Paying your insurance bill can sometimes feel like a chore. You have to remember when it’s due log in to your account enter payment details, and confirm the transaction. It’s not difficult, but it does require time and attention each month or quarter. That’s why services like Erie Niagara Insurance Bill Pay can be so useful – they automate the payment process so you don’t have to think about it. In this article, we’ll look at how Erie Niagara’s bill pay service works and how it can save you time and hassle.

Overview of Erie Niagara Insurance

Let’s start with some background on Erie Niagara Insurance. Customers in several Midwest and Northeast states can get auto, home, life, and business insurance from this company. They are known for excellent customer service and competitive rates. On January 1, 2019, the Erie Insurance Group and the Niagara Insurance Association merged to form Erie Niagara Insurance.

What is Erie Niagara Insurance Bill Pay?

Customers of Erie Niagara Insurance Bill Pay can set up their insurance premiums to be paid automatically on a regular basis. This means that every month you don’t have to pay your insurance bill by hand; the system does it for you. Once you set up bill pay, your payments will be taken out automatically on the due date from the method you chose.

The bill pay service is available for all personal lines insurance policies from Erie Niagara, including auto, home, condo, renters, and more. It can be used for installments or to pay policies in full. You can use it to pay from either a checking/savings account or a debit/credit card.

Benefits of Using Erie Niagara Insurance Bill Pay

There are a number of advantages to using the bill pay system

Avoid Late Fees – When you set up automated payments, you no longer have to worry about forgetting a bill and incurring late fees. The system will deduct your payment on time, every time.

Fewer Bills to Track – With bill pay, you only have to check in periodically to make sure your payment method and details are up to date. No more keeping track of monthly or quarterly due dates.

Saves Time—Automated payments save you the trouble of paying your bills by hand every month. That’s less time spent logging in and submitting payments.

Flexible Schedule – You can choose the day of the month your payments are deducted to match up with your pay cycle.

Payment Reminders – Erie Niagara will send you email reminders 3-5 days before your scheduled payment dates.

Easy Cancellation – You can cancel or change your automated payments anytime through your online account.

How to Enroll in Erie Niagara Insurance Bill Pay

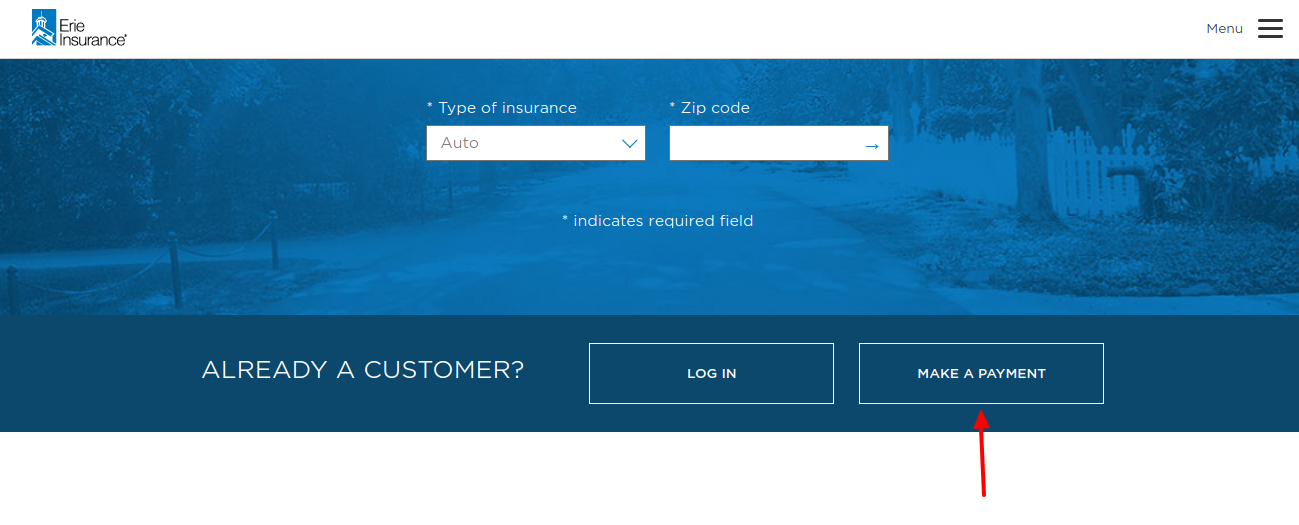

Signing up for bill pay is quick and straightforward. Here are the steps:

- Log in to your Erie Niagara online account

- Under “Billing & Payments”, click “Manage Bill Pay”

- Choose whether to pay from a bank account or card

- Enter your account information

- Pick a payment date and frequency

- Review and submit your enrollment

Once enrolled, Erie Niagara will withdraw payments automatically going forward. You’ll want to keep your payment method details up to date and monitor your scheduled payments periodically.

Making One-Time Payments

In addition to recurring automated payments, you can also make one-time payments through your Erie Niagara online account. Just log in, go to Billing & Payments, and choose “Make a One Time Payment”. You can pay from either a bank account or credit/debit card.

One-time payments are useful for paying any remaining balance if you have bill pay set up, or for paying in full if you don’t use automated payments. Erie Niagara offers multiple ways to pay to suit your preferences.

Erie Niagara Bill Pay Security

When paying bills online, security is always a potential concern. Erie Niagara uses industry-standard encryption and security measures to keep your transactions and information safe. Payments are processed through secure payment gateways.

You also have to log in to your password-protected online account to access bill pay. This prevents unauthorized access and payments. As long as you safeguard your login credentials, you can feel confident using the automated payment system.

Is Erie Niagara Insurance Bill Pay Right for You?

If you’re tired of keeping track of insurance payment due dates and going through repetitive payment steps, then Erie Niagara’s bill pay system may be perfect for you. By automating your recurring payments, you save time each month and avoid potential late fees if you forget a bill.

The ability to choose your payment date and method also provides flexibility. For insurance customers who want to set it and forget it when it comes to premium payments, bill pay eliminates hassle and brings peace of mind. Consider enrolling the next time you log in to your Erie Niagara account.

What do I do if I am having trouble making an online payment?

Please contact Customer Care:

Customer Care (800) 458-0811, option 4 Monday – Friday, 8 a.m. – 11 p.m. (Eastern) Saturday, 9 a.m. – 4:30 p.m. (Eastern)

Erie Family Life (800) 458-0811, option 3 Monday – Friday, 8 a.m. – 5:30 p.m. (Eastern)

You can choose the paperless billing option for your eligible Erie Insurance policies.

Can an online payment be made on more than one policy/account billing number?

Yes. You can make a payment on more than one policy/account billing number, but not at the same time. Each policy payment must be a separate transaction.

Erie and Niagara Insurance Association review, pros and cons, legit, quote (update 2024)

FAQ

How do I pay my Erie insurance bill by phone?

What is ERIE express pay?

How much is the late fee for Erie insurance?

Is ERIE car insurance good?

Does Erie & Niagara Insurance Association offer autopay recurring payment?

Sign up for Erie and Niagara Insurance Association’s AutoPay EFT recurring payment option and your policy premium will be electronically withdrawn from your checking, savings or business account automatically. THIS SERVICE IS FREE – ALL INSTALLMENT FEES ARE WAIVED! AutoPay will make your life easier.

How do I pay my Erie Family Life Insurance Bill?

(Credit card payments are not available with all of our payment plans or with Erie Family Life policies.) Please contact Customer Care to make a payment by phone. Mail payments to: With automatic payments, you can have your payments drawn automatically from a checking or savings account. It’s a quick and convenient way to pay your insurance bill.

Which Erie Insurance payment options are available?

Automatic Payments are available for auto, home, boat and personal catastrophe liability policies on certain payment plans, including Annual, Quarterly, 9 Month or Monthly. ERIExpressPay® is ERIE’s automatic payment option for business insurance policies. Chek-matic is ERIE’s recurring monthly direct debit programs for life insurance payments.

How do I contact Erie & Niagara Insurance Association?

If you have any questions about AutoPay or need any assistance in enrolling, please contact your agent or call us at 1-800-234-9876 (M-F 8:30am – 4:30pm EST) and request the Accounting Department. Thank you for choosing Erie and Niagara Insurance Association. We appreciate the opportunity to serve you.