Paying your Verizon bill can be easily managed through PayPal Credit – a flexible online credit option offered by Paypal With Verizon being one of the major telecommunication networks in the US, many users opt for autopay and online bill payment services for convenience This is where integrating your Verizon account with PayPal Credit can make bill payment quicker and simpler.

An Overview of Paying Bills through PayPal

PayPal allows users to pay their utility, credit card and other bills online through their platform By linking your biller account on PayPal, you can view bill amounts and due dates as well as make one-time payments or set up automatic payments. According to PayPal, it may take up to 5 days for your payment to reflect in the biller’s system.

To start paying bills via PayPal, you need to first link the biller by searching for their name, entering account details and adding them in your PayPal account. You can do this either on the PayPal website by going to your dashboard, clicking on “More” and then “Pay your bills” or directly through the PayPal mobile app by tapping on “Payments” and then “Bills”.

Once the biller is linked, you can easily pay by choosing the bill and clicking on “Pay”. Here you can select a payment method, review bill details and send the payment. Supported payment methods include bank account, debit/credit card, PayPal balance or PayPal Credit.

What is PayPal Credit and How Can It be Used for Paying Bills?

PayPal Credit previously known as Bill Me Later, is essentially a credit account offered by PayPal that lets you make purchases and then pay for them later over time. It can be used to pay for bills online shopping, and other services and applications that accept PayPal.

Some key features of PayPal Credit:

-

No interest if paid in 6 months – For purchases over $99, you get 6 months to repay without accruing any interest. This makes it easy to manage large bills and pay them off over time.

-

Credit line – Approved applicants get a reusable credit line that can be used to pay bills as well as make other purchases. The initial limit is between $250 to $5000.

-

Monthly payments – Instead of paying the full bill amount at once, you can make monthly payments over 6 months. The monthly payment is fixed based on your total balance.

-

Quick online application – It only takes a few minutes to apply for PayPal Credit online and get a credit decision. Compared to regular credit cards, the process is much faster.

-

Electronic statements – You get instant online access to your PayPal Credit account statements showing balance, available credit, payment due date, transactions etc.

-

PayPal purchase protection – Eligible purchases get PayPal purchase protection covering issues like non-delivery of items ordered online.

Step-by-Step Guide to Pay Verizon Bill with PayPal Credit

If you already have a Verizon account set up, here are the simple steps to use your PayPal Credit for paying your Verizon bill:

1. Apply for PayPal Credit

You can submit an application on PayPal.com or the PayPal app. Make sure to have your personal and income details ready for the application form. The whole process should not take more than 5-10 minutes.

Once approved, you can start using the credit line to make payments right away. The credit limit and APR offered will depend on factors like credit score, income, and credit utilization.

2. Link Verizon Bill Account with PayPal

Go to PayPal’s bill payment page and search for Verizon. Provide your Verizon account number and billing details to link it. You only have to do this once.

3. Pay Your Verizon Bill

When your next Verizon bill is due, log into your PayPal account and go to the bill payment section. Select the Verizon bill, click on Pay, enter the billed amount and submit the payment.

The great thing about PayPal Credit is you don’t have to pay the full bill amount upfront. Depending on your total bill, you can make minimum monthly payments over a 6 month period without any interest charges.

4. Make Your Monthly Payments

PayPal will send you monthly statements with the minimum amount due for that cycle. Make sure to pay at least the minimum amount before the due date to avoid late fees. The rest of the balance can be paid off over the next billing cycles.

Once paid off fully within 6 months, you pay no interest charges at all! If you cannot pay it off within 6 months, a deferred interest rate is applied from the date of transaction.

Pros of Paying Verizon Bill with PayPal Credit

Here are some of the benefits of managing your Verizon account and payments through PayPal Credit:

-

Convenience – With a few clicks, you can easily view your outstanding amount and due date. The entire payment process is quick and simple.

-

Flexibility – The 6 month interest-free period allows you to pay large bills in installments and adjust cash flows. This can be very helpful for managing one-time large payments.

-

Rewards – You can earn rewards on PayPal purchases that can be redeemed for gift cards, travel benefits, cash back and more.

-

Purchase protection – Get up to $30,000 coverage in case issues arise with items bought online through PayPal Credit.

-

Credit building – Responsible use of PayPal Credit can help establish a credit history and good credit score.

-

Credit line – Having a reusable PayPal Credit line lets you make additional purchases without applying for new credit.

-

No late fees – PayPal does not charge late payment fees like some other creditors. As long as you pay the minimum amount due on time, you will not incur penalties.

Potential Drawbacks to Consider

While PayPal Credit makes bill payment and managing expenses simpler, there are a few drawbacks to keep in mind as well:

-

If the full bill amount is not paid within the 6 month promotional period, interest charges apply from the original transaction date. The APR of 26.99% is quite high.

-

There are no sign-up bonuses or rewards points offered for signing up, unlike regular credit cards.

-

Paying only the monthly minimum due will increase the total interest paid over the repayment period.

-

For large balances carried over several billing cycles, the compounding interest can accumulate quickly and make the balance quite expensive.

-

There is no grace period – interest starts accruing immediately for amounts not paid off within 6 months.

-

Late or missed payments negatively impact your credit history similar to other credit accounts.

Tips for Using PayPal Credit Responsibly

-

Avoid using PayPal Credit for everyday expenses and non-essential purchases. Stick to large bills and emergency payments only.

-

Setup automatic payments through your bank account to pay at least the minimum amount due so as to never miss a payment.

-

Pay more than the minimum whenever possible to reduce the principal balance each month. This will minimize total interest paid.

-

Avoid maxing out your credit line. Keep utilization under 30% for optimal credit scores.

-

Review monthly statements carefully and address errors or fraudulent transactions promptly.

-

Contact PayPal support if you anticipate missing payments or are undergoing financial hardship to explore alternative payment arrangements.

Paying your Verizon wireless, Fios or other bill with PayPal Credit offers an easy and flexible way to manage payments over 6 months. However, make sure to use it judiciously for large amounts that can be repaid within the interest-free period. Responsible usage of the credit line is important to avoid accumulating expensive interest charges down the line. Evaluate your finances and spending patterns carefully before applying. Used wisely and sparingly, it can be a useful tool for conveniently managing your household utilities and monthly bills.

Can I pay my bills with PayPal?

Yes. You can use PayPal to link, pay, and manage your bills from the PayPal app or the PayPal website. For more information on Bill Pay, please see our user agreement.

Linking a Bill

On our website:

- Go to your Dashboard.

- Click More near the top right of the screen.

- Click Pay your bills.

- Search for your biller. If youve previously added a biller, click Add a New Bill first.

- Select your biller and enter your bill account details.

- Click Add Your Bill.

On the PayPal app:

- Tap

Payments.

Payments. - Tap Bills.

- Tap Pay your first bill.

Tips:

- If your biller doesnt appear in the search results, try typing the billers full name or using more precise keywords. If the biller still doesnt appear, we may not have them available this time.

- When linking a biller, please have your latest paper or online bill statement available to ensure you have the correct account number and billers information.

- The ability to link and pay a bill through your PayPal account is only available for Personal users.

Paying a Bill On our website:

- Go to your Dashboard.

- Click More near the top right of the screen.

- Click Pay your bills.

- Click Pay next to the billers name.

- Review the bill details and click Pay.

- If prompted, enter the payment amount, and click Next.

- Select your payment method and payment date.

- Click Send Payment or Schedule Payment for a future payment.

On the app:

- Tap Payments.

- TapBills.

- Tap the bill you want to pay.

- Tap Pay.

Tips:

- You can pay your bill with any suitable payment method in your Wallet, including a bank account, debit or credit card, your PayPal balance, or PayPal Credit.

- Once a bill is linked, some billers will display the amount due and due date information. Please check your statement to confirm how much you need to pay and when if this information doesnt appear.

- Some billers may not allow you to schedule payments for a future date.

- Once youve paid your bill, it can take up to 5 days to appear on the billers system. Depending on the billers, sometimes it can be credited right away.

Why is my bill showing as unpaid or overdue after I paid it through another channel? If you paid your bill using another channel it can take additional time to reach our system and show as “paid”.You can disregard the due or overdue information showing in your PayPal account. Why was I charged a late fee when I paid my bill on time? Some billers may not consider your bill paid until 5 days after it has been sent. Depending on the billers, sometimes it can be credited right away. Please contact your biller directly to find out why your payment was considered late and to request a correction or late fee refund. The biller may ask you to provide your payment confirmation email.

How To Pay Bills with Paypal – Full Guide 2024

Can I Pay my Verizon phone bill with PayPal?

Verizon does allow customers to pay their bills via Paypal. As Verizon and other large companies continue to streamline their processes, handy digital payment methods like Paypay are becoming more widely used for day-to-day bill payments. So, if you are looking to pay your phone bill from Verizon with the money in your PayPal, then you are in luck.

What payment method does Verizon use?

Eliminate stamps and late fees with Auto Pay, Verizon’s automatic monthly payment plan. Your monthly bill is paid from the account of your choice: checking or savings account, debit card or credit card. Is there a charge for any payment method? Lose the paper — ask for Verizon’s p aper-free billing.

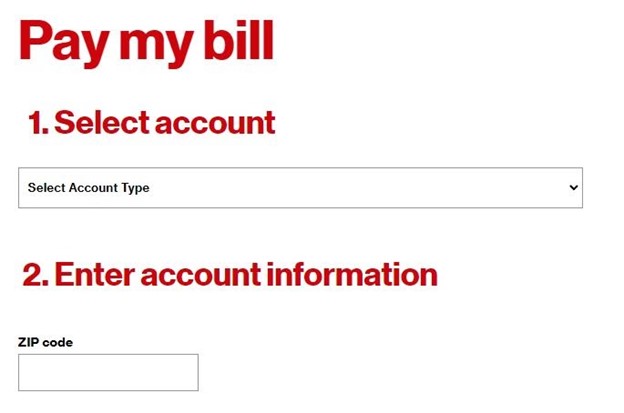

How do I Pay my Verizon Wireless bill?

Enter your mobile number or Verizon account number, as well as your billing ZIP code to continue. Have a 5G Home, LTE Home or connected device? Learn where to find your mobile number on your receipt or the device interface. Use this page for secure payment of your Verizon Wireless Bill.

How do I add a payment method to my Verizon account?

Choose Payment Settings on the left > Payment Settings > Add a new payment method. Click Online Banking. Select your bank from the list provided. Follow the prompts to sign in to your banking account using your bank account’s username and password. Note: Verizon can’t view your bank login information.