Figuring out how to pay your Medicare premiums can be confusing, especially if you are new to the program. Medicare has several parts, each with their own premiums and billing methods. Knowing when and how your Medicare bills arrive and the different ways you can pay them is key to avoiding issues. This guide breaks down the basics of understanding and paying your Medicare insurance bills.

How Medicare Bills Are Sent

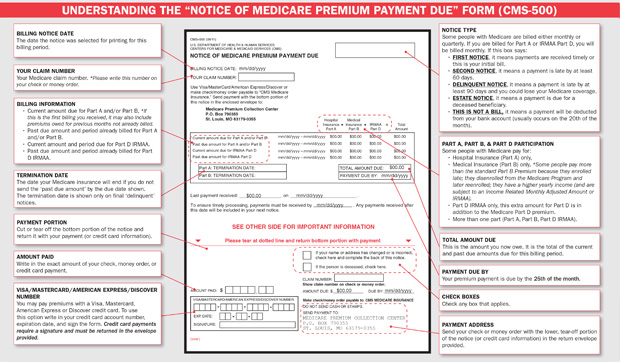

These are the different ways you might get your Medicare premium bills, based on the parts of Medicare you have.

Part A

Most people don’t pay a premium for Medicare Part A because they or their spouse paid Medicare taxes while working If you do have to pay, you’ll get a “Medicare Premium Bill” (CMS-500 form) quarterly from Medicare

Part B

If you get Social Security or Railroad Retirement Board benefits, your Part B premium is deducted from your benefit payment each month You won’t get a separate bill.

You’ll get a CMS-500 Part B Medicare premium bill every three months if you don’t get these benefits.

Part C (Medicare Advantage)

Private insurers manage Medicare Advantage plans, so premium bills come from that specific company, not Medicare. Bills are usually monthly.

Part D (Prescription Drug Plan)

Like Part C, Part D plan premium bills come from the private provider. Bills are also monthly.

Medicare Premium Bill Details

Quarterly Medicare premium bills have important details you need to pay properly:

- Your Medicare Number

- Premium amount due

- Due date

- Billing time period covered

Make sure to double check the billed amount each quarter in case your premium changed. Rates are updated annually.

If you think the bill is incorrect or never received one, contact Medicare immediately to sort out the issue and avoid penalties.

How to Pay Medicare Premiums

Medicare offers several payment options to fit different needs and preferences.

Pay Online

For premium bills from Medicare, you can pay online through your MyMedicare.gov account for free. This lets you use a debit card, credit card, or bank account transfer. You can set up one-time or recurring payments.

You can also likely set up online bill pay through your bank by providing Medicare’s billing information, but a fee may apply.

Pay by Phone

Call 1-800-MEDICARE and use the automated system or speak to a representative to make a payment from your bank account or by credit/debit card.

Pay by Mail

Detach and mail the payment stub from your Medicare premium bill with a check or money order. Make sure it arrives by the due date.

Pay in Person

Take your Medicare premium bill to your local Social Security office and pay with cash, check, money order, or credit/debit card.

No matter what payment method you use, make sure Medicare gets your premiums by the due date to avoid penalties and coverage issues. Track payments and billing history through your MyMedicare.gov account.

What If I Miss My Medicare Premium Payment?

It’s essential to pay your Medicare premiums on time each month or quarter. If you miss a payment, here’s what happens:

-

You may have to pay a late enrollment penalty – 10% for each 12 month period you missed enrolllment. This results in permanently higher premiums.

-

You could lose your Medicare benefits for the time period covered by the unpaid premium.

-

You may have to pay for any health services you received during a lapse in coverage.

-

Your access to enroll in Medicare plans may be restricted until caught up.

To get reinstated after missed premiums, you’ll need to pay the overdue amount plus any late fees incurred. Avoid all these headaches by keeping Medicare premiums current.

Can Medicare Premiums Be Waived?

There are a few scenarios where your Medicare premiums could be waived if you qualify:

-

You have very low income – If your income and assets fall under certain limits, your state Medicaid program may pay your Medicare premiums.

-

You have end stage renal disease (ESRD) – There is a 30 month period where Medicare covers people with ESRD without premiums.

-

You’re still working over 65 – If you have group health coverage through your job, you can delay Part B enrollment and avoid premiums.

-

You’re a disabled widow/widower – Disabled widow(er)s under 65 may qualify to enroll in premium-free Part A.

-

You’re in a Medicare Savings Program – These state programs pay all or part of Medicare premiums if you meet income and asset requirements.

Always report any life changes like income reductions to Social Security, as it could make you newly eligible for programs that reduce Medicare costs.

How Do I Get Help With Medicare Bills?

If you are having issues affording Medicare premiums or paying your bills on time, don’t hesitate to seek assistance. Here are some options:

-

State Health Insurance Assistance Programs (SHIPs) provide free Medicare counseling and can assist with billing questions.

-

Medicare Savings Programs through Medicaid help pay all or part of Medicare premiums for limited income beneficiaries.

-

Talk to your provider about switching to a plan with a reduced monthly premium if affordability is a concern.

-

Pharmaceutical companies may offer cost sharing assistance programs for brand name prescriptions.

-

Apply for Extra Help through Social Security to get prescription drug costs paid if you have limited income and assets.

-

Ask your former employer about retiree health insurance or Medicare supplement plans they may offer.

Explore all possible avenues for Medicare financial assistance. Small changes can make a big difference in what you pay for Medicare!

Medicare Bill Paying Tips

-

Carefully review each bill to confirm the amount and coverage period are correct. Don’t just assume it’s the usual amount.

-

If you qualify for Medicaid or another program that pays premiums, make sure this is indicated on your bill so you do not pay.

-

Pay the full billed balance by the due date to avoid issues. Partial payments can still result in a penalty.

-

Notify Medicare immediately if you need to change your address or billing details to prevent missed bills.

-

Set payment reminders and track payment history to avoid accidental missed payments.

-

Report life changes like income fluctuations that could make you eligible for financial assistance programs.

-

Seek help if you are struggling to pay premiums on time – don’t let bills lapse.

Staying on top of Medicare bills takes some work, but a few proactive steps will help everything run smoothly. Know your billing details, payment options, and deadlines to master Medicare premiums. With the right preparation, you can eliminate Medicare billing worries and focus on your health.

When are Medicare premiums due?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of our billing timeline.

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

4 ways to pay your Medicare premium bill:

- Pay online through your secure Medicare account (fastest way to pay).Log into (or create) your secure Medicare account to use this free service to pay by credit card, debit card, or from your checking or savings account. How do I pay using my account? Pay My Premium Now

- Sign up for Medicare Easy Pay. With this free service, we’ll automatically deduct your premium payments from your savings or checking account each month. Get details about Medicare Easy Pay.

- Pay directly from your savings or checking account through your banks online bill payment service Some banks charge a service fee. Get details so your payment goes through on time.

- Mail your payment to Medicare. Pay by check, money order, credit card, or debit card. Fill out the payment coupon at the bottom of your bill, and include it with your payment.

- If you’re paying by credit or debit card, be sure to complete and sign the coupon. If you don’t sign the coupon, we can’t process your payment and it will be returned to you.

- Use the return envelope that came with your bill, and mail your Medicare payment coupon and payment to: Medicare Premium Collection Center PO Box 790355 St. Louis, MO 63179-0355

- Include your payment coupon with your payment so we can apply your payment to your account. We can’t process your payment on time without the coupon. If you don’t have your payment coupon, write your Medicare Number on the check or money order.

Medicare Part B Premiums | How To Pay Your Medicare Bill

How do I Pay my Medicare bill?

Mail your payment to Medicare. Pay by check, money order, credit card, or debit card. Fill out the payment coupon at the bottom of your bill, and include it with your payment. If you’re paying by credit or debit card, be sure to complete and sign the coupon. If you don’t sign the coupon, we can’t process your payment and it will be returned to you.

How do I Pay my Medicare premiums?

Here are the ways to pay your Medicare premiums: 1.**Online Payment**: – **Log into your secure Medicare account**: You can pay online using your credit card, debit card, or directly from your checking

How do I make a Medicare payment over the phone?

You can write your credit or debit card information on the tear-off portion of your Medicare bill and mail it to Medicare. You can also send payments by check or money order to the address on your Medicare bill. Use the tear-off coupon so your payment isn’t delayed. You cannot make a payment to Medicare over the phone.

Do I need to pay my Medicare premiums manually?

Most people don’t receive a bill from Medicare for their premiums because they are taken directly from Social Security or Railroad Retirement Board checks. However, there are certain cases when you’ll need to pay these bills manually. Like many other federal service providers, Medicare has created several ways for you to pay your premiums easily.