Paying bills on time each month is crucial for maintaining good credit and avoiding late fees. But with due dates scattered throughout the month, it can be easy to miss a payment. A bill pay checklist is an invaluable tool to help you stay organized and prevent oversights.

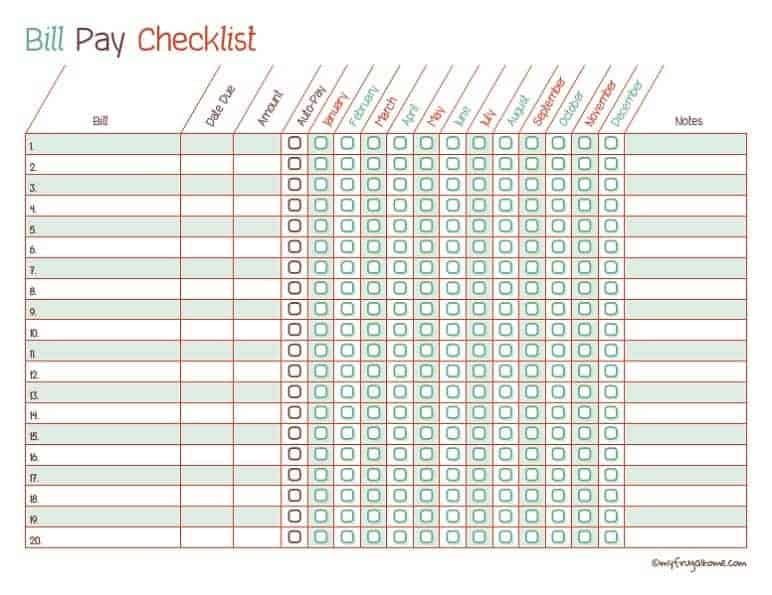

My Frugal Home’s free Printable Bill Pay Checklist is one of the most useful bill organizers I’ve found. In this article, I’ll explain what makes it so great and how to get the most out of using it

Why You Need a Bill Pay Checklist

When you receive a bill in the mail or email, it’s easy to put it aside and think you’ll remember to pay it later. But as the month gets busy it’s not hard to forget a bill until you get a late notice.

Using a checklist ensures all your bills get paid on time, which provides several benefits

-

Avoid late fees – Late payments typically incur fees from $25-50. Those can add up fast.

-

Maintain good credit – Payment history makes up 35% of your credit score. Late payments negatively impact your score.

-

Prevent service interruptions – Utilities and other services can be disconnected if you miss payments. This causes major inconveniences.

-

Reduce stress – Nothing adds pressure like realizing you forgot to pay a bill. A checklist gives peace of mind.

Why My Frugal Home’s Checklist Stands Out

There are plenty of free bill pay checklists online, so what makes this one so great? Here are some key features:

Customizable

You can add your specific bills, due dates, and payment amounts. This level of customization ensures the checklist is tailored to your needs.

Visible Layout

With bills listed down the left side and months across the top, it allows you to easily tick off payments at a glance.

Annual View

Seeing the full year provides perspective on when your bills are due. This helps with budget planning.

Extra Space

There’s room to write confirmation numbers, notes, or mark dates paid. These details can prevent confusion.

Downloadable and Printable

You can access the PDF checklist right from your computer, phone, or tablet. And it’s designed for clean printing too.

This winning combination of flexibility, functionality, and clarity is what sets My Frugal Home’s checklist apart.

How to Use the Bill Pay Checklist

Let’s walk through the process of using this checklist to stay on top of your bills:

Step 1: Download the Checklist

Go to My Frugal Home’s Printable Bill Pay Checklist page and click to download the PDF file.

Be sure to open it with an application like Adobe Acrobat Reader so you can save your changes.

Step 2: Customize with Your Information

Input each of your bills by name, due date, and amount owed into the fields. For bills that vary, you can leave the amount column blank.

If you pay bills for multiple people, use the notes section to specify accounts.

Step 3: Print or Save the Checklist

You have the option to print out your tailored checklist or just save the PDF to refer back to each month. Either way, the information will be handy.

Printing allows you to physically check off each bill and provides a hard copy for your records. Saving digitally makes access quick and easy if your bills are mostly online.

Step 4: Use the List to Pay Bills

Refer to your checklist as you pay bills each month. Physically check them off or make note on the PDF.

Doing this ensures no payments slip through the cracks. You’ll gain peace of mind knowing everything is paid.

Step 5: Review Next Month’s Bills

Once all bills are paid for the month, do a quick review of the next month’s bills. This gives you time to plan and budget accordingly.

The annual view on the checklist makes seeing upcoming due dates simple.

Tips for Getting the Most from the Checklist

Follow these tips to maximize the effectiveness of the bill pay checklist:

-

Update due dates or amounts if they change. Keeping details current avoids confusion.

-

Mark dates paid along with confirmation numbers. This provides helpful records.

-

Highlight bills by week to spread out payments and avoid low account balances.

-

Set payment reminders on your calendar for any non-fixed due dates.

-

Review upcoming bills each month or week. Anticipating payments helps budgeting.

-

Print multiple copies if dividing bill responsibilities with others. Assign bills per page.

-

Compare with bank and credit card statements. This verifies your records match theirs.

-

Save blank copies to reuse each new year or make customized lists for different purposes.

Adapt the Checklist to Your Needs

One of the best things about a DIY bill organizer is that you can customize it in different ways:

-

Monthly view – Print just one month at a time if you prefer focusing on the current period.

-

Extra pages – Print additional copies and number them if you need more bill lines per page.

-

Digital use – Type in bills but don’t print. Save, update, and refer to the PDF monthly.

-

Weekly focus – Use highlights or notes to split bill due dates into weekly reminders.

-

Shared bills – If you split bills with a partner, note who pays which bills.

-

Bill details – Add account numbers, customer service phone numbers, or auto-pay info.

-

Non-bill uses – Apply the checklist structure to non-bill payments like subscriptions, memberships, or regular financial goals.

The basic checklist template works great as-is. But you can tweak it to suit your style or situation even more.

Sign Up for the My Frugal Home Newsletter

The My Frugal Home website offers tons of free printables and great money-saving tips. Sign up for their email newsletter to get helpful frugal living information delivered to your inbox.

You’ll receive:

- Access to new printables when they are released

- Budget-friendly recipes

- DIY and home decor inspiration

- Holiday ideas

- Time-saving cleaning and organizing methods

- Parenting and family life tips

My Frugal Home focuses on practical ways to save money and get organized. Their newsletter gives you valuable resources to simplify life and reduce spending.

Conquer Bill Payments with My Frugal Home’s Checklist

Never miss a bill payment again with My Frugal Home’s bill pay checklist. It takes the stress out of managing monthly bills and helps avoid unnecessary fees.

This printable provides the perfect format for staying on top of due dates. With a little effort upfront to customize it, you’ll reap rewards for years to come.

What bill pay strategies or tools have worked well for you? Share your thoughts in the comments!

Prefer to Keep Things Digital?

Just save a copy of this file to your preferred device, and update it each time you pay a bill. Easy!

10 Low Income Frugal Hacks For 2024

What is a bill pay checklist?

This post may contain affiliate links. View our disclosure. Use this printable bill pay checklist to check off your bills as you pay them each month. It’s an easy way to catch oversights before they result in late fees and added interest. The form is fully editable, so you can customize it with all of your bill pay information before you hit print.

How do I fill out a bill payment checklist?

Wait until you next whole month, and start using the system. As a bill comes in, or once a week (you choose), open the bill, write in the amount due and the due date, and then write in the date you paid the bill as you pay them. The checklist you chose will prompt you with what info to fill out.

How do I track my monthly bill payment?

Annual Bill Pay with Monthly Amounts #2 This one-page sheet also allows you to track the amount you paid each month, as you pay it. You fill in the deadline day of the month in the “Day” column, then when you pay the bill, you fill in the amount you paid (that’s the “check”). 3. Bi-Weekly Paycheck Bill Payment Tracker