Seeing mysterious terms like “self-pay” on your medical bills can be confusing. You likely have questions about what self-pay means, why it’s applied to your bill, and most importantly, what your responsibilities are for paying these charges.

In this article, we’ll explain what self-pay means on medical bills, when it typically occurs, how self-pay discounts can help reduce costs, and tips for managing self-pay medical expenses. Arm yourself with knowledge so you can handle any self-pay medical bills with clarity and confidence.

What Does Self-Pay Mean on Medical Bills?

Patients who self-pay their medical bills must pay them out of their own pocket. This usually occurs in two main scenarios:

-

If a patient is uninsured, they are considered self-pay and must cover the entire bill themselves.

-

If a patient has insurance but the plan doesn’t cover certain services, the patient is responsible for the non-covered charges.

Self-pay also applies if patients have met their annual deductible limit but have other outstanding costs like co-pays or co-insurance.

The bottom line is that any medical expenses not paid by an insurer fall into the self-pay category and are owed by the patient.

Common Reasons Self-Pay Occurs

There are a few key reasons why self-pay commonly shows up on medical bills

-

Patient is uninsured

-

Service is not covered by insurance (e.g. elective procedures)

-

Patient has a high deductible plan but hasn’t met deductible

-

Patient obligation like co-pay or co-insurance applies

-

Patient received care out of network

-

Claims processing error or denial occurs

Understanding what triggers self-pay charges can help you identify mistakes or appeal insurance decisions if needed.

Self-Pay Discounts Can Reduce Costs

The good news is many providers offer self-pay discounts to help make medical expenses more affordable for uninsured patients. Discounts typically range from 25-50% off hospital charges when self-pay applies.

Always ask if any self-pay discounts are available when you are uninsured or have uncovered services. Hospitals often automatically apply self-pay discounts, but it varies by provider.

In addition, some facilities offer quick-pay discounts if you pay your bill quickly after services. Taking advantage of potential discounts provides significant savings on self-pay medical bills.

Tips for Managing Self-Pay Health Expenses

If you are hit with a large self-pay medical bill, here are some tips to make costs more manageable:

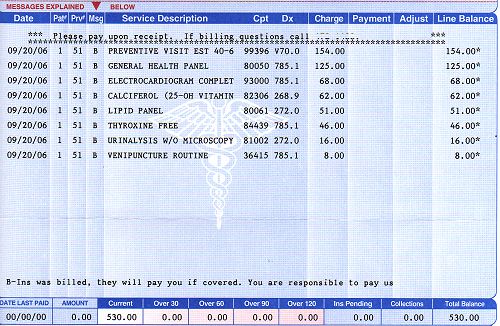

- Ask for an itemized bill and review for errors

- Negotiate for discounts and payment plans

- Check if financial assistance is available

- Use tax savings accounts to cover costs

- Setup interest-free credit card promotions

- Consider medical tourism for major procedures

With proactive planning and negotiating, you can reduce and effectively budget for self-pay medical expenses.

Common Self-Pay Billing Questions

You likely still have some questions about handling self-pay bills. Here are answers to some frequently asked questions:

What if I can’t afford to pay my self-pay bill?

- Many providers offer financial assistance programs and payment plans for those with financial hardships. Ask to apply for their financial assistance program.

Why am I suddenly getting self-pay bills when I have insurance?

- This usually occurs if you received out-of-network care or services that are not covered by your plan. Always check if providers are in-network beforehand.

What if I already paid my deductible this year?

- If you already satisfied your deductible but are still getting self-pay bills, there may be an insurance processing error. Contact your insurer to investigate.

Can I negotiate down my self-pay charges?

- Yes, you can negotiate by requesting discounts, payment plans, or applying for financial assistance. Be polite but persistent.

With the right questions and advocacy, you can address any problematic self-pay bills that come your way.

Take Control of Your Medical Costs

Receiving a medical bill with confusing self-pay charges can be upsetting and frustrating. But now that you understand common reasons self-pay occurs, how to maximize discounts, and get answers to FAQs, you can take control.

Being proactive will help you reduce the costs you are responsible for and develop a manageable payment plan if needed. Don’t let medical bills filled with self-pay charges overwhelm you. Arm yourself with knowledge so you can handle them strategically and minimize expenses.

Put it in writing

The first step in collecting what your self-pay patients owe you is to have a formal, written payment policy. The purpose is to ensure that everyone understands its ultimately the responsibility of the patient (or guardian or caregiver for dependent people) to pay for your services.

In addition to this point, any formal payment policy should contain these elements:

- Patients not enrolled in health plans are responsible for the entire amount of their bills.

- Patients in health plans are responsible for any amounts the plans dont pay, up to the entire amount.

- Payment is due the day you provide the service unless other arrangements are made in advance, put in writing and signed by you and the patient.

- Payment must be made in a form specified as acceptable to the practice. The policy should state whether you accept payment by credit cards, debit cards and checks. If you do accept credit or debit cards, list the ones you accept, and make it clear that you accept only these. If you accept checks, specify what identification you require.

Payment problems usually arise because patients dont understand whats expected of them. When a new patient makes an appointment, your staff should outline your payment policy, including the rate for an initial visit. You might want to mail, fax or E-mail your written payment policy to the patient before the visit.

Its also important to spread the word in the office. Post copies of your policy. Put copies for patients at the reception desk. At a new patients first visit, have a staff member explain your practices ground rules, including your payment policy. When you are sure the patient understands and agrees, have him or her sign the policy.

Getting uninsured patients to pay

If uninsured patients cant pay your fee in full, your staff should ask them to sign promissory notes before you deliver services. Establish a plan with regular payments; set both due dates and the amount due. Ensure that the patient understands the schedule, agrees to it up front, expects to be able to make the payments and signs the promissory note.

The patient should be asked to make a down payment before you start an involved or expensive treatment protocol. If the patient is seeking nonurgent treatment, delaying it gives the patient a chance to assemble a substantial down payment. Remind patients that the larger the down payment, the smaller the installments will be.

To spur uninsured patients to make their payments, send routine payment reminders. If a patient fails to make a scheduled payment, your staff should call and try to find out why — in a cordial way. Dont chastise or threaten debtors; just seek information. If the patient is unavailable, reluctant to talk or unwilling to make a payment, your staff should send a letter. If the patient has unexpected financial troubles, such as a change in employment or marital status, you may need to work out a new payment schedule.