You already have a lot to do as a business owner without having to worry about paying bills. It takes time away from running your business to print and mail checks, keep track of due dates, and chase down late notices. That’s why Wells Fargo makes it easy for you to pay your bills by letting you do it online.

In this comprehensive guide, we’ll explain the key benefits of using Wells Fargo Business Bill Pay and walk through how to easily enroll and start saving time today

Benefits of Wells Fargo Business Bill Pay

Switching to online bill payment through Wells Fargo Business Bill Pay provides a range of helpful advantages

Convenience

-

You can pay all of your bills safely online in one place, without having to deal with paper checks.

-

Schedule one-time or recurring payments to be sent automatically on your chosen date.

-

Receive email confirmations and reminders for added peace of mind.

Control

-

View payment history and track bill expenses in one place.

-

Customize rules for each payee like payment date and amount.

-

Change or cancel payments up to the send date.

Cost Savings

-

No monthly fee to use Business Bill Pay.

-

Avoid late fees by scheduling bills to be paid on time automatically.

-

Reduce paper checks, envelopes, and postage costs.

Mobility

-

Access Business Bill Pay via Wells Fargo mobile app to pay bills on the go.

-

Get text or email alerts when payments are processed.

-

Receive notifications if account balances are low.

Reliability

-

Wells Fargo guarantees scheduled bill payments will be sent on time and debited from your account when due (exclusions apply).

-

Secure payments with bank-level encryption and security measures.

-

Wells Fargo covers any late fees if payments are delayed past the scheduled send date.

Getting Started with Business Bill Pay

Ready to start enjoying the conveniences of Business Bill Pay? Here’s how quick and easy it is to get set up:

Step 1: Open a Wells Fargo business checking account

-

Business Bill Pay requires a Wells Fargo business checking account.

-

Apply online or visit a branch to open an account.

Step 2: Enroll in Wells Fargo Business Online

-

Business Bill Pay is accessed through Wells Fargo Business Online banking.

-

If you don’t have it, enroll online or with a banker.

-

Business Online allows you to view balances, transfer funds, deposit checks, and more.

Step 3: Sign up for Business Bill Pay

-

Once you have Business Online access, enroll in Business Bill Pay.

-

You can sign up online after logging into your account.

-

There’s no monthly fee and enrollment only takes a few minutes.

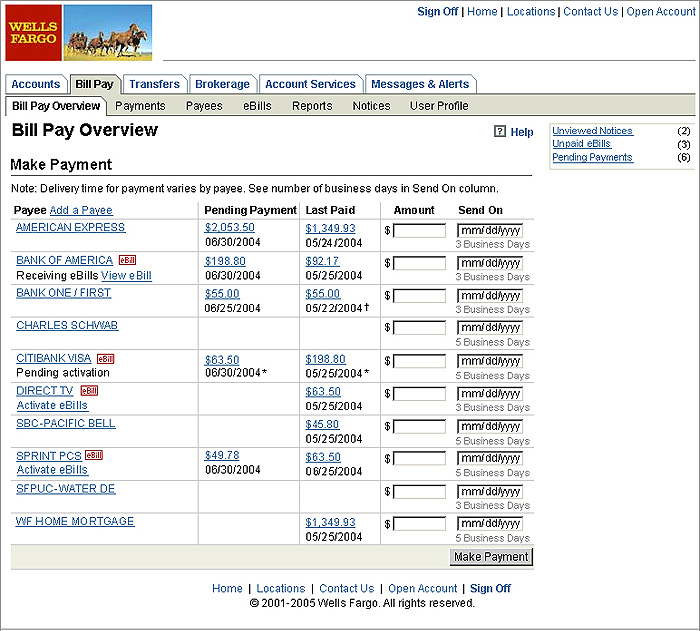

Step 4: Add Payees

-

Search for payees you want to pay like utility companies.

-

Your Wells Fargo accounts and loans will already appear as payees.

-

Enter details like account numbers, addresses, and nicknames for each payee.

Step 5: Schedule Payments

-

Choose one-time or recurring payments for each payee.

-

Pick the send date and payment amount.

-

Set up text or email reminders and confirmations.

-

Establish autopay rules to pay varying bill amounts automatically.

And that’s it! Once your payees and payments are scheduled, Wells Fargo handles the rest. Just log in anytime to view your payment activity or make changes as needed.

Key Features of Business Bill Pay

Now let’s explore some of the top features and capabilities available with Wells Fargo’s Business Bill Pay solution:

-

Mobile Access – Pay bills and manage payments on the go via the Wells Fargo mobile app for your iPhone, iPad, or Android device.

-

eBills – Receive electronic bills from participating payees directly within Business Bill Pay. View, download, or print anytime.

-

Payment Calendar – See all your scheduled one-time and recurring payments in one place on an easy payment calendar.

-

Spending Report – Download detailed reports showing all your payment activity and spending by payee.

-

Text/Email Alerts – Optional alerts keep you informed on payment status, approaching due dates, and low account balances.

-

Expedited Payments – For an additional fee, rush same day or overnight check payments for urgently due bills.

-

Auto Pay – Set bills to pay automatically each month or on a schedule, even if the amount changes.

-

ELINKS – Pay federal or state taxes electronically through EFTPS or state ELINKS programs.

Why Choose Wells Fargo Business Bill Pay?

Wells Fargo has helped businesses like yours make payments easily and securely for over 20 years. Here’s why you can trust Wells Fargo Business Bill Pay:

-

Serving over 1.5 million business customers with Business Online and Bill Pay solutions.

-

Winner of 11 Best in Class awards for treasury management capabilities from Greenwich Associates.

-

All payments guaranteed with the reliability and integrity backed by Wells Fargo.

-

Bank-level security and encryption protects your account information.

-

U.S.-based customer service with extended hours provides helpful support.

-

Established history with over 170 years of serving businesses across the nation.

Ready to Streamline Bill Pay?

Managing company finances is hard enough without inefficient, outdated payment processes. Save yourself time and headaches by adopting the convenient online Business Bill Pay solution from Wells Fargo.

Centralize your payments, automate recurring bills, and track spending easily in one place. And do it all securely on your computer or mobile device with Wells Fargo Business Online and Bill Pay. Sign up today and make bill paying a breeze!

Esta página solo está disponible en inglés

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

To enroll in Business Bill Pay, you need a Wells Fargo business checking account and must enroll for access to Wells Fargo Business Online®.