Paying your credit card bill on time each month is crucial for maintaining good credit and avoiding expensive late fees. For Home Depot credit card holders, you have a few different options to pay your bill conveniently. This article will provide tips on the best ways to pay your Home Depot credit card bill online or by phone.

Enroll in Autopay

The easiest way to ensure your Home Depot credit card bill gets paid on time is to enroll in autopay. With autopay, the minimum payment or total balance will automatically be deducted from your bank account each month on the due date.

To enroll in autopay for your Home Depot credit card

- Log into your account online at https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLCN_HOMEDEPOT

- Under the “Manage Account/Card” section, select “Autopay”

- Choose whether you want the minimum payment or full balance deducted each month

- Enter your bank account information

Once enrolled, you don’t need to worry about remembering to pay your bill each month. The funds will automatically be transferred from your bank account on the payment due date.

Pay Online

If you don’t want autopay the next best option is to pay your Home Depot credit card bill online. Paying online allows you to securely pay your bill from your bank account without writing and mailing a check.

Follow these steps to pay your Home Depot credit card bill online

- Go to the Home Depot credit card website and log into your account

- Under “Manage Account/Card”, click on “Make Payment”

- Choose whether you want to pay the minimum balance, total balance, or a custom amount

- Enter your payment information including bank account number and routing number

- Review payment details and submit

Your online payment will typically process in 1-2 business days. Make sure to schedule the payment at least a few days before the due date to ensure it’s received on time.

Pay by Phone

If you prefer to speak to a customer service representative, you can easily pay your Home Depot credit card bill over the phone.

To pay by phone:

- Call the number on the back of your credit card

- When prompted, choose the “Pay by Phone” option

- Enter your 16-digit account number and other verification details

- Choose whether to pay minimum balance, total balance, or custom amount

- Provide your debit/credit card information to make the payment

One benefit of paying by phone is that you can ask any account questions you may have. The representative can also confirm exactly when the payment will be processed.

Schedule Future Payments

Whether you pay online or by phone, most credit card issuers allow you to schedule future payments. This is helpful if you get paid bi-weekly or semi-monthly and want your payment to align with your pay schedule.

To set up a future payment with Home Depot:

- Log into your account and access the payment screen

- Rather than making the payment immediately, choose the “Schedule Payment” option

- Select the future date you want the payment to be made

- Enter the payment amount and submit

The scheduled payment will be processed automatically on the date selected as long as you have sufficient funds in your account.

Consider Automatic Payment Allocation

If you often carry a balance from month to month, utilize the automatic payment allocation option. This setting allows you to determine how any amount paid over the minimum payment is applied.

For instance, you can choose to have amounts over the minimum payment applied to the highest interest rate balance first. This paydown order saves you the most on interest charges.

To use automatic payment allocation:

- Access payment settings in your online account

- Find the option for “Payment Allocation”

- Choose how you want payments over the minimum amount allocated

- Save changes

Pay with Points or Rewards

If your Home Depot credit card offers a rewards program, consider redeeming your points or rewards to pay your bill. Most issuers allow you to cash in rewards at a set conversion rate and apply the amount to your balance.

To pay with points:

- Access your credit card rewards dashboard

- Choose the option to redeem rewards

- Select “Apply to Balance” as the redemption method

- Enter the number of points to redeem and submit

Using rewards to pay your bill is an easy way to get value from your accumulated points while still paying your bill.

Set Payment Reminders

Even if you don’t enroll in autopay, be sure to set payment reminders so your bill isn’t late. Most credit card companies allow you to opt into payment reminders via email, text, or in your account.

To set reminders:

- Go to your Home Depot credit account settings

- Find the option for notifications or alerts

- Select payment reminders and choose your preferred method of notification

- Pick how many days before the due date you want the reminder

Receiving a payment reminder a week before your due date is a simple way to avoid accidentally missing a payment.

Review Payment History

It’s important to routinely log into your Home Depot credit account and review your payment history. This allows you to confirm payments were received on time and avoid inaccurate late fees.

To review payment history:

- Access your account online or via the mobile app

- Navigate to the payments section under account details

- Here you will see your transaction history including amount paid and date received

- Scan to ensure payments match your records

If you notice any discrepancies in payments, contact customer service right away to get it corrected.

Set Up Account Alerts

In addition to payment reminders, be sure to enable account alerts for things like:

- Large purchases made on your card

- Available credit drops below a certain level

- Statement ready for review

- Late payment warning

- Returned payment alert

Receiving alerts on account activity can help you stay on top of your Home Depot credit card and catch any unauthorized charges. Enable any alerts that will help you manage your account.

Avoid Late Fees

The easiest way to avoid late fees with your Home Depot credit card is to pay at least the minimum amount due before the payment due date each month. Home Depot typically charges around $28 for a late payment.

If an unforeseeable emergency arises that will prevent you from paying on time, call Home Depot customer service right away. They may be able to waive the late fee if you have a good history with your account.

Set Up Recurring Charges Cautiously

One pitfall to avoid is signing up for too many recurring charges on your Home Depot card. Subscription services, monthly memberships, etc can make it trickier to pay your balance off each month.

If you do set up any recurring bills on your Home Depot credit card, be sure to factor that fixed monthly cost into your budget. This will help ensure you have the funds to pay your total balance each month and avoid interest charges.

Pay More Than the Minimum

To keep credit card debt from accumulating, always try to pay more than just the minimum amount due each month. Paying only the minimum due causes interest charges to accrue quickly.

Develop a budget that allows you to pay substantially more than the minimum payment each month. This higher payment will go toward reducing your overall balance.

Track Credit Card Rewards

If you have a Home Depot credit card that offers robust rewards on your spending, be sure to track your rewards earnings each month. Most issuers provide an online dashboard that shows your available points balance and redemption history.

Monitoring your rewards ensures you don’t miss out on any bonuses or accrued points over time. You can redeem these points for statement credits, merchandising, gift cards, or travel.

Review Available Credit

One important account detail to periodically review is your available credit on your Home Depot card. This refers to your total credit limit minus your current balance.

Having a high balance relative to your limit can negatively impact your credit score. Try to keep your balance below 30% of your total limit. If needed, make payments mid-cycle to free up available credit.

Staying on top of your remaining available credit ensures you have room on your card for essential purchases or emergencies.

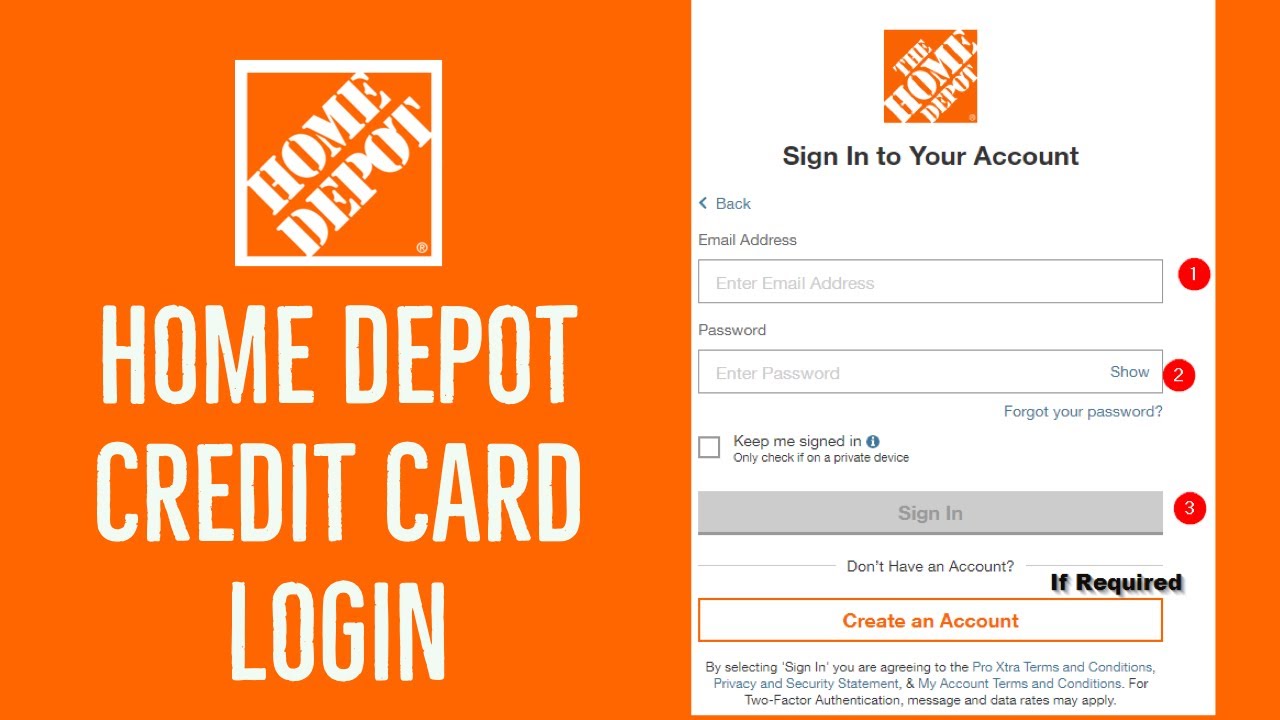

Create Account Login Credentials

If you’ve opened a Home Depot credit card but haven’t created your online account yet, be sure to do so right away. Having an online account and mobile app allows you to easily manage your card.

To register your card online:

- Go to https://www.homedepot.com/c/credit-center and find the link to log into your account

- Provide your 16-digit card number and personal details

- Create a secure username and password

- Configure two-factor authentication for added security

With an online account, you can view your balance, make payments, set alerts, redeem rewards,

Home Depot Credit Card Review 2023 – Home Depot Consumer + Project Loan Home Improvement Mastercard

How do I subscribe to Home Depot credit card alerts?

By enrolling in or editing Alerts, you can subscribe to daily, weekly, or monthly account update notifications such as account balance, payment due, and payment posted, via SMS text messaging. Alerts will come from The Home Depot Credit Card Alerts, and you can text STOP to 95245 to stop Alerts, or text HELP to 95245 to receive help.

Does Home Depot offer a credit card?

Yes, **The Home Depot** offers several credit card options to help you with your home improvement needs.Here are the details: 1.**Consumer Credit Card**: – This card is a convenient option for everyday

How do I contact Home Depot?

Please call us at: 1-800-HOME-DEPOT (1-800-466-3337) The Home Depot financing helps both pros and DIYers do more. Learn more about Home Depot commercial credit cards, consumer credit cards, and Home Depot loans.

Can you get a Home Depot project loan with a credit card?

You can also take advantage of exclusive, Home Depot Consumer Credit Card offers, just for being a cardholder. If you’re tackling a larger renovation project, like a bath or kitchen makeover, you can get a Home Depot Project Loan with a line of credit of up to $55,000, with up to 84 months to pay it off, and no annual fees.