PayPal has grown to be one of the most popular ways to send and receive money online. But did you know that you can pay your bills every month with PayPal?

Paying bills through PayPal offers several benefits. You can schedule recurring payments so your bills are always paid on time. You can easily track payments and manage bills in one place. And you can earn cashback rewards when paying some bills with PayPal.

In this comprehensive guide I’ll walk through how to pay bills with PayPal, including setting up billers making one-time and recurring payments, getting cashback offers, and more. By the end, you’ll be an expert at streamlining bill pay with PayPal.

Getting Started with PayPal Bill Pay

Ready to start using PayPal to pay your bills? Here are the quick steps to get set up:

-

Sign up for a PayPal account if you don’t have one already. You can use a bank account, credit/debit card, or existing balance.

-

Download the PayPal app on your mobile device or access your account on the website,

-

Click “More” near your profile icon, then select “Pay your bills” from the menu.

-

Search for or select the biller you want to pay. Add your account details.

-

Choose a payment method and schedule one-time or recurring payments.

After adding your billers, PayPal makes it easy to pay all of your bills at once.

Adding Billers to PayPal

The first step to paying bills with PayPal is adding the companies you want to pay. PayPal has thousands of established billers like utility companies, cable providers, insurance companies, and more.

To add a biller:

-

On the Pay Bills page, click “Add a biller”

-

Search for the company name or browse categories like utilities, loans, etc.

-

Select the biller and enter your account number or other info

-

Check that the details are correct then click “Add your bill”

If your biller isn’t listed, you may be able to add it by contacting their customer service for help connecting your accounts. Certain small, local businesses may not be compatible billers.

Once added, your billers will be saved to easily manage and make future payments. You can add as many companies and accounts as you need in one place.

Making One-Time Payments

For bills that vary monthly like utilities and cable, you’ll likely want to make one-time payments. Here are the steps for paying a bill with PayPal when you receive it:

-

Go to “Pay Bills” and select the biller you want to pay

-

Enter the payment amount if it’s not populated automatically

-

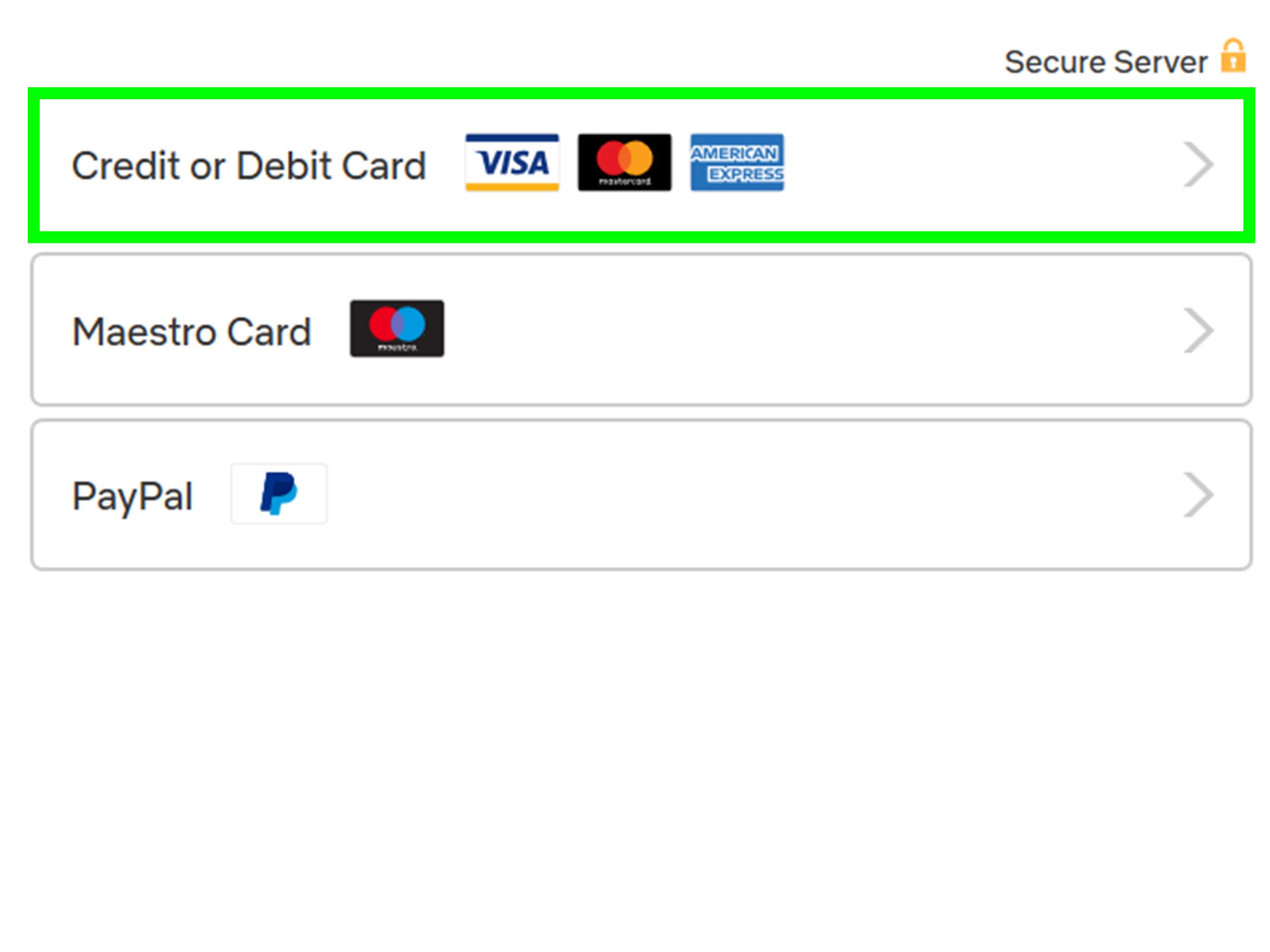

Choose a payment method from your PayPal balance, bank account, or card

-

Select the date you want the payment to be sent

-

Confirm payment details and submit

The money will be debited from your chosen payment method and sent to the biller on the scheduled date. You’ll receive a confirmation email with details.

One-time payments give you control each month to pay different amounts owed. It’s quick and easy with just a few clicks!

Setting Up Recurring Payments

Many bills like mortgages, subscriptions, and memberships are the same fixed amount each month. In these cases, it makes sense to set up recurring payments with PayPal.

Here’s how to schedule automatic payments:

-

Locate the biller account and click “Set up recurring payment”

-

Enter the fixed payment amount

-

Pick the date each month you want payments to be sent

-

Choose a payment method to automatically debit

-

Select frequency of monthly, quarterly, annual, etc.

-

Review details and confirm setup

Once enabled, PayPal will withdraw the set amount on the scheduled date indefinitely until you cancel. You can adjust date, amount or payment method anytime.

Recurring payments save you effort of manually paying fixed bills every month. Set it and forget it!

Getting Cashback on Bill Payments

One great perk of paying bills with PayPal is you can earn cashback! Certain partner billers give cash rewards when you pay with PayPal.

Here are some ways to earn:

-

Get up to $12 back yearly paying U.S. mobile bills

-

Earn up to $48 cashback annually on U.S. streaming services

-

Get up to $6 back yearly on select magazine subscriptions

-

Receive varying rewards for bills from eBay, Etsy, Overstock and more

Cashback is automatically applied as a credit to your PayPal balance. There’s no forms to submit or points to track. It’s an effortless way to save money by using PayPal!

Managing Bills and Payments

After you’ve added your billers, PayPal offers a centralized hub to manage them. On the Pay Bills page, you can:

-

View due dates and recent payment history

-

Check pending scheduled payments

-

Click biller names to see account details

-

Monitor cashback rewards earned

-

Edit or remove billers as needed

Use the Pay Bills dashboard as your one-stop command center to monitor due dates, send payments, update biller info, and more. Everything is efficiently accessible in one place!

Helpful Tips for Paying Bills with PayPal

As you integrate PayPal bill pay into your routine, keep these tips in mind:

-

Schedule payments at least 3-5 days before the due date in case of delays

-

Set payment reminders through your PayPal notifications

-

Contact biller customer service if there are ever issues with linked accounts

-

Periodically update your saved card on file if it expires or is lost/stolen

-

Review statements monthly to ensure correct payment amounts were sent

-

Take advantage of cashback offers by paying supported billers with PayPal

By following this advice, you can avoid late fees, earn rewards, and keep your bill payment process running smoothly.

The Convenience of PayPal Bill Pay

Paying bills doesn’t have to be a mundane task. With PayPal, you can streamline payments and even earn a little extra money.

If you’re still relying on checks and snail mail to pay bills each month, it’s time to upgrade to PayPal. You’ll be able to automate recurring payments, instantly send funds, receive due date alerts, earn cashback, and more.

PayPal provides a superior bill payment experience that saves time and hassle. Simplify your personal finances today by managing all your bills in one convenient place!

Paying bills when they’re due

Have you ever asked yourself, “When are my bills due?” With expenses scattered across multiple payment sources and on different schedules, it’s understandable that you might get overwhelmed with paying every bill when its due.

But paying your bills on time can help boost your financial health, avoid unnecessary late fees and penalties, and could help you maintain your credit score. On the other hand, late payments have the potential to lead to damaged credit, higher interest rates, and even difficulty obtaining credit in the future.

So, to the best of your financial ability, paying bills when they’re due should be at the top of your to-do list.

Many companies offer online bill payment options, making it easy to stay on top of your bills and avoid the pitfalls of late payments.

Whether for utilities, credit cards, insurance premiums, or other expenses, you can usually pay them online through a secure payment portal. As a result, you can avoid the hassle of mailing in checks or making lengthy phone calls, saving you time and effort.

Plus, when you pay bills online, you can schedule payments in advance, receive alerts when bills are due, and keep track of your payment history — all potentially useful benefits that can help you make payments on time.