurance

- Mobile phone service

- Gym memberships

- Streaming services

- And many more!

For one-time payments, the money is deducted from your account immediately. With recurring payments, you can choose for the money to be deducted on the scheduled date or several days prior to account for processing time. This prevents payments from being late if the due date falls on a weekend or holiday.

Transfer money instantly from checking or savings to cover bill payments. Set up alerts to notify you when account balances drop below a certain level so you can transfer funds to avoid overdrafts.

Get Started with Curacao Financial Bill Pay Today

If you’re still stuck in the dark ages of paying bills by check and manual processes, it’s time to step into the modern era. Curacao Financial’s online bill pay eliminates the hassles of traditional bill payment. Paying your bills has never been faster or easier. Sign up today to start saving time while avoiding late fees and gaining control over when and how your bills get paid.

Make a Payment F

FAQ

Can I make a Curaçao payment online?

How do I contact the Curaçao credit card customer service?

What services does Curacao financial offer?

Curacao Financial offers a wide range of services such as secure money transfer, recurring services, check cashing, mobile top up, and bill payment.

How do I download the Curacao Money Transfer app?

To download the Curacao Money Transfer App, go to the App Store or Google Play Store and search for Curacao Money Transfer or click on the link below: 03 What do I need to send Money through the Curacao Money Transfer App? 04 Why is the app asking me to verify my Mobile device?

Who provides Curacao credit?

*Curacao Credit (and the Curacao Credit Card) is provided by Adir Financial, LLC (or its parent, Adir International, LLC), a related company of Adir Money Transfer Corp., dba Curacao Financial. Use your cellphone or tablet to download the app from the App Store or Google Play Verify your identity and setup your Curacao Credit (optional)

How do I send money in Curacao?

Your recipient can have money available for pickup, or deposited directly (options vary by country). You can pay using your Curacao credit and/or Credit Cards like Discover, Visa or Master Card. Sending and receiving money is convenient and simple. With Money Transfer you can send money in a variety of ways: