Missing a credit card payment can happen to anyone. When you forget a due date, get busy, or have an unexpected cost, you can’t pay your bill in full. A late payment once in a while isn’t a big deal, but not paying your credit card bill for months on end can cost you a lot of money. Find out what really happens when you don’t pay your credit card bill by reading on.

Your Credit Score Will Plummet

The biggest immediate impact of not paying your credit card bill is damage to your credit score Payment history makes up a whopping 35% of your FICO credit score – the most heavily weighted factor Every time you miss a payment, it will be reported to the credit bureaus and your score will take an immediate hit.

How much your score drops depends on your credit profile. Some people may only lose a few points on their score for a single 30-day late payment if they have always paid their bills on time. A new late payment, on the other hand, could lower your score by 50 to 100 points if you already had late payments or a short credit history.

The later a payment is the more damage it causes. A 30-day late is not as bad as a 60-day late which is better than a 90-day late. Once your account becomes severely delinquent, your score can plummet by 150 points or more.

You’ll Be Charged Late Fees

In addition to credit damage, your credit card company will likely impose late payment fees. The fee is typically $25-30 for your first late payment. But if you continue not paying your bill, subsequent late fees ramp up to $35-40.

Some issuers charge a higher penalty APR instead of a late fee. This involves raising your interest rate to 25-30% for future transactions. Read your card agreement to see if your issuer imposes late fees, a penalty rate, or both.

Your Interest Charges Increase

Even if your card doesn’t have a penalty APR for late payments, your regular interest charges will still rapidly increase the longer you go without making a payment This is because credit cards calculate interest each month on your average daily balance

When you leave your balance unpaid, that balance continues accumulating interest month after month. For example, if you carry a $1,000 balance at 17% interest and stop making payments, after a year your balance would grow to around $1,270 even without any new charges.

Your Credit Limit Can Be Reduced

Many card issuers will fight back against persistent late payments by lowering your credit limit. This reduces the risk they have to take on with your account. However, it also hurts your credit utilization ratio, which is the percentage of your total credit limit that you’re using.

Higher utilization leads to additional credit score damage. For the best scores, experts recommend keeping utilization below 30%. You could have extra credit score damage if your limit drops from $10,000 to $5,000 but your balance stays at $3,000. This is because your utilization goes from 203% to 206%, which is more than 203% of your available credit.

You’ll Be Barred From Balance Transfers

Transferring a credit card balance to a new card with a 0% intro APR is a common tactic for reducing interest costs. However, if you have late payments on your credit, you will likely be denied for the best balance transfer offers. Most balance transfer cards require at least good to excellent credit.

Even if you can get approved, the terms probably won’t be very advantageous. The issuer will either decline to transfer over your existing delinquent balance, or will apply a reduced intro term or higher transfer fee. Expect to pay 3-5% upfront on the transfer, rather than the typical 0-3%.

Your Account Gets Sent to Collections

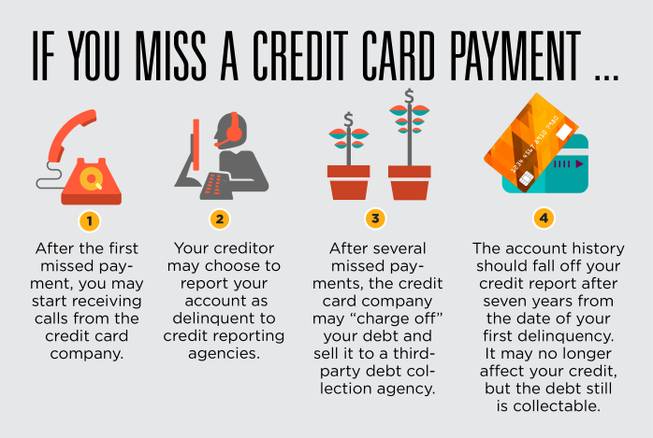

After 6 months of no payments, credit card banks will often “charge off” the account. This means they write your debt off as a loss for accounting and tax purposes. However, you still legally owe the debt and the bank will attempt to collect through all legal means available.

In most cases, original creditors sell charged-off accounts to third-party collection agencies. These agencies specialize in collecting old, delinquent debts. Their methods can be aggressive and include non-stop phone calls, lawsuits, wage garnishment, liens on property, and seizure of assets. Having an account in collections severely devastates your credit for 7 years.

You May Be Sued

For large credit card balances, especially $10,000+, it’s common for collection agencies to file a lawsuit against you. They will first attempt to work out a settlement, but if that fails, they will sue for the full amount plus court fees and interest.

If you do not respond to the lawsuit and go to court, they will win a default judgement. This gives them the power to garnish your paycheck, freeze your bank account, put liens on your home and vehicles, and possibly foreclose on or repossess assets. Your wages can be garnished up to 25% in most states.

How To Recover From Unpaid Credit Cards

If you owe back payments on your credit card, take action as soon as possible to mitigate damage. Here are some tips:

-

Contact your issuer to see if they offer hardship programs with reduced payments and waived fees.

-

Consider a balance transfer to a card with 0% interest for up to 18 months. This pause on interest can help you pay down the principal faster.

-

Explore debt management plans through a nonprofit credit counseling agency, which can secure lower interest rates from creditors.

-

Negotiate a pay for deletion agreement in exchange for paying collections in full. This can help remove negative marks from your credit reports.

-

Rebuild credit by becoming an authorized user on someone else’s card or opening a secured card. Use the card responsibly to demonstrate you’ve changed your habits.

-

Wait 7 years for the unpaid account to fall off your credit report before applying for prime credit again.

No matter what, start making whatever payments you can, even if very small. This shows creditors you intend to pay and may prevent your account from being charged off or sent to collections in the first place. Don’t bury your head in the sand hoping unpaid cards will go away – take action quickly to minimize credit damage.

How does a credit card affect my credit score?

Your credit card provider will share information with credit reference agencies about the way you use your card to update your credit score. This information will help other creditors decide how risky it is to lend money to you.

Credit files state the balance owed, your payment history and if the account has defaulted. Credit card providers give extra information to the credit file companies, including:

- Your credit limit

- How much you’ve spent each month

- How much money you’ve withdrawn from a cash machine each month

Worrying about credit card bills could be a sign you need debt help

We can help if you’re in debt. You can get free and confidential debt advice online now. We’ll recommend the best way to deal with any debts you have, and also tell you about other organisations who can support you.

Also, if you’re eligible, you could get Breathing Space. This means your creditors wont be able to add interest or fees to your debts, or take enforcement action, for up to 60 days.

In this section you’ll find advice about:

- what to do if you’re struggling to pay credit card bills

- what your credit card company will do about regular missed or minimum payments

- how to transfer balances to pay off credit card debt

- how your credit card can affect your credit score or file

What Happens If You Never Pay Your Credit Card? (Explained)

FAQ

What happens if you never pay your credit card bill?

What happens if you just don’t pay your credit cards?

What happens to credit card if not paid?

How often do credit card companies sue for non-payment?

What happens if you don’t pay your credit card bill?

There are several outcomes of not paying your credit card bill, and they’re all relatively serious. The consequences may vary depending on the number of payments missed and the number of accounts that have missed payments. After enough missed payments, the consequences become more serious.

What happens if you stop paying a credit card?

When you stop making payments on your credit card, several consequences can occur: 1.**Increased Interest Rates**: If you stop paying your credit card, you’ll be in violation of your card’s terms of service.As

What if I can’t pay my credit card?

If you can’t pay your card, don’t freak out. Like anything in life, this too can be managed before it’s a worst-case scenario. Another thing to keep in mind is that you have more options if you take action before your due date hits. The sooner you act, the more likely you are to handle it without major complications or penalties.

What happens if you never pay off your credit card debt?

If you never pay off your credit card debt, your account may get reported to the credit bureaus, and you could receive a derogatory remark on your credit card report, specifically a charge-off. A charge-off happens when a payment has yet to be made on a debt for a certain period of time, usually around 180 days.