Getting a hospital bill in the mail can be an unpleasant surprise. The total owed can easily reach thousands or tens of thousands of dollars You examine the bill wondering – how long do I really have to pay this off? Hospital billing time limits vary, but in most cases you have some time to pay Just be sure to avoid interest, late fees, and hits to your credit by learning the policies and taking action.

The Timeline for Getting a Hospital Bill

When should you expect to get your bill after leaving the hospital after a stay or procedure? There is no set time, but bills usually come in:

-

Each bill is sent within 30 days. Bills usually arrive within a month for routine tests, doctor visits, or small emergencies.

-

Within 60-90 days – For extensive hospital treatment like surgery childbirth or major procedures, it may take 1-3 months to finalize and send the bill.

-

6 months to 1 year – In more complex cases with many itemized charges, bills can sometimes take up to a year to generate and mail out.

Hospitals have dedicated medical billing staff working on coding claims, submitting to insurance, determining patient responsibility, and invoicing. This intricate process causes billing delays in some situations.

How Long Do You Have to Pay a Hospital Bill?

How long do you have to pay that dreaded hospital bill after getting it? The standard in the business is 30 days from the date of the initial statement. However, terms vary:

-

Some hospitals give you 60 or even 90 days to pay.

-

Payment plan installments may be monthly.

-

If you qualify for financial assistance, extended flexible timelines apply.

Check your hospital bill statement for the exact payment due date. Missing this deadline can result in late fees, interest charges, and collection action.

Hospital Billing Time Limits By State

Each state sets its own statute of limitations on how long a hospital has to bill patients for medical services. Deadlines range from 1 year up to as long as 6 years:

-

New York – 2 years

-

California – 1 year

-

Texas – 11 months

-

Florida – 5 years

Hospitals submit claims to insurance shortly after discharge. But if issues arise, they can keep refiling and rebilling for years depending on state law.

For example, if your insurer denies a claim as “medically unnecessary,” the hospital accounting department can spend months appealing and rebilling while providing additional medical evidence. Only when appeals fail and payment options are exhausted might you then receive a past-due bill for your responsibility.

Options for Paying a Late Hospital Bill

What if you get a bill for hospital care provided 1, 2, or even 3 years ago that you weren’t aware of? Here are some options to resolve the situation:

-

Verify accuracy – Request medical records and itemized billing details to validate you actually received the services and the charges appear correct.

-

Negotiate – Ask the hospital billing department if they can reduce the old bill by a certain percentage if you pay a lump sum promptly.

-

Payment plan – See if you qualify to pay off the past-due amount in more affordable monthly installments over 6-12 months.

-

Financial assistance – Nonprofit hospitals are required to provide financial hardship help for qualified low-income uninsured and underinsured patients.

-

Collections – If you ultimately cannot pay, the overdue account will get referred to a collections agency. At this point, negotiate with them to settle the debt.

While frustrating to deal with, an old hospital bill isn’t necessarily cause for panic. Use the above strategies to ease the financial pain.

Consequences of Not Paying Your Hospital Bill

Ignoring and neglecting to pay your hospital bill can negatively impact your finances

What is Medical Debt?

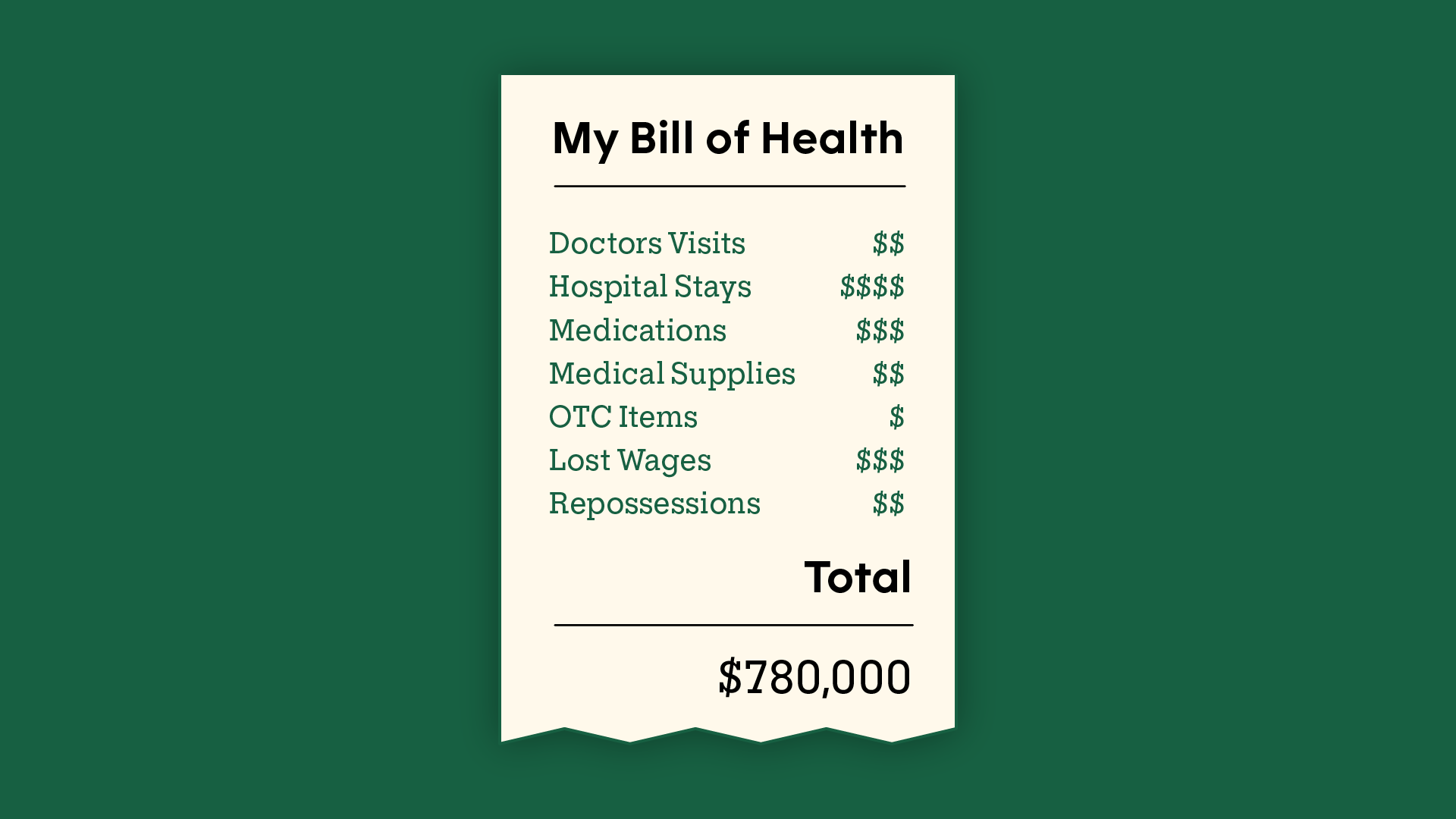

Medical debt is a debt that arises from a visit or interaction with a health care provider, such as a hospital, clinic, doctor, or nurse. Two-thirds of medical debts are the result of a one-time or short-term medical expense arising from an acute medical need.

Unlike many other consumer debts, people rarely plan to take on medical debt. For example, you might get into a car accident and end up in an emergency room. You are released with a concussion and a broken leg. You leave the ER without paying a bill. Perhaps a bill never comes, you get better, and forget about it. Then, much later, you receive a collections call, and you have no documentation to defend your case.

Medical debt is unique because consumers have less ability to shop around for medical services. Medical billing and collections practices can also be confusing and difficult to navigate. After billing, providers often send unpaid accounts to third-party collections. These companies have little access to providers’ records, which can make it difficult for consumers to confirm that the medical debts claimed by collectors are valid and accurate.

Know Your Rights

If you are a California consumer with a medical bill that has been sent to a debt collector, you have rights! Before paying any debt collector, always confirm the accuracy of their claim. You have the right to request a verification of the debt from the debt collector and from your provider. Before paying a debt collector with possible fake claims, or worse, getting involved with a lawsuit or paying expensive penalties, it’s important to know rights and your options.

- No Surprise Medical Bills: Unexpected or surprise bills can result from receiving out-of-network care, without your knowledge or consent, at an in-network health facility. Surprise medical bills often happen when you cannot control who provides your care. Both California and federal laws protect consumers from surprise medical bills, which means debt collectors may not collect these debts.

- Free or Reduced Care: If you cannot afford to pay certain hospital or medical bills, depending on your income, you may be entitled to free or reduced care. Uninsured patients or patients with high medical costs who are at or below 400 percent of the federal poverty level are eligible to apply for a hospital’s charity care or discount payment policy. Charity care is available even when your bill is past due. Hospitals cannot sell your patient debt to a debt buyer unless you are ineligible for financial assistance, or you have not responded to a hospital’s attempt to offer assistance for 180 days.

- Credit Reporting Timeframe: Hospitals, or any owner of your hospital debt including collection agencies, cannot report negative information to a credit reporting agency or file a civil complaint in court until 180 days after initial billing. Debt collectors must inform you of this timeframe in their first written communication with you.

- No Reporting Paid Medical Debt: As of July 2022, the three major credit reporting agencies have agreed to not include paid medical debt on consumers’ credit reports. Starting March 30, 2023, these agencies have also agreed to stop reporting medical debts under a certain dollar threshold (at least $500) on credit reports, even if the alleged medical debt is unpaid and in collection.

- Written Notices in Communication: Hospitals are required to provide you with a specific notice before transferring a hospital debt to a debt collector. This notice will include a copy of an application for free or reduced care under that hospital’s policy. In the first written communication with you, debt collectors must also send you a copy of this notice.

How Long Do You Have To Pay Hospital Bills? – CountyOffice.org

FAQ

How long before a medical bill goes to collections?

Do medical bills affect your credit?

Is there a time limit on medical bills in California?

How long after a service can a company bill you?

How long does it take to pay medical bills?

“It’s normally within three to six years,” Gross explains. “ [But] even after that time, the hospital can still try to collect.” These time frames are called medical billing time limits, which is how long it’s allowed to take to submit a claim to the payer—whether that’s you or your insurance. Do you have to pay medical bills? In short, yes.

How long does a hospital have to pay a credit card bill?

From now until Jun. 30, 2022, a hospital must wait for six months after the service date to submit an overdue bill to credit bureaus. But lucky for us, that rule is changing. Gross says that beginning Jul. 1, 2022, that timeframe is being pushed out to 12 months.

How long does it take for a medical bill to arrive?

It could take longer than you think for a medical bill to arrive in your mailbox. Many insurers require providers to bill them in a timely manner, but that could still be months. Once a bill is sent to the insurer, health care providers have to wait for payment before billing a patient for the balance.

What if I can’t pay my medical bills?

Unpaid medical bills can lead to calls from debt collectors, dings to your credit report, and potentially bankruptcy. If you can’t pay your medical debt, you can ask for a payment plan that’s affordable for you, find financial assistance programs, or consolidate the debt. Some organizations offer grants to help you pay medical debt.