Customer service is essential for any company, but especially for those in the financial services industry. Customers need to feel confident that any issues or concerns will be promptly and satisfactorily addressed. TFS Bill Pay, a leader in payment solutions for Chapter 13 bankruptcy filers, recognizes the importance of customer service and makes it a top priority.

An Overview of TFS Bill Pay

TFS Bill Pay was founded in 2011 with the goal of helping individuals going through Chapter 13 bankruptcy to automate and simplify their required plan payments. Since its inception, TFS Bill Pay has grown considerably and now serves hundreds of thousands of customers across the United States.

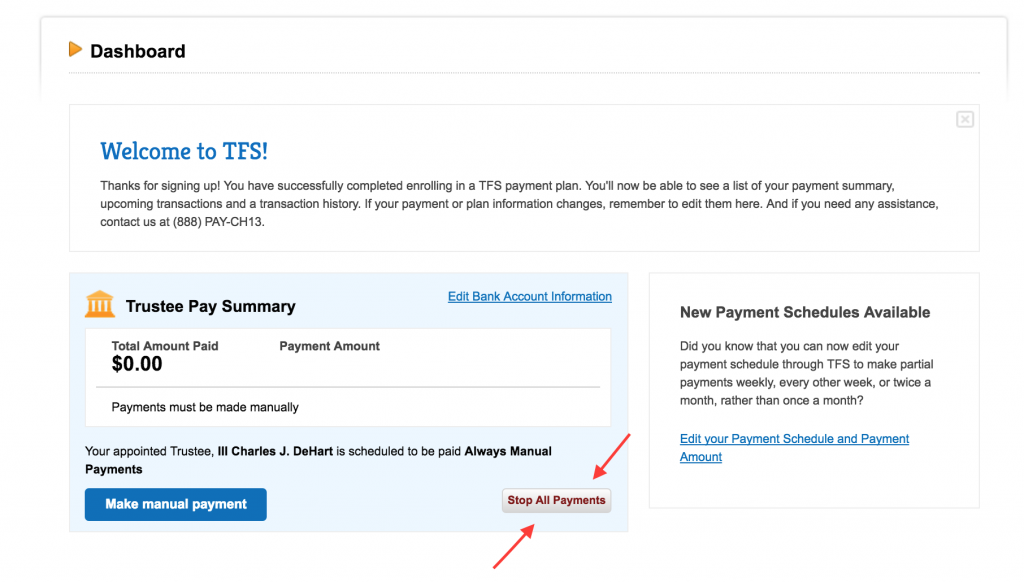

The company’s services allow Chapter 13 filers to easily set up and manage recurring payments to bankruptcy trustees This saves customers the hassle of having to manually send checks or money orders every month TFS Bill Pay also provides payment receipts and 24/7 account access through their online portal. They work with all kinds of payment methods, including debit cards, prepaid cards, and MoneyGram.

Essentially TFS Bill Pay strives to make the Chapter 13 payment process as smooth and stress-free as possible for its customers. Their commitment to customer service plays a big role in achieving this goal.

Emphasizing Customer Service

TFS Bill Pay recognizes that undergoing Chapter 13 bankruptcy is a challenging time for their customers, both financially and emotionally They want to alleviate some of that burden through top-notch customer service

Some of the ways TFS Bill Pay emphasizes customer service include:

-

24/7 Customer Support – Customers can call 888-729-2413 anytime to speak with a knowledgeable customer service representative. Wait times are minimal.

-

Detailed FAQs – The TFS Bill Pay website contains extensive frequently asked questions covering account setup, payments, account management, and more. Customers can easily search for answers.

-

Secure Contact Form – Customers can submit general inquiries, comments, and suggestions through a secure contact form on the TFS Bill Pay website.

-

Responsiveness – Email and phone inquiries are answered promptly, usually within 24 hours. Customers do not have to wait long for assistance.

-

Feedback Options – TFS Bill Pay provides multiple ways for customers to share feedback about their experiences. This allows them to continually improve.

-

Knowledgeable Support – Customer service reps receive ongoing training on Chapter 13 bankruptcy so they can understand customer needs and provide accurate information.

-

Issue Resolution – If a customer has an issue with a payment or their account, TFS Bill Pay works hard to quickly resolve it to the customer’s satisfaction.

-

Account Access – Through the TFS Bill Pay online portal, customers have 24/7 access to manage payments, view payment history, update account information, and more.

-

Payment Reminders – Customers receive reminders when payments are coming due or failed payments need to be addressed. This prevent accounts from becoming delinquent.

-

Customer Education – TFS Bill Pay provides a library of explanatory videos and articles so customers understand how their services work, their account options, and their role in the Chapter 13 process.

As you can see, TFS Bill Pay utilizes numerous strategies and channels to ensure customers are supported. Their customer service touches every area of operations.

Customer Service Features in Action

To understand how TFS Bill Pay’s customer service works in real-life situations, let’s look at a few examples:

Scenario 1: Samantha just had her Chapter 13 plan approved but she is confused about how to set up payments with TFS Bill Pay. She calls their 24/7 customer support line and speaks to a representative who walks her through the entire enrollment and verification process. The rep answers all of Samantha’s questions and helps her set up an automatic monthly payment using her debit card.

Scenario 2: Andrew has been using TFS Bill Pay for months but his trustee recently changed. He needs to update the payee information for his recurring payments. Andrew logs into his TFS Bill Pay account and clicks on “Manage Recurring Payments” but he is unsure exactly what to edit. He uses the live chat feature to connect with a customer service rep. The rep quickly looks up Andrew’s account, understands his situation, and provides step-by-step instructions for changing the payee details so Andrew’s payments will now go to the new trustee.

Scenario 3: Lisa just realized that her TFS Bill Pay account is past due because her last payment failed when her debit card expired. She is worried the trustee will take action against her. Lisa immediately calls TFS Bill Pay support and explains the issue. The customer service representative reassures Lisa that they will sort this out. They work with her to update her debit card details. The rep also explains that they will contact the trustee and make them aware the late payment was accidental. The rep confirms with Lisa that her account is now in good standing. Lisa feels relief knowing TFS Bill Pay had her back.

Why Customer Service Should Be a Priority

As these examples demonstrate, good customer service is hugely important for both the client experience and company reputation. When customers feel supported, they are more likely to stick with a service long-term and refer others.

For a company like TFS Bill Pay that works with clients undergoing financial hardship, customer service is particularly essential. Chapter 13 bankruptcy is highly stressful, and people need to know someone has their back. By providing caring, knowledgeable customer support, TFS Bill Pay eases people’s anxieties around the repayment process.

Additionally, many TFS Bill Pay customers are new to managing an online financial account. They often need more guidance to feel comfortable signing up for and using the services. Strong customer support provides that hand-holding and gives people confidence in the platform.

Making customers feel valued also stimulates engagement. When people know TFS Bill Pay is there for them, they are more likely to proactively reach out with questions or feedback to improve their experience. This enables TFS Bill Pay to continually refine their products and services.

Key Takeaways

- Excellent customer service needs to be a core priority for any company, but especially for those in financial services working with vulnerable clients.

- TFS Bill Pay recognizes the importance of customer support and has comprehensive systems in place, including 24/7 phone assistance, timely inquiry response, transparent feedback channels, and more.

- Strong customer service improves client experiences, company reputation, customer retention, referrals, and engagement.

- By providing knowledgeable, compassionate assistance to Chapter 13 filers, TFS Bill Pay eases payment anxieties and establishes trust in their platform.

In today’s highly competitive, online-driven world, customer service can directly impact a company’s bottom line and future success. Businesses like TFS Bill Pay that make support a central focus will be well-positioned for growth and longevity. Prioritizing the customer just makes sense.

How to Sign Up With TFS

FAQ

What is the phone number for TFS pay 888 729 2413?

What is the phone number for TFS support?

What is a TFS bill pay?

How to make one time payment with TFS bill pay?

What is TFS bill pay?

TFS Bill Pay is the online & automated payment solution for Chapter 13 bankruptcy payments. The TFS system allows individuals to pay their monthly bankruptcy payments easily and securely from the comfort of their own home. You can learn more about all the features of TFS here. How does TFS work?

What is TFS & how does it work?

TFS is the Online and Automated Solution for Chapter 13 Bankruptcy Payments. The challenge to surviving your bankruptcy is making payments on time and keeping accurate records. TFS provides an easy-to-use online payment option for monthly bankruptcy payments including an option to use a Debit Mastercard.

How do I contact TFS If I don’t see a ‘contact us’ button?

If you don’t see a “Contact Us” button, you can email us here. You can call us at 888-729-2413. Effective March 1, 2024 Torri P. Martin been appointed to serve as the new Chapter 13 Trustee in this district. For TFS users in this District, there is nothing for you to do regarding your TFS account for this change.

What should I do if I Change my TFS account?

For TFS users in this District, there is nothing for you to do regarding your TFS account for this change. All necessary updates to TFS accounts will be made automatically and all payments will be processed as scheduled. For any questions about this change, contact TFS by email at [email protected] and we’ll be happy to assist.