Paying bills is a necessary but often tedious task. Mailing paper checks, keeping track of due dates, and logging into multiple websites to make payments can be time consuming and frustrating Thankfully, Capital One’s online bill pay feature provides a convenient solution to simplify bill payment In this comprehensive guide, we’ll explain what online bill pay is, outline the benefits of using Capital One’s online bill pay, provide step-by-step instructions for setting it up, and answer frequently asked questions. Read on to learn how online bill pay can save you time and hassle when managing your monthly expenses!

What is Online Bill Pay?

Online bill pay allows you to pay your bills through your bank’s online or mobile app. With online bill pay, you can schedule one-time or recurring payments to companies, individuals, or merchants directly from your checking account. You no longer need to write and mail paper checks or visit multiple websites to pay all your monthly bills. Online bill pay centralizes all your payments and provides a simple way to manage due dates and track payment history.

Many major banks now offer online bill pay services, including Capital One. Capital One’s online bill pay is fast, secure, and completely free for all personal checking account holders. Setting up bill pay through your Capital One account provides a seamless way to stay on top of bills right from your laptop or smartphone.

Benefits of Using Capital One’s Online Bill Pay

Here are some of the major benefits of using Capital One’s online bill pay system

-

Convenience – Manage all bills in one place and avoid logging into multiple sites. Schedule one-time or recurring payments 24/7.

-

Time savings – No more mailing paper checks and waiting for payments to process. Online payments occur quickly.

-

Organization – Track all scheduled payments and payment history in your Capital One account. Get bill reminders and notifications.

-

Flexibility – Schedule payments to occur on a specific date or as soon as possible. Change or cancel payments when needed.

-

Security – Capital One uses advanced encryption to keep your data secure. No need to share sensitive information when paying bills.

-

Budgeting – Review upcoming scheduled payments at a glance and check your balance before new transactions.

-

No fees – Online bill pay is completely free for all Capital One personal checking account holders.

Overall, Capital One’s online bill pay provides an easy, fast, and secure system to simplify your monthly payments. The convenience of managing bills through your Capital One account can save you significant time compared to conventional payment methods.

Step-by-Step Guide to Setting Up Online Bill Pay

Ready to streamline bill payment with Capital One’s online bill pay? Follow these simple steps to get started:

Step 1: Log into your Capital One online banking or mobile app

Access your Capital One checking account through the online banking portal or mobile app. You’ll need your account username and password to log in.

Step 2: Locate the online bill pay tab

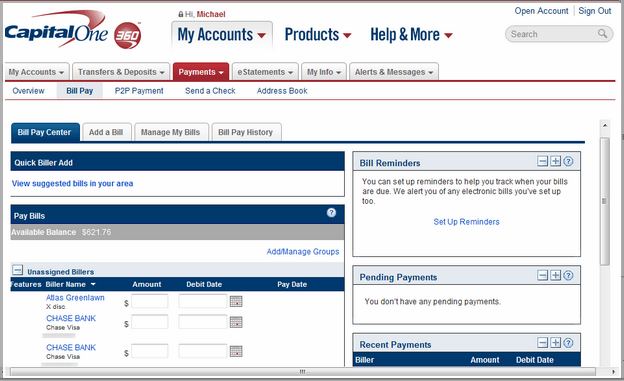

In the online banking portal, click on the “Pay Bills” tab located along the top navigation. In the mobile app, tap on the “Move Money” tab, then select “Pay Bills.” This is where you’ll manage online bill pay.

Step 3: Set up payees

A payee is any company, service, individual, or merchant that you want to pay. Enter the payee name and account details, such as an account number, to establish them as a payee. You can add as many payees as you need.

Step 4: Schedule one-time or recurring payments

Once your payees are set up, you can schedule one-time or recurring payments to each payee. Pick the payment amount, date, and frequency as desired.

Step 5: Confirm your scheduled payments

Review your scheduled payments for accuracy before payments are processed. You can edit or cancel upcoming payments as needed.

And that’s it! Once your payments are scheduled through Capital One’s online bill pay, you’re all done. Sit back as Capital One handles the rest and get ready to enjoy the convenience of simplified bill management.

Frequently Asked Questions about Online Bill Pay

Still have some questions about using Capital One’s online bill pay? Here are answers to some of the most frequently asked questions:

How long does it take for online bill payments to process?

Most electronic payments arrive at the payee within 1-2 business days. Allow 3-4 business days before any due dates to ensure on-time arrival. Mailed paper checks can take 5-10 days to arrive.

Can I schedule automatic recurring payments?

Yes, you can set up automatic recurring payments to occur on a fixed date and frequency of your choice, such as the 1st of every month.

What if I need to edit or cancel a scheduled payment?

You can easily edit or cancel payments at any time before processing begins, typically 1-2 days before the scheduled payment date.

Is there a fee to use Capital One’s online bill pay?

Online bill pay is completely free for all Capital One personal checking account holders. There are no fees or monthly costs.

What information do I need from payees to set them up?

You’ll need the payee’s name, mailing address, account number, and phone number in most cases. Store these details when first establishing the payee connection.

Can I schedule payments to individuals?

Yes, Capital One’s online bill pay allows you to schedule one-time or recurring payments to individuals using their name, address, and other requested details.

How do I check the status of payments I’ve scheduled?

You can easily view status updates on all scheduled one-time and recurring payments in your Capital One account’s online bill pay tab.

How far in advance can I schedule a payment?

You can schedule payments up to 12 months in advance, allowing ample time to account for due dates and plan your finances.

Can I pay every type of bill through online bill pay?

You can pay most common bills such as utilities, credit cards, subscriptions, rent, and car payments. Some payees like courts or the IRS may not accept online payments.

How does Capital One notify me about upcoming payments?

You can opt in to receive email, text, and push notification reminders as bills become due, ensuring you never miss a payment.

Pay Bills with Ease Using Capital One’s Online Bill Pay

By now it should be clear that Capital One’s free online bill pay system can make it remarkably simple to stay on track with bills. Consolidating all your payments through a single secure hub saves you time, provides flexibility, and gives you control over your finances each month. Sign up for online bill pay through Capital One today to streamline the bill payment process starting next month. The days of paper checks and keeping track of multiple logins will be over!

How long will payments take to deliver?

Capital One Bill Pay will deliver payments as quickly as possible. Making payments electronically is our first priority, posting either the same day or the next business day.

Payments that cannot be delivered to a biller electronically will be made by paper check and may take up to seven business days for delivery. Check payments may take up to seven business days for delivery. Additional processing time may be added based on individual biller requirements for processing checks.

What is an electronic payment?

Electronic payments are posted the same day with a virtual card or on the next business day. A virtual card is a one-time card number generated to deliver your payments quickly and securely. In the case that a biller is not capable of receiving payments electronically, payments will be made by paper check.