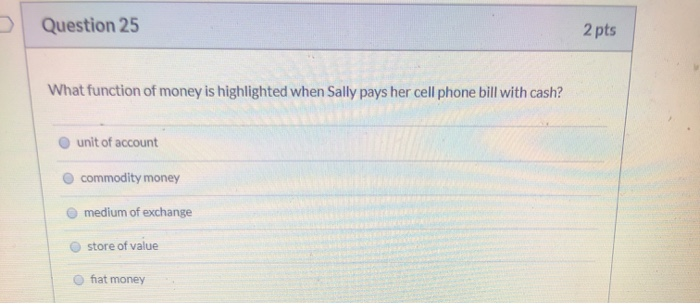

When you pull out your wallet, grab some cash, and hand over bills and coins to pay your cell phone bill, you’re using money for one of its key functions – as a medium of exchange. The ability to use money to purchase goods and services is an essential quality that makes money so valuable in the economy Let’s explore this function of money and why it comes into play when using cash to pay expenses like your cell phone bill

What is the Medium of Exchange Function of Money?

Money serves three main functions:

- Store of value – It holds purchasing power over time

- Unit of account – It provides a common way to price goods/services

- Medium of exchange – It can be used to intermediary purchase items

As a medium of exchange, money acts as an intermediary instrument that buyers can use to obtain desired products or services from sellers. Money facilitates transactions as the universal payment method accepted by both parties.

Goods and services no longer have to be directly exchanged through bartering Money allows indirect exchange through a mutually agreed upon currency

How Paying in Cash Reflects the Medium of Exchange Function

When you pay your cell phone bill with cash, money acts as a go-between for the transaction. Instead of having to trade a good or service directly with your cell provider, cash is a standard form of payment that both you and the seller can agree on.

Exchanging paper cash currency represents an indirect transaction where money is used as the intermediary payment method. The cash allows you to obtain the service (cell phone coverage) even though no goods/services are directly traded between the buyer and seller.

Efficiency of Using Money Over Direct Bartering

Imagine if you had to pay your cell phone bill by directly trading some sort of good or service every month to the provider. That would be extremely inefficient compared to using money as a medium of exchange.

Some key benefits of using money versus direct bartering include:

-

Money is accepted by everyone, but the person who is trading a good might not want it.

-

Money makes it easy to compare the values of different things, but bartering makes it hard to do so.

-

Money is a divisible, portable, and durable exchange medium; goods to barter may not have those qualities.

So paying cash for expenses like your cell phone bill offers much more efficiency compared to directly exchanging goods or services.

How Currency Evolved to Serve This Function of Money

In the early stages of civilization, direct bartering of goods and services was the only way to transact without money as a medium. But currency eventually developed to make exchanging much easier by serving as an intermediary instrument accepted by all parties.

Key stages in the evolution of physical currency include:

-

Commodity money – Items with intrinsic value like gold coins were used.

-

Paper money – Paper currency and bills backed by precious metals emerged.

-

Fiat money – Currency declared as legal tender by the government but with no intrinsic or extrinsic value.

Now we have universally recognized and standardized paper bills and metal coins that serve as money used as a medium of exchange in the economy.

Usage of Digital Money vs. Cash as Exchange Mediums

While paper cash historically served as the primary medium of exchange, digital payments and money transfers have grown in usage today. Payment methods like:

- Credit/debit cards

- Online transfers

- Mobile payments

- Cryptocurrency

…allow electronic exchange of money without requiring the payer and payee to be physically present with paper bills. So paying your cell phone bill online reflects the medium of exchange function in digital form rather than physical currency.

Yet cash still remains an accepted medium of exchange for many transaction types, even with the rise of digital payments. The medium of exchange function can be fulfilled whether exchanging physical or digital currency.

When Bartering May Make More Sense Than Cash Transactions

While using money is much more efficient as an exchange medium, direct bartering does have some advantages in certain situations. For example:

-

If parties don’t have access to usable currency

-

If parties want to avoid transaction fees/taxes on exchange

-

If parties have goods/skills that directly meet the other’s needs

-

If parties want a creative or more social exchange

So in some cases, the medium of exchange function of money could be set aside in favor of bartering between willing participants with complementary wants.

Shared Understanding of Money’s Role Facilitates Transactions

When you hand over cash to pay your cell phone bill, you can safely assume the seller accepts and values that currency. This shared understanding of using money as an intermediary medium of exchange is what greases the wheels of the economy.

Both buyers and sellers recognize money’s function in facilitating efficient transactions. This acceptance enables you to pay bills with universal cash instead of having to barter directly.

So next time you pull out your wallet to pay in cash, remember you’re utilizing an essential function of money that makes commerce far more practical than in the days of pure bartering!

Want better grades, but can’t afford to pay for Numerade?

Enter your parent or guardian’s email address:

Already have an account? Log in

Video Answers to Similar Questions Best Matched Videos Solved By Our Expert Educators

How to Save Money on Your Phone Bill with Card Credits – Watch Me Pay My Phone Bill

FAQ

When I use money to pay my cell phone bill, which function of money is being used?

What function of money is highlighted when I put cash under my mattress to have on hand for unexpected emergencies?

What function of money is highlighted when TSAI pays her water bill with cash?

What is the function of the money?