As a business owner or freelancer, getting paid on time is crucial for maintaining positive cash flow. However, late and delayed payments are a common struggle. Using “bill pay upon receipt” payment terms on your invoices can help ensure timely payment.

But what exactly does bill pay upon receipt mean? Essentially, it means that your client must pay their invoice immediately when they receive it This article will break down everything you need to know about bill pay upon receipt invoicing.

What Is Bill Pay Upon Receipt?

Bill pay upon receipt, also known as due upon receipt, is an invoicing payment term that requires the client to pay the total amount owed as soon as they receive the bill or invoice

This differs from more common payment terms like net 30 or net 60 which allow the client 30 or 60 days respectively to make the payment. With bill pay upon receipt terms, you expect payment by the next business day at the latest.

Some key things to know:

- It means payment is due immediately or by the next business day

- The client must pay the total invoice amount right away

- You expect fast payment compared to net 30, etc.

- It’s a way to get paid ASAP for goods/services

Essentially, bill pay upon receipt invoices are a way to clearly communicate to clients that you expect quick payment after sending the bill. It aims to prevent late payments and improve cash flow.

When Is Bill Pay Upon Receipt Used?

Bill pay upon receipt payment terms are best suited for certain scenarios:

- One-time clients or projects

- New client relationships

- Clients with poor payment history

- Large invoices or projects

- Businesses with limited cash flow

It likely won’t be suitable as a default for all client invoices. But it helps with new clients when you want to make sure they know you expect to be paid quickly before you take on more work. It reduces the risk of delayed payments.

You may also use bill pay upon receipt terms with an existing client if they have been frequently late paying invoices. It can help prevent poor payment habits from continuing.

The Pros of Bill Pay Upon Receipt Terms

There are some notable upsides to requiring bill pay upon receipt:

-

Faster payments – You receive owed money more quickly, improving cash flow.

-

Prevents late payments – The terms make clear you expect fast payment, avoiding delays.

-

Easier to track – With quick turnover, there’s less risk of forgetting unpaid invoices.

-

Better for project budgeting – Faster payments allow better planning for project costs.

-

Saves time – You avoid spending excessive effort chasing down late payments.

-

Encourages good habits – May motivate clients to pay bills faster going forward.

For businesses tight on cash flow, bill pay upon receipt terms can provide needed clarity and reliability around when you’ll get paid. It may be worth trying with new client relationships or clients with a history of paying slowly.

The Cons of Bill Pay Upon Receipt Terms

However, there are also some downsides to consider:

-

Inconvenient for clients – Some clients can’t pay immediately and find it difficult.

-

Discourages recurring work – Client may avoid you in the future due to rigid terms.

-

Harms client relationships – Can come across as demanding or distrusting of clients.

-

Not suitable for all invoices – More flexibility needed on some projects.

-

Reduces likelihood of early payment discounts – Client has no incentive to pay before receipt.

-

May increase disputes – Overly rigid terms could lead to payment conflicts.

The intent is not necessarily to make bill pay upon receipt your default for all clients. Doing so may strain your business relationships and cost you repeat work. Use judgment to decide when it makes sense to require immediate payment.

How To Word Bill Pay Upon Receipt Terms on an Invoice

If you do choose to use bill pay upon receipt terms, wording the invoice properly is key. Some tips:

-

Thank the client for their business to start positively.

-

Clearly state that payment is expected immediately on receipt. For example, “Payment is due within 24 hours of invoice receipt”.

-

Spell out payment instructions – how to submit payment, acceptable methods, etc.

-

If available, include late fees that may be imposed if payment is delayed.

-

Use a polite but firm tone. Avoid sounding demanding or confrontational.

Adjust the wording as needed based on your specific business and relationship with each client. The key is ensuring the terms are clear and expectations around immediate payment are well-communicated. Sending invoices electronically also speeds up receipt versus mailed invoices.

Alternatives to Bill Pay Upon Receipt Terms

While bill pay upon receipt improves cash flow, it is sometimes too rigid. Here are common alternatives:

Net 7 or Net 14 Terms

The client has 7 or 14 days respectively to pay the invoice amount. This still encourages reasonably fast payment.

Net 30 Terms

One of the most common – the client has 30 days from the invoice date to pay. Offers more flexibility while preventing extremely late payments.

Invoice Due End of Month

Rather than a set number of days, the invoice must be paid by the last day of the current month.

Offer Early Payment Discounts

Such as 2% off if paid within 5 days. Incentivizes fast payment without rigid due upon receipt terms.

Consider your business needs and client relationships as you decide between different payment term options on invoices. Bill pay upon receipt has clear benefits in some cases, but also downsides to weigh.

How to Get Paid Faster as a Small Business

Beyond bill pay upon receipt terms, some other tips for getting paid faster:

-

Automate invoicing – Online invoicing software speeds up creation and delivery of invoices.

-

Offer online payment options – Gets you paid faster versus checks that must clear the bank.

-

Build rapport with clients – Strong relationships lead to good payment habits.

-

Stick to contracts – Outline terms like payments clearly in initial contracts.

-

Charge late fees – Enforcing fees improves incentive to pay on time.

-

Stop work after non-payment – Don’t continue projects if invoices go unpaid.

The above best practices, along with strategic use of bill pay upon receipt terms, can significantly improve small business cash flow.

FAQs About Bill Pay Upon Receipt

What if a client can’t pay immediately upon receipt?

Some flexibility may be required. Discuss reasons for difficulty paying with the client and agree on a short timeline acceptable to both parties. But the expectation should still be for very fast payment.

Can I require electronic payment for bill pay upon receipt terms?

Yes, specifying e-payment methods like bank transfer or online portal payment helps facilitate faster payment. But you cannot mandate only credit card payment, for example, if the client wishes to pay another way.

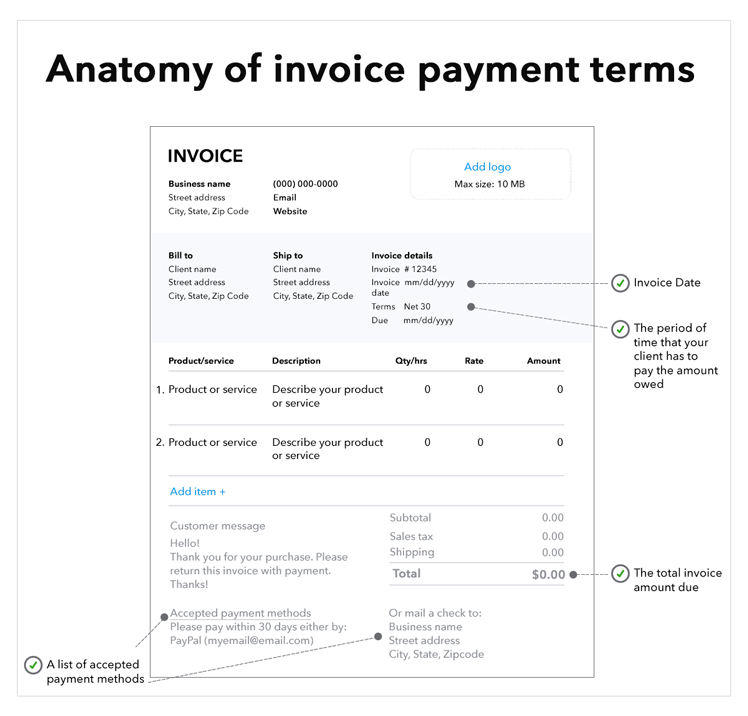

Where do I indicate the bill pay upon receipt terms on the invoice?

The terms should be clearly stated along with the payment due date and amount owed on the invoice. Many invoicing programs have dedicated fields for documenting payment terms.

What if I accidentally didn’t include bill pay upon receipt terms on the first invoice?

You can include adjusted terms requiring immediate payment on the next/follow-up invoice. But notify the client first that going forward you require payment upon receipt.

What should I do if a client keeps paying invoices late despite bill pay upon receipt terms?

First clarify the terms directly with the client. If late payments continue, consider halting additional work, adding late fees, involving a collections agency, or legal options as a last resort.

Wrap Up

Bill pay upon receipt or due upon receipt payment terms on invoices can significantly improve cash flow for small businesses and freelancers. By requiring clients to pay immediately, you reduce the cash lag time between submitting invoices and getting paid.

However, consider both the pros and cons before making bill pay upon receipt your standard for all invoices. Use caution building initial relationships and maintain a professional tone when enforcing your terms. Combined with other best practices, bill pay upon receipt is one strategy to get paid faster and maintain positive cash flow.

Pros of due upon receipt invoicing

There are several advantages to using the due upon receipt payment term on your invoices, including:

- Quicker payment turnaround. If you have limited financial resources available, which is common for freelancers and small businesses alike, quick payments are of the utmost importance. This is especially true if you need that capital to reinvest and start on your next project.

- More reliable cash flow. Many businesses struggle with cash flow, which can have a major impact on overall financial health. By relying on timely payments, you can avoid common financial pitfalls and plan ahead.

- Less time wasted chasing down outstanding invoices. You already have enough things to worry about when trying to make your business a success. Repeatedly following up on invoices shouldn’t be one of them.

- Reduced risk of forgetting about outstanding invoices. With all the responsibilities on your plate, it can be easy to lose track of unpaid invoices.

Due upon receipt invoicing can help make running your business a smoother process. However, it might not be as advantageous for your clients.

How to word a request for immediate payment

To maintain great relationships with clients, make sure to word your request for immediate payment appropriately. Use polite but direct language that clearly stipulates payment due date and payment instructions.

Use the following tenets to guide you as you write a request for immediate payment:

- Show gratitude for their patronage: “Thank you for your purchase of [X].”

- Explain your payment expectations: “Payment must be completed within one business day of receiving invoice.”

- Provide clear payment instructions: “Complete payment by using our online payment portal.”

Remember: An invoice requiring immediate payment should not come as a surprise. Clients should understand that payment is due upon receipt when your contract is completed.