Paying property taxes is an inevitable obligation for Guilford County homeowners and real estate investors. Fortunately, Guilford County Tax Department offers convenient online payment options to pay tax bills digitally.

This comprehensive guide will outline the process of paying Guilford County property taxes online through the tax portal, explaining how to view bills, make one-time payments, set up installment plans, and manage accounts.

Benefits of Paying Taxes Online

Guilford County residents can enjoy several advantages by paying property taxes electronically:

- Fast and easy online payments 24/7.

- Avoid standing in line at the tax office.

- Secure payment processing and data encryption.

- View current and past tax bills in one place.

- Set up automatic payments from bank account.

- Manage tax accounts fully online.

The online portal provides a simple, efficient way to pay without the hassle of mailing checks.

Accessing the Tax Payment Website

To get started paying Guilford County taxes online, go to GuilfordPropertyTax.com. This is the official tax payment website managed by the county.

There is also a handy link under the “Pay” section of the Guilford County Tax Department homepage.

Bookmark the portal for quick access year-round.

Creating a Tax Account Profile

First-time users of the tax payment website will need to register for an account. Click on “Register” and provide your email address and phone number.

Next, enter your Guilford County property tax ID number and parcel number found on your bill.

Create a secure username and password you’ll use to manage your tax account going forward.

Logging In to an Existing Account

If already registered, click “Log In” and enter your username and password.

Use the “Forgot Password” link if you need to reset and create a new password to access your account

Once logged in, you’ll see your total outstanding balance and account overview.

Making a One-Time Payment

After logging into your tax account, you can make instant online payments.

Click “Make Payment” and enter the payment amount – either the full balance due or a partial payment.

Select payment method – ACH bank transfer or debit/credit card – and submit your payment details.

You’ll receive a confirmation email with transaction receipt. Payments post instantly.

Setting Up a Payment Plan

Guilford County allows taxpayers to establish monthly payment plans to pay taxes over time.

Under the “Installment Plans” section, enroll in a dynamic payment plan tied to your changing property tax balance.

Input your bank account information to automatically withdraw budgeted installments on the due date of your choosing. Add additional one-time payments anytime.

Automatic Payments from Bank Account

For hands-free tax payments, enroll in auto-pay through your online account. This automatically pays the full balance on each bill from your bank account.

To enable auto-pay, go to “My Profile” and view auto-pay settings. Turn auto-pay on and verify your bank account number.

You’ll receive email notifications prior to each auto-payment date informing you of the amount.

Receiving Paperless eBills

Save paper and postage by opting in to receive Guilford County property tax bills electronically.

Go to “My Profile” and check “Subscribe to eBilling” to receive tax bills and reminders via email moving forward.

You’ll get an email notification when each new bill is ready to view and pay online through your account.

Understanding Charges and Calculating Tax

When logged into your account, you can see a detailed breakdown of your property tax bill, including:

- Assessed home value

- Tax rate per $100 of value

- Special district taxes

- Late payment penalties

- Credits applied

Use the tax estimator tool to forecast taxes based on hypothetical home sales prices and assessed values.

Avoiding Penalties and Interest

Guilford County tax bills are due September 1st each year. Payments after January 5th incur a 2% penalty plus 0.75% monthly interest.

Delinquent accounts may be sent to collections or face foreclosure auction.

Pay on time via autopay, eBills, and reminders to prevent added fees. Partial payments minimize penalties on any balance due.

Getting Payment Assistance

Qualified disabled and elderly homeowners can obtain property tax relief through Guilford County’s Tax Relief Program.

If facing financial hardship, taxpayers can call 336-641-3822 to arrange an installment payment plan with the tax office.

Closing a Tax Account

Notify the Guilford County Tax Department prior to selling, transferring, or otherwise disposing of assessed real estate.

Email [email protected] with your parcel number and details to settle the account.

This ensures you receive the final bill and closes your online account to prevent issues.

Customer Support Contacts

Get help with online tax payments by:

- Emailing [email protected]

- Calling 336-641-3822 during business hours

- Using the live chat widget on the payment portal

The tax office team can answer billing questions, take payments, reset accounts, and more.

Paying Guilford County property taxes online provides convenience, savings, and organization. Follow this guide to register your tax account, make quick payments, enroll in auto-pay, and avoid penalties through the digital portal.

Guilford County residents have property tax concerns

FAQ

Can you pay Guilford County property taxes online?

How do I find my NC property tax bill?

Can I pay my Colorado property taxes online?

How do I pay my Guilford County tax bill online?

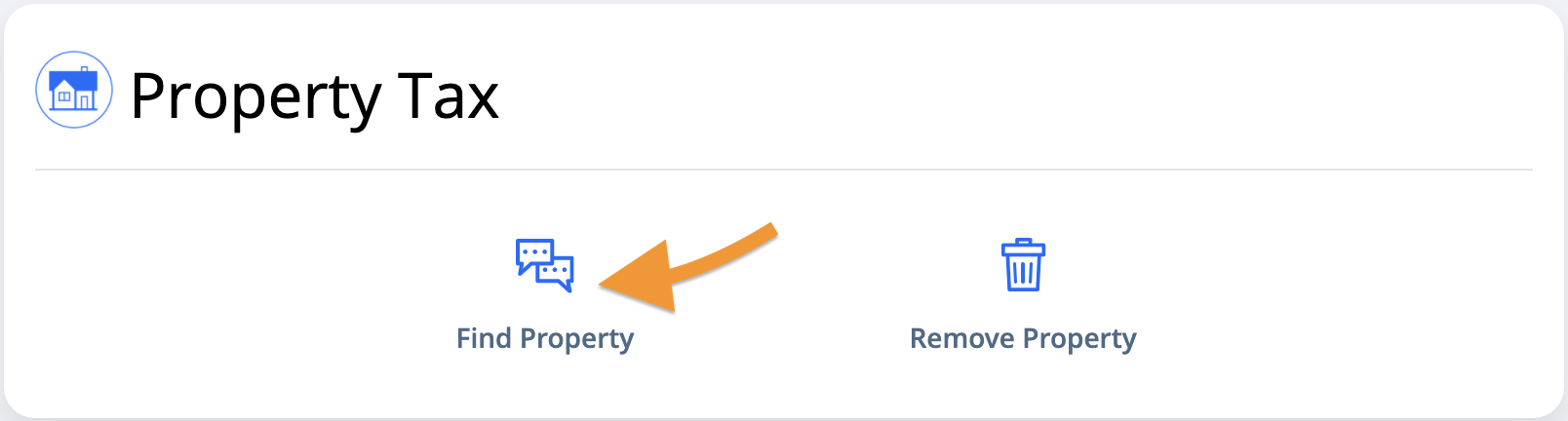

(No CASH Please) The Guilford County Tax Department uses a service called Payit that allows you to pay tax bills online, by phone, or in person. Payit collects processing and/or transaction fees to deliver quality services more efficiently with no upfront costs to Guilford County.

How do I contact the Guilford County Tax Department?

Those activities and responsibilities were consolidated into the Guilford County Tax Department. For property tax inquiries, visit the Guilford County Tax Department website or call 336-641-3363 for assistance.

What is the Guilford County app?

Download the myGuilfordCounty App Today! Download the official app of Guilford County, North Carolina – myGuilfordCounty. The myGuilfordCounty app brings governments and people closer together. Residents can make payments, keep track of records, and get reminders, all in one secure and easy to use solution.

Who collects property taxes in Guilford County?

The Collector’s Office is responsible for the collection of all property taxes due to Guilford County as well as Greensboro, Jamestown, Oak Ridge, Pleasant Garden, Sedalia, Summerfield and Whitsett, Gibsonville, and parts of Archdale, Burlington, Kernersville and High Point.