It’s that time of year again – tax season. For many, filing taxes can be confusing and stressful. One of the biggest sources of stress for taxpayers is figuring out how to pay their tax bill. Knowing your options for paying your taxes is important so you can choose the best payment method for your financial situation. In this comprehensive guide we’ll walk through everything you need to know about paying your federal tax bill.

When is My Tax Bill Due?

The first thing to know is when your tax payment is actually due. Most people who file their own taxes have to send in their return and payment by April 15th. If April 15 is a holiday or weekend, the due date is moved to the next business day.

However, you can file for an automatic six month extension which will give you until October 15th to file your return. This extension gives you more time to file, but not more time to pay. You still need to estimate what you owe and pay any anticipated tax bill by April 15th to avoid penalties and interest.

For business taxes and self-employed individuals, payment deadlines vary depending on the type of tax Estimated quarterly income tax payments are generally due on April 15th, June 15th, September 15th, and January 15th of the following year.

It is very important to know the exact due dates for your taxes so that you don’t have to pay late fees. Mark your calendar so you remember when payment is due.

How Much Do I Owe?

Before you can pay your taxes, you need to know how much you owe. Calculating this can get complicated, but here are some tips

-

Use last year’s tax return as a baseline for what you might owe. Make adjustments up or down based on any major life changes.

-

Complete your tax return for the current year. The amount due on your return is what you need to pay.

-

Check for any previous year unpaid balances or penalties which need to be paid.

-

Review estimated tax payments you already made for the year to see if you paid enough.

-

Account for any refund you might receive when estimating your remaining bill.

There are online calculators and estimators that can help give you an idea of your tax liability. But doing the math yourself ensures you know precisely what you owe.

When Should I Pay My Taxes?

Ideally, you should try to pay your taxes in full by the deadline to avoid interest and penalties. But there are a few options if you can’t swing paying the full amount on time:

-

File on time, pay what you can: To avoid failure-to-file penalties, file your return by the deadline even if you can’t pay in full. Pay as much as possible by the due date to minimize interest and late payment penalties.

-

Get an extension: As mentioned, you can get an automatic 6-month extension to file which gives you more time to sort out your finances. Pay as much as you can estimate you owe by the original deadline.

-

Request a payment plan: The IRS offers payment plans including short-term extensions and monthly installment plans. This allows you to pay over several months for a fee.

Paying as much as early as possible, even if not the full amount, minimizes any penalties and interest. It also shows the IRS you are making a good faith effort to meet your tax obligations.

Payment Options from the IRS

The IRS provides several payment options to choose from. Here are some of the most common ways to pay your federal taxes directly to the IRS:

-

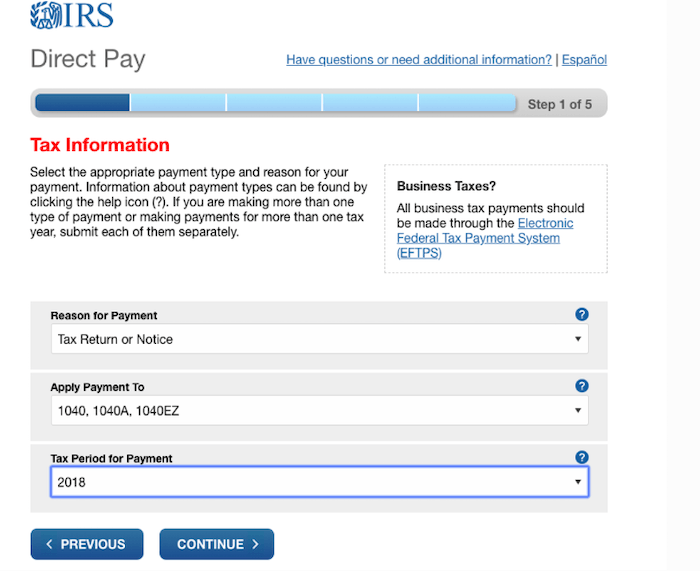

Direct Pay: This free service allows individuals to securely pay their income taxes directly from a checking or savings account. No fees apply. You don’t need to register or create an account.

-

IRS Online Account: Creating an online account with the IRS allows you to view your full tax account and make one-time or recurring payments.

-

Electronic Funds Withdrawal: When e-filing, you can choose to have your tax payment withdrawn electronically from your bank account.

-

IRS2Go: The IRS mobile app allows you to make payments by debit or credit card. Third-party convenience fees apply.

-

Phone: You can call the IRS directly at 1-800-829-1040 to make a payment from your bank account. An $2.50 – $3.95 fee applies depending on payment amount.

-

Mail: Send a check or money order along with a payment voucher to the applicable IRS mailing address. Make checks payable to “US Treasury” and include your name, address, type of tax, and tax year on the check.

-

Same-Day Wire: If you need to make a payment immediately, you can do a same-day wire from your bank account. Bank wire fees apply.

-

Debit or Credit Card: One of the quickest options is to pay directly with your credit or debit card. Third-party convenience fees apply. Cards from Visa, MasterCard, American Express, and Discover are accepted.

Online Payment Services

In addition to the IRS options, you can use a third-party payment service which will collect the funds from you and deliver payment to the IRS on your behalf. Some popular online payment services include:

-

PayPal: Schedule a one-time or recurring tax payment using your PayPal funds or linked bank account or cards. Transaction fees apply.

-

Square: Make IRS tax payments through Square’s online portal or point-of-sale software. Processing fees apply per transaction.

-

Venmo: Use your Venmo balance or linked bank account to pay your IRS tax bill. Standard Venmo fees apply.

These services provide another layer of convenience and flexibility in how you pay your taxes. The payment processors take care of delivering the funds to the IRS so it’s one less thing for you to worry about.

Payroll Deductions and Estimated Payments

If you’re an employee, having taxes withheld from each paycheck helps ensure you’re paying your tax bill throughout the year. To cover any remaining balance due, self-employed individuals or small business owners should make quarterly estimated income tax payments. Making payroll deductions and estimated payments helps avoid getting stuck with a large tax bill all at once when it’s time to file.

Use the IRS Tax Withholding Estimator tool to determine if you need to adjust your withholdings. And refer to Form 1040-ES to calculate your quarterly estimated payments. Staying current with these payments minimizes any penalties for underpayment come tax time.

What If I Can’t Pay At All?

Despite your best efforts, you may find yourself unable to pay your tax bill in full by the deadline. If paying even part of the amount due would cause financial hardship, you have a few options:

-

Apply for an Offer in Compromise: If you can demonstrate an inability to ever fully repay your tax debt, you may be able to settle for less than the full amount owed under this program. Strict eligibility requirements apply.

-

Request a payment plan: Setting up an installment agreement allows you to pay monthly over 6-72 months. Certain fees apply and interest continues growing during the payment term.

-

Delay collection: If experiencing economic hardship, you can request your account is placed into uncollectible status which pauses IRS collection efforts until your financial situation improves. Interest and penalties continue accruing during this time however.

While not ideal, these options are available for taxpayers truly unable to make payments for legitimate reasons. The IRS may ask for detailed documentation to verify your inability to pay.

Consequences of Not Paying

Make no mistake, not paying your owed taxes has serious repercussions. Here are some possible consequences if you don’t pay your tax bill:

-

Interest – Interest starts accruing as soon as your payment is late, even by one day. The current IRS interest rate is 6% annually. This can quickly multiply your original tax debt.

-

Penalty fees – A failure-to-pay penalty of 0.5% per month applies for outstanding taxes owed starting after the deadline. This penalty maxes out at 25% of the unpaid balance.

-

Wage garnishment – The IRS can contact your employer to require garnishing a portion of your wages to help settle your tax debt.

-

Bank levy – Your bank or financial accounts can be seized by the IRS to pay off your unpaid taxes.

-

Lien – An IRS tax lien gets attached to your assets and property as collateral until you settle your tax debt. This can negatively impact your credit.

Ignoring your tax obligations only makes the problem worse. If you owe back taxes, address it as soon as possible to avoid harsh collection actions down the road.

Paying Your Taxes Doesn’t Have to Be Stressful

While it may seem intimidating, paying your taxes doesn’t need to be a dreaded experience. Now that you know all your options for taking care of your tax bill, you can choose the payment method that works best for your financial situation.

Remember key tips like filing on time, paying as much as you can afford, and requesting help if you genuinely can’t pay. Staying on top of your tax obligations throughout the year makes tax time much smoother. With this guide,

Make an estimated income tax payment

You can make an estimated income tax payment with an Individual or Fiduciary Online Services account. Pay directly from your bank account, or by credit card for a fee.

If you need to make an estimated tax payment for a partnership, see Partnership information.

Pay an open audit case

Before you receive a bill, you can make a payment toward the balance on an open audit case through your Online Services account.

If you received a bill (assessment) for an audit case, do not use this online service. Instead, see Pay a bill or notice.

How to Pay Your Taxes

FAQ

How do I make a payment on my taxes?

How do I pay taxes to IRS?