Managing finances and paying bills on time can be a real headache. Between due dates, late fees and keeping track of who you owe money to, it’s easy to feel overwhelmed. This is where Quicken Bill Pay 2018 comes in – it’s designed to make managing and paying your bills easy fast, and efficient.

As a longtime user of Quicken’s financial software, I was eager to try out their new Bill Pay platform when it launched in 2018. After testing it out for several months now, I’m happy to report that Quicken Bill Pay 2018 delivers on its promises and provides a smooth, stress-free bill payment experience. In this article, I’ll give an overview of how Quicken Bill Pay works, its key features, and my experience using this tool to manage bill payments.

How Does Quicken Bill Pay 2018 Work?

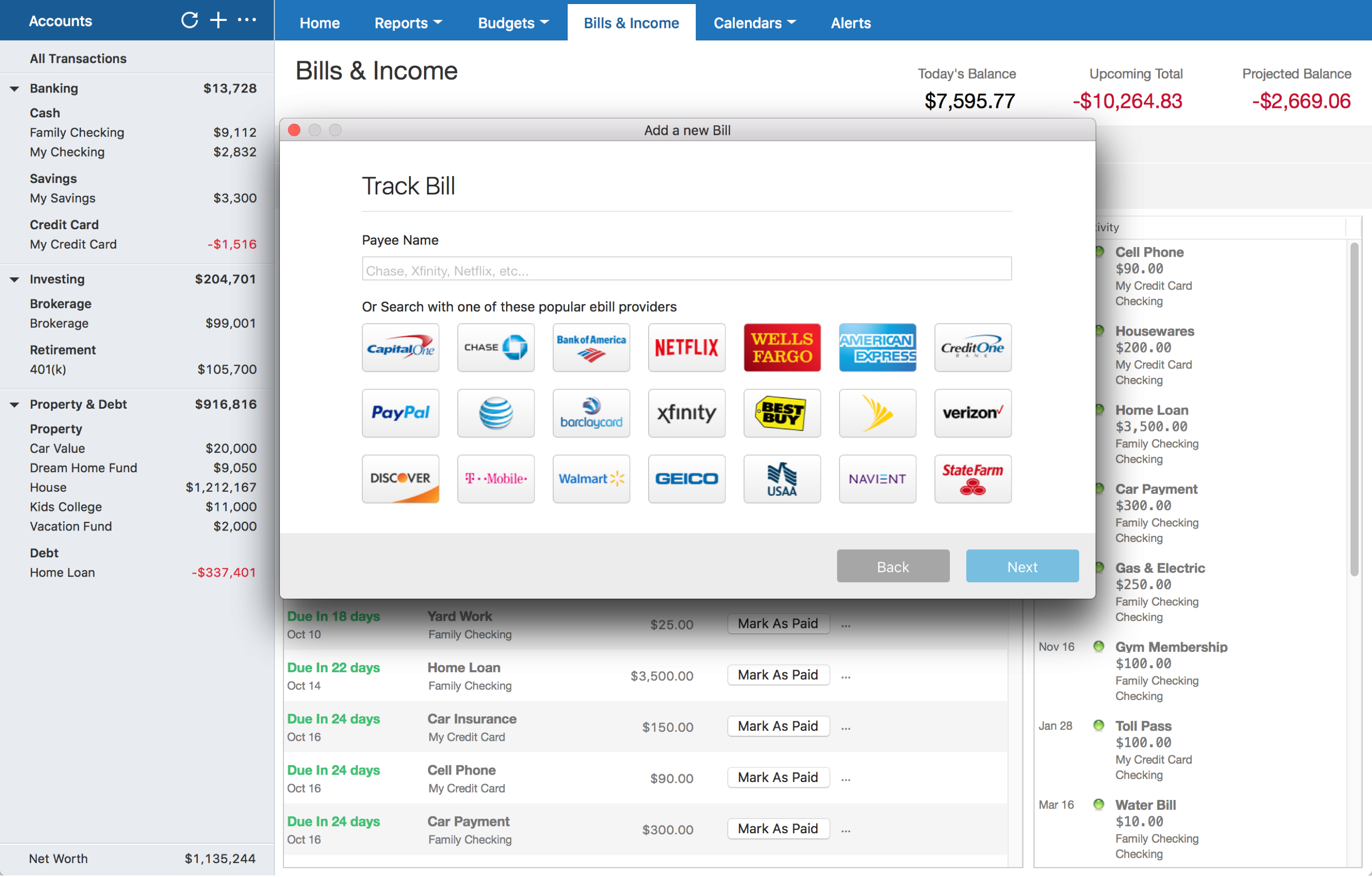

Quicken Bill Pay is directly integrated into your Quicken software. Once you link the accounts you use to pay bills, Quicken automatically retrieves your latest bills through its eBills feature. You can then view, manage, and pay these bills directly within Quicken.

Quicken Bill Pay offers two easy payment options

Quick Pay – Make online payments to thousands of participating billers. Works similarly to services like online banking bill pay.

Check Pay – Quicken prints and mails a paper check to any payee, even if they don’t accept electronic payments. No need to buy checks or stamps.

After entering or approving bill amounts, you simply schedule payments through whichever option works for that bill. Quicken Bill Pay handles the rest – either processing the payment digitally or printing/mailing a check. It’s all done directly through your Quicken account.

Key Features of Quicken Bill Pay 2018

Here are some of the standout features that make Quicken Bill Pay 2018 a great bill management tool:

-

Integration with Quicken software – view bills and make payments without leaving your financial management app.

-

Access bills in one place – Quicken automatically retrieves your latest bills through eBills.

-

Schedule future payments – schedule one-time or recurring payments well in advance. Avoid late fees.

-

Payment tracking – monitor pending and past payments from your Quicken register.

-

Quick Pay network – fast digital payments to thousands of billers.

-

Check Pay – physical check option for any payee without adding checks to Quicken.

-

On-time payment guarantee – up to $50 in late fee coverage if a payment is late.

-

Bank-level security – encrypted transactions and password protection.

Overall, the service provides multiple ways to pay bills conveniently while keeping everything organized in your Quicken app. The on-time guarantee also adds great peace of mind.

My Experience Using Quicken Bill Pay

As someone who has always preferred handling bills myself, I was skeptical when Quicken first introduced their own bill pay service. But I’m very glad I gave it a try – Quicken Bill Pay 2018 has made my monthly bill routine so much smoother.

Here are some of the biggest benefits I’ve experienced:

Single dashboard for all bills – I love having one place to view upcoming bills, due dates, and payment status. No more flipping through a stack of papers. The eBills feature pulls in the latest bills automatically so I don’t miss anything.

Easy scheduling – For bills with fluctuating amounts like utilities, I set up repeating payments through Quick Pay. Fixed mortgages and loans I schedule as individual future payments. The calendar makes visualizing due dates simple.

Quick Pay convenience – I’m pleasantly surprised by how many of my regular billers participate in Quick Pay’s digital payment network. super fast and easy.

No more buying checks – Check Pay is a game changer for payees who don’t take electronic payments. I save money on checks and stamps.

Reliability and security – Between Quicken’s reliability guarantees and bank-level security, I have total peace of mind that my payments will go through on time safely.

While it took a little time to set up initially, it was easy to connect my accounts and start scheduling payments through Quicken Bill Pay. Now that it’s running, it saves me time and hassle each month. I won’t go back to my old way of handling bills!

Is Quicken Bill Pay 2018 Right for You?

Quicken Bill Pay is a great option if you’re looking for an automated, streamlined way to manage bill payments through your Quicken or Qwinn Bank account. The major benefits include:

- Easy access to bills and payment options within Quicken

- Multiple payment methods including Quick Pay and Check Pay

- Ability to schedule one-time or recurring future payments

- Guaranteed on-time delivery of payments

- Bank-level security for transactions

However, there are a few things to keep in mind:

- There is a monthly fee of $9.95 (may be waived for certain account types)

- You need a compatible Quicken product like Quicken Deluxe or Premier

- If you prefer full control of printing checks, the Check Pay feature may take some adjustment

For me, the convenience and reliability outweigh the small monthly fee. But assess your specific needs – if you only have a few bills, Quicken Bill Pay may be more tool than you need. Overall though, it’s a fantastic service for managing bills and payments all in one place.

Get Started with Quicken Bill Pay 2018

Ready to simplify your bill payment routine? Signing up is easy and you can be up and running with Quicken Bill Pay 2018 in no time. Here are the quick steps to get started:

-

Make sure you have a compatible Quicken product like Deluxe or Premier. Quicken Bill Pay comes included or can be added on.

-

Enable Bill Pay in your Quicken settings. Link the bank accounts you use to pay bills.

-

In the Bills tab, add payees by connecting your first eBills accounts.

-

Select bills and schedule one-time or recurring payments through Quick Pay or Check Pay.

-

Manage and track your scheduled bill payments in the Quicken register.

Also, be sure to take advantage of Quicken Bill Pay 2018 resources:

-

Detailed setup guides – Quicken provides step-by-step instructions for getting started.

-

Phone support – Quick friendly experts can walk you through any issues.

-

Security – Your transactions and data are safe with Quicken encryption and security measures.

With Quicken Bill Pay 2018, you can streamline the way you manage and pay bills each month. Say goodbye to late fees, cluttered desks, and hassle. Instead, enjoy the convenience of an automated, secure bill payment solution that integrates seamlessly with your Quicken financial management. Give it a try today!

Second, enable a payment account for Quick Pay

- In the Bills & Income tab, click the gear icon in the upper right.

- Select Pay Bills with Bill Manager.

- Review the Terms of Use and click Agree if you want to proceed.

- Complete the verification process, then click Enable Accounts.

- In the Payment Accounts for Quicken Bill Manager screen, select the account (usually checking) that you want to use to pay bills with and select Enable.

- In the Enable Payment Account screen, fill out the necessary information.

- Check the box at the bottom of the screen.

- Click Enable Account.

Once you have entered your payment account information, you’ll see a verification screen letting you know that you can now use the account for Quick Pay payments.

If you wish to only use Quick Pay: Click Done, then click Done again in the Payment Accounts for Quicken Bill Manager screen to return to the Bills & Income tab and start paying bills with Quick Pay.

If you also want to use Check Pay: There is a verification process to enable a payment account for Check Pay. This process calls for the verifying of two micro-deposits (between $.01 and $.99) that will be made to your account. The payments may take up to three days to appear. Follow the steps below to complete the Check Pay verification.

First, you will need to add an online bill

Note: If you already have online bills set up, you can move on to Enable a payment account for Quick Pay.

- Go to the Bills & Income tab, then click Get Started.

If you do not see the Get Started button, click the + (plus sign) in the upper-right corner of the Bills & Income screen and select Online Bill.

- Search for the name of the biller you wish to add.

- Enter the login credentials you use for that billers website and click Continue. Quicken will then authenticate the account and search for your bills.

- After the biller is added, a confirmation screen will follow. You can link an existing Reminder or create a new Reminder. Please note that after a biller is added, it may take some time for a new bill amount and PDF to appear in Bill Manager.

- You can then choose to add another bill or click Done to finish. You can also select to enable a payment account. If you start this process here, you can skip to Step 3 in the next section.

How To Use Quicken Bill Pay Account Pay Online Or

FAQ

Does Quicken still have Bill Pay?

How much does Quicken Bill Pay cost?

Can you take payments through Quicken?

How do I make a Quicken bill payment?

When you’re ready to make a payment, just click the Quick Pay or Check Pay button. You can see the status of your payments in the Last Payment column. Quicken Bill Manager also offers two ways to pay your bills: Quick Pay and Check Pay! Quick Pay: Send electronic payments to billers (payees) who have online accounts accessible by Quicken.

How does Quicken Bill manager work?

Quicken has moved to a new Bill Pay platform to improve your experience. Quicken Bill Manager offers two ways to easily pay your bills with Quicken: Quick Pay: Send electronic payments to billers (payees) who have online accounts accessible by Quicken. This includes over 11,000 billers.

Can I use my bank’s bill pay in Quicken?

If you use your bank’s bill pay in Quicken, you can continue to use it the same way you do now. Bank Bill Pay will not change. If you’re ready to start using Quicken Bill Manager, click here for instructions.

What’s new in Quicken 2018?

They include improved online bill management, new investment features, and simpler upgrades with Quicken’s membership program, which provides automatic access to the latest versions. From staying on top of finances to managing investments, the 2018 releases of Quicken help customers manage their finances at every stage of life.