As you approach retirement, one of the most pressing questions on your mind might be, “How much income can I expect from my hard-earned pension savings?” If you’ve diligently accumulated a pension pot of £100,000, you’re likely wondering how that translates into a steady stream of income during your golden years. In this comprehensive guide, we’ll explore the world of annuities and provide you with a detailed understanding of how much you can expect to receive from a £100,000 annuity in the UK.

Understanding Annuities: A Guaranteed Income for Life

An annuity is a financial product that allows you to convert a lump sum of money from your pension pot into a guaranteed income stream for life. By purchasing an annuity, you essentially exchange your pension savings for a series of regular payments from an insurance company. This can provide you with a sense of security and peace of mind, knowing that you’ll have a reliable source of income to cover your living expenses during retirement.

Factors Influencing Annuity Income

Before diving into the specifics of how much a £100,000 annuity might pay, it’s essential to understand the various factors that can impact the amount of income you’ll receive. These factors include:

-

Age: Generally, the older you are when you purchase an annuity, the higher your annual income will be. This is because the insurance company expects to make payments over a shorter period.

-

Health and Lifestyle: If you have certain medical conditions or engage in high-risk activities, you may qualify for an “enhanced” or “impaired life” annuity, which can provide a higher income stream.

-

Annuity Type: There are different types of annuities, such as level, increasing, or investment-linked, and each one will yield a different income stream.

-

Payment Frequency: You can choose to receive your annuity payments monthly, quarterly, semi-annually, or annually, which can affect the overall amount you receive.

-

Additional Features: Options like a guaranteed minimum payment period or a spouse’s pension can impact the income you receive from your annuity.

How Much Will a £100,000 Annuity Pay in the UK?

According to the latest annuity rate information from Legal & General, one of the UK’s leading providers, a £100,000 annuity could provide you with a guaranteed annual income of approximately £4,455 for the rest of your life. This figure is based on the following assumptions:

- You are a 65-year-old in good health at the time of purchasing the annuity.

- You opt for a lifetime annuity with a guaranteed minimum payment period of 10 years.

- You do not choose any additional product options or benefits.

- You take the full 25% tax-free cash lump sum from your pension pot, leaving £75,000 to purchase the annuity.

It’s important to note that this figure is just an estimate, and your actual annuity income may vary depending on your individual circumstances and the options you choose.

Maximizing Your Annuity Income

While a £100,000 annuity can provide a solid foundation for your retirement income, there are several strategies you can consider to potentially increase the amount you receive:

-

Delay Purchasing: If you can delay purchasing your annuity until a later age, you may be eligible for higher annual payments due to the reduced life expectancy.

-

Consider Enhanced Annuities: If you have certain medical conditions or lifestyle factors that may affect your life expectancy, an enhanced or impaired life annuity could offer higher income payments.

-

Explore Annuity Options: Different annuity types, such as increasing or investment-linked annuities, may better suit your specific needs and potentially provide higher income over time.

-

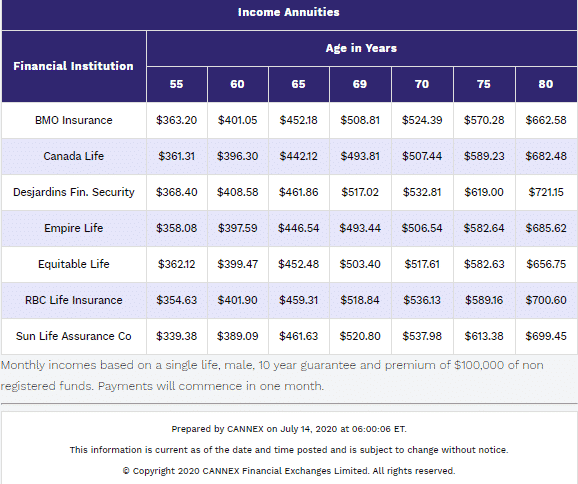

Shop Around: Annuity rates can vary significantly between providers, so it’s crucial to shop around and compare quotes from multiple companies to ensure you get the best deal.

-

Seek Professional Advice: Engaging the services of a qualified financial advisor can help you navigate the complexities of annuities and ensure you make an informed decision that aligns with your retirement goals and financial situation.

Weighing Your Options: Annuity vs. Drawdown

While annuities offer the security of a guaranteed income for life, they are not the only option available to retirees. Another popular choice is pension drawdown, which allows you to keep your pension pot invested and withdraw funds as needed. This approach can provide greater flexibility and the potential for growth, but it also carries the risk of your pension pot running out during your lifetime.

The decision between an annuity and drawdown will depend on your individual circumstances, risk tolerance, and retirement goals. It’s essential to carefully consider the pros and cons of each option and seek professional guidance if necessary.

Final Thoughts

Retirement planning is a complex and personal journey, and the amount of income you’ll receive from your pension pot will depend on various factors. By understanding the intricacies of annuities and the potential income a £100,000 annuity can provide, you’ll be better equipped to make informed decisions about your retirement income strategy.

Remember, the figures provided in this guide are estimates, and your actual annuity income may vary. It’s always advisable to consult with a qualified financial advisor who can provide personalized advice tailored to your unique circumstances and help you navigate the complexities of retirement planning.

How much does a 100 000 annuity pay per month?

FAQ

How much does a $100,000 annuity pay per month?

Is 100k enough to retire UK?

How much will 500k annuity pay UK?

How much annuity can I get for 100k?