Paying bills can be a tedious task. Writing checks buying stamps mailing envelopes – it takes time and effort every month. That’s why online bill pay services like Wells Fargo’s are so appealing. With just a few clicks, your bills are paid automatically. It seems too good to be true!

There may be a catch, though. Are there any hidden fees that people should be aware of that come with Wells Fargo Bill Pay? I did some research on Wells Fargo Bill Pay fees so you don’t have to. Keep reading to learn what I uncovered.

How Bill Pay Services Work

Bill pay services allow you to pay bills online through your bank’s website or mobile app. Here’s a quick rundown of how they work:

-

Connect your bank account to the bill pay service. This is typically a checking account.

-

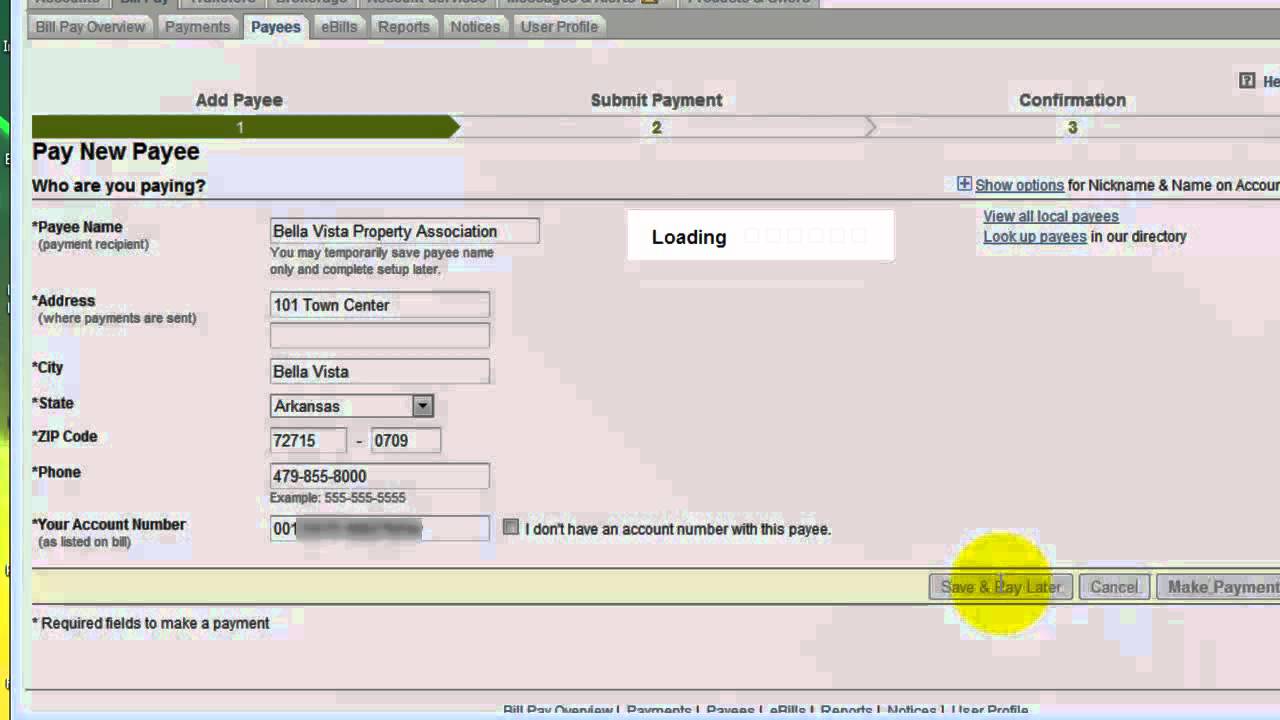

Add billers you want to pay, like utilities, credit cards, etc. Provide details like account numbers.

-

Schedule one-time or recurring payments to those billers.

-

The service that pays your bills will either send an electronic payment or a paper check on your behalf.

-

You get notifications when payments are sent and can track payment history.

It’s super convenient since it automates the bill paying process. The service does all the work of mailing checks and you avoid late fees.

Wells Fargo Bill Pay Overview

Wells Fargo’s bill pay platform allows you to pay bills from your Wells Fargo checking account It’s called Wells Fargo Online Bill Pay

With it, you can

-

Pay bills electronically or by mailed check

-

Set up one-time or recurring payments

-

Receive and view eBills

-

Access it via desktop or mobile app

-

Pay Wells Fargo credit cards and loans too

It’s free for Wells Fargo checking account holders. Now let’s look at whether there are any hidden fees.

Wells Fargo Bill Pay Fees

The good news is…drumroll please…Wells Fargo Bill Pay itself is completely free! There are no monthly service fees or per transaction fees. You can send as many payments as you want without additional cost.

But there are a couple scenarios where fees could come into play:

Overdraft Fees

If a scheduled Bill Pay payment overdraws your account, Wells Fargo’s standard overdraft fees would apply. For example:

- You schedule a $500 Bill Pay check on the 1st

- Other transactions occur, reducing your balance to $300 on the 2nd

- The $500 check is processed on the 3rd, overdrawing the account

- Wells Fargo’s overdraft fee would be charged (typically $35)

So you do need to be cautious about timing of payments and account balances to avoid overdrafts.

Check Processing Fees

For payees that can’t accept electronic payments, Wells Fargo sends physical checks. If the recipient elects to process that check electronically, Wells Fargo charges a fee, typically around $5.

This isn’t common but it can happen. The recipient is opting to process the check in a way that costs Wells Fargo more money behind the scenes.

Account Maintenance Fees

If your checking account itself has a monthly maintenance fee, that would still apply when using Bill Pay. Bill Pay doesn’t waive or alter the terms of your checking account.

For example, Wells Fargo’s Everyday Checking account has a $10 monthly fee unless certain balance or deposit requirements are met.

Tips to Avoid Wells Fargo Bill Pay Fees

While Wells Fargo Bill Pay is free, here are some tips to avoid the fees that could stem from using it:

-

Carefully monitor your checking account balance as scheduled payments approach to avoid overdrafts.

-

Build a buffer into your balance in case payments process sooner than expected.

-

If concerned about overdrafts, you can set up Overdraft Protection by linking to savings or credit. This prevents fees by automatically transferring funds if needed.

-

When possible, encourage payees to accept electronic payments instead of physical checks.

-

If you receive a Bill Pay check, opt to deposit it instead of processing it electronically. This avoids the check processing fees.

-

Understand the monthly fee structure of your checking account and ensure requirements are met each month.

The Bottom Line

The bottom line is Wells Fargo Bill Pay itself is free. There are no hidden service fees or gotchas. But you do need to be thoughtful about account balances and overdrafts to prevent fees. As long as you monitor your checking account activity and avoid overdrawing it, you can use Wells Fargo Bill Pay fee-free!

It takes the hassle out of paying bills each month. And compared to buying stamps and paper checks, it can actually save you money in the long run. As with anything, being an informed user is key. Now that you know what to watch out for, you can confidently use Wells Fargo Bill Pay to make bill paying a breeze.

QuickBooks® Online Banking (Business)

Access your online banking balances and transactions directly through your QuickBooks software. You can also use the software to pay bills and make transfers.

QuickBooks is offered by Intuit Inc. Wells Fargo doesnt own or operate QuickBooks. Intuit is solely responsible for its content, product offerings, privacy, and security. Please refer to Intuits terms of use and privacy policy, which are located on Intuits website and are administered by Intuit.

To use this service, you must have an eligible Wells Fargo checking account and a username and password to access Wells Fargo Online.

Note: Cancelling the Wells Fargo Direct Connect service does not remove your data from your computer. Your Wells Fargo Direct Connect data that has been previously connected to Quicken or QuickBooks must be separately removed or deleted, which is your responsibility.

Quicken® Online Banking (Business)

Access your online banking balances and transactions directly through your Quicken software. You can also use the software to pay bills and make transfers.

Quicken is offered by Quicken, Inc. Wells Fargo doesnt own or operate Quicken. Quicken is solely responsible for its content, product offerings, privacy, and security. Please refer to Quickens terms of use and privacy policy, which are located on Quickens website and are administered by Quicken.

To use this service, you must have an eligible Wells Fargo checking account and a username and password to access Wells Fargo Online.

Note: Cancelling the Wells Fargo Direct Connect service does not remove your data from your computer. Your Wells Fargo Direct Connect data that has been previously connected to Quicken or QuickBooks must be separately removed or deleted, which is your responsibility.

How to Pay Bills Using Wells Fargo | 2023

FAQ

Does Wells Fargo charge for Bill Pay?

Does Bill Pay charge fees?

Does Wells Fargo charge for business Bill Pay?

Does Wells Fargo charge a fee?

How do I pay my Wells Fargo bills online?

Remember, you can access Bill Pay if you have a Wells Fargo checking account and are enrolled in Wells Fargo Online.If you haven’t already, enroll now to get started.Then sign on to Wells Fargo Online

Does Wells Fargo offer a bill pay payment guarantee?

Our Bill Pay Payment Guarantee also does not cover indirect, special, or consequential damages arising out of the use of the Bill Pay service. Wells Fargo does not recognize “Grace Periods,” “Late After,” “Postmarked By” dates, or other similar designations when considering the reimbursement of late fees or finance charges.

Is there a monthly service fee to use bill pay?

1. There’s no monthly service fee to use Bill Pay. Account fees (e.g., monthly service) may apply to your account (s) that you make Bill Pay payments from. We don’t charge overdraft fees on Bill Pay transactions, but Bill Pay transactions can contribute to overdrafts.