Paying your phone bill on time every month is crucial to avoiding penalties and keeping your service active But life happens, and you may find yourself unable to pay on time If you pay late, what exactly happens? Here’s a complete overview of the repercussions, how to minimize the damage, and tips to avoid paying late in the future.

Overview of Paying Phone Bills Late

In general, here’s what to expect if your phone bill is overdue:

-

Late Fees The provider will charge a late fee usually $5-10 or a percentage of your monthly bill.

-

Service Interruption If you go too long without paying, the provider may suspend your service until you pay the past due amount.

-

Collections: If you don’t pay your bill on time for a certain amount of time, usually 60 to 90 days, the provider will send your account to collections. This damages your credit score.

-

Termination: If you never pay, the provider will eventually terminate your service agreement and blacklist the phone number.

The specifics depend on your provider, contract terms, and state regulations. Providers like Verizon and T-Mobile have some leniency for occasional late payments. But repeated tardiness will result in escalating enforcement actions.

Late Payment Fees

If your phone bill isn’t paid by the due date, you’ll be charged a late fee. This is typically $5-10 or a percentage of your monthly bill, whichever is greater.

For example, Verizon charges a $7 late fee in most states. Other providers charge 5-10% of the outstanding balance due.

Some key points on late fees:

-

Charged per billing cycle, so monthly bills accrue multiples fees when chronically late.

-

Assessed as early as 1 day after the due date.

-

Due even if you arrange a payment plan for the outstanding balance.

-

Waived occasionally as a courtesy for first late payment.

The takeaway is that 1 late bill equals 1 late fee. Get in the habit of paying on time to avoid these unnecessary extra charges every month.

Service Interruption and Suspension

The worst consequence of paying phone bills late is having your service interrupted or suspended entirely.

Most providers will suspend service within 30-60 days of nonpayment. This means no voice, text, or data services until you pay the past due amount in full. Suspended lines will remain active for incoming calls and texts for a short grace period before the provider fully disconnects the line.

Service interruption is highly disruptive, especially for cell phone service. To get reconnected, you’ll need to pay:

- The full past due balance

- Any late payment fees

- A restoration fee, typically $20-50

This makes getting current on your bill an expensive endeavor after suspension occurs. Avoid this worst-case scenario by paying on time or setting up a payment plan if you anticipate issues paying your bill.

Account Sent to Collections

If you go too long without paying your phone bill, eventually the provider will send the account to collections. This typically happens between 60-90 days past the due date.

Third-party collection agencies will attempt to collect the full past due balance, plus additional fees. Having an account in collections also damages your credit standing for up to 7 years.

You can sometimes negotiate a settlement for a lower payoff amount with the collection agency. But this still harms your credit.

The only way to avoid collections is to pay off the balance or set up a payment plan before the provider closes the account and assigns it to collections. Monitor aging balances closely to prevent this.

Service Agreement Termination

In the worst case, not paying your phone bill can result in the provider terminating your service agreement entirely.

This usually happens after 6 months to 1 year of nonpayment, depending on the provider.

Consequences of service termination include:

- Permanent disconnection of your phone line

- Blacklisting the phone number so it can’t be reused

- Charging the remaining balance of any device payment plan

- Referral to collections for any unpaid balance

- Reporting nonpayment to credit bureaus, harming your score

Service termination is very damaging financially and to your credit. Avoid it at all costs by paying enough to keep accounts active, even if you can’t pay in full every month. Prioritize staying current on any device installment plans tied to your service agreement.

Minimizing Damage from Late Payments

No one’s perfect. Even the most diligent bill payers slip up occasionally. Here are some tips to minimize damage if you do pay late:

-

Call right away: Contact support as soon as you know you’ll be late. Providers can note the account to possibly waive the first late fee.

-

Arrange a payment plan: Set up installment payments or extend your due date. As long as you pay on time under the plan, you can avoid suspension.

-

Pay something: Even a partial payment shows good faith. Providers are less likely to suspend service if you pay a portion before the due date.

-

Avoid missing multiple payments: The worst consequences happen after chronic late payments. Make it a 1-time exception, not the norm.

-

Stay in touch: Keep the lines of communication open with support. The provider can advise on options before taking enforcement actions.

-

Negotiate: If service is suspended or the account is in collections, negotiate a lower payoff amount or payment plan if possible.

The takeaway is to act quickly and stay engaged with the provider. That demonstrates you intend to pay and limits the penalties.

Tips to Avoid Paying Late

We all hate paying extra fees. The stress of dealing with service interruptions is avoidable. Here are some tips to avoid needing to pay phone bills late:

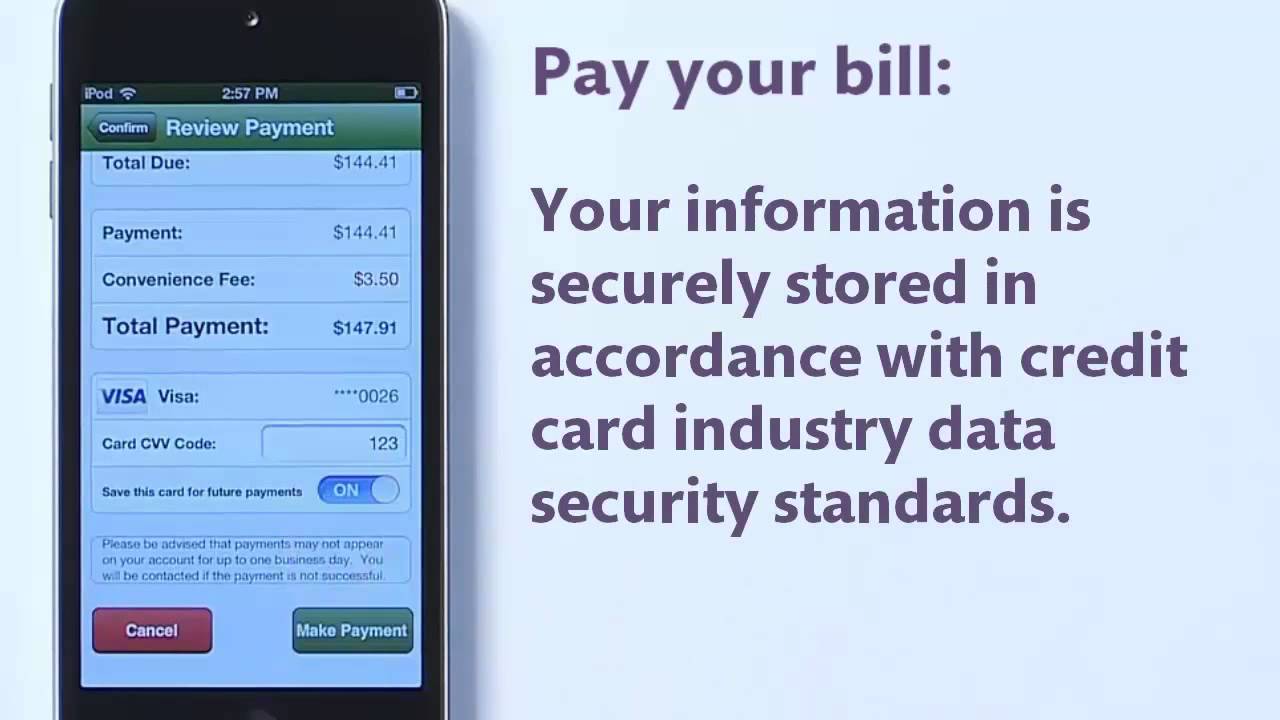

Enable Auto-Pay

Automating your phone bill payment is the easiest way to guarantee on-time payment. Auto-pay deducts your bill from a credit card or bank account each month.

Set it and forget it, and late fees become a thing of the past. Just be sure your payment method always has sufficient funds on the due date.

Use Payment Reminders

If you don’t love auto-pay, then diligently watch for your bill each month. Set up custom reminders and alerts so your bill never sneaks up on you.

Many online bill pay systems let you configure email or text alerts at intervals before the due date. Use these to your advantage.

Know Your Due Date

You can’t pay on time if you don’t know the due date. Note your billing cycle dates and due date on your calendar.

Set a reminder a few days in advance as a fail-safe in case your bill notification slips by.

Leave Wiggle Room

Don’t wait until the exact due date to pay, especially for mailed payments. Mail delivery can take 3-5 days.

Build in a buffer of 5-7 days and pay earlier in your billing cycle. This ensures any mail delays don’t result in a late payment.

Review Monthly Spending

Do a quick budget check to ensure your phone bill fits before the due date nears.

If your usage spiked that month or other expenses limited your budget, you’ll know you need to get creative to pay on time.

Know Your Late Payment Options

Familiarize yourself with payment plans and late date adjustments offered by your wireless provider. This allows you to act quickly if you anticipate issues paying on time.

Waiting until after the due date limits your options versus arranging flexibility proactively.

Communicate Financial Hardship

If you face extenuating circumstances, like job loss or medical expenses, explain the situation to your provider. There are often special accommodations for hardship cases to avoid suspension or collections.

Letting your provider know before you miss a payment gives the best chance at flexibility. Don’t wait until your service is interrupted to speak up.

What Happens If You Routinely Pay Late

The impacts escalate if you are consistently late making payments:

-

Repeated late fees erode your budget.

-

Chronic late payers are often excluded from fee waivers or flexible options.

-

The provider terminates service more rapidly for repeat violations.

-

Frequent late payments affect your credit score worse over time.

Make paying your phone bill on time a habit. Using auto-pay or reminder alerts makes this easy to accomplish. Your wallet and your credit score will thank you.

Options If You Can’t Afford Your Phone Bill

If you genuinely can’t afford your phone bill, you have options beyond paying late:

-

Review your plan: Downgrade services or features to lower your monthly cost.

-

Use a payment plan: Arrange installments to spread your balance over 2-3 manageable payments.

-

Take a billing pause: Temporarily suspend service if you’ll be overseas or otherwise without service for a defined period.

-

Negotiate: Explain your situation and attempt to negotiate discounted service or other billing concessions.

-

Switch providers: Compare rates and move to a provider with monthly costs better suited to your budget.

-

**Cancel service

Shipping charges These charges vary on the desired shipping times.

- Assessed in the event an account is referred to a third-party collection agency.

- Calculated as a percentage of the amount due to the extent permitted by applicable law.

- This appears on your bill as “One Time charge for outside collection fee“.

Expecting an adjustment? Keep the following in mind:

- Adjustments are listed in the Monthly Summary under Credits & Adjustments

- The amount will be deducted from the Total Current Charges.

Most deposits are returned after 12 months of active services if your account has stayed in good standing

- Returned deposits are applied to your account balance first.

- Interest is applied at the rate the law requires.

- We refund deposits on final credit balances upon request unless otherwise required by law.

- Canceled accounts must wait a minimum of 30 days with no payment or charge activity before any credit balance can be refunded to allow time for final charges to be billed.

- You can request any remaining deposit credit balance to be refunded to the original payment method or prepaid card.

- Payments older than 12 months from the date of request are not eligible for refunds

- Some credit balances arent eligible for a payment refund and will apply toward your future monthly charges.

- Canceled accounts must wait a minimum of 30 days with no payment or charge activity before any credit balance can be refunded to allow time for final charges to be billed.

- Once your refund request is submitted, we will provide you with the refund decision. Some situations require manual review, which is typically completed within one business day, and decision results are sent via text message.

- For checking/savings account refunds:

- Refund can only be requested by the account holder.

- Accounts with a recent history of returned check payments may have the refund held for 7 days to allow time for the payment to clear before refunding.

- If approved, your refund will typically be deposited within three business days from approval date.

- For credit/debit card refunds:

- Card payments can only be refunded back to the original card.

- If approved, your refund will typically be deposited within three business days from approval date.

- For prepaid card refunds:

- Refund can only be mailed to the account holder.

- If approved, your refund will typically arrive within 10 business days by USPS ground mail from approval date.

Regulatory Programs & Telco Recovery Fee This fee is not a government tax or imposed by the government; rather, the fee is collected and retained by T-Mobile to help recover certain costs we have already incurred and continue to incur.

- The Regulatory Programs component helps defray costs for funding and compliance with government mandates, programs and obligations, like E911 or local number portability.

- The Telco Recovery component helps defray costs and charges imposed on us by other carriers for delivery of calls from our customers to theirs and for certain network facilities (e.g., leases), operations, and services we obtain to provide you with service.

- Voice lines: $3.49 per line every month (Regulatory Programs $0.50; Telco Recovery $2.99)

- Mobile Internet lines: $1.40 per line every month (Regulatory Programs $0.12; Telco Recovery $1.28)

Some states, counties, and cities impose gross receipts taxes and excise taxes on telecommunications providers, which may cover wireless communications services, sales and rentals of wireless devices, and other services T-Mobile provides. T-Mobile may choose to recover the costs associated with these gross receipts taxes by charging customers a monthly recovery fee on each line of service, and other local charges we recover.

- $20 per line, for the first three lines, plus tax, and is due when you restore service after a non-payment service interruption.

- This appears on your bill as “Restore from Suspend“.

- Check Account suspensions for more details.

- $35 device connection charge due at sale.

- $5 for each bill reprint through Customer Care.

- One free reprint per calendar year. Each additional month will be charged a $5 fee.

- Download and print up to 18 previous bills for free by logging in to your T-Mobile account.

- This appears on your bill as “Bill Reprint Fee“

- $2 fee charged for providing an itemized bill which lists all local, long distance and roaming calls.

- This appears on your bill as “Detailed Billing All“

- Late fees can be avoided by paying your bill by the payment due date or setting up AutoPay, which can be through your account online or in the T-Mobile app.

- A late fee of the greater of 5% of applicable monthly charges or $7 or the maximum amount allowed under state law is applied to your account if not paid by the due date.

- Washington D.C., Maryland, and New York have the following percentages for calculating late fees:

- Washington D.C.: 2.0%

- Maryland: 1.66%

- New York: 2.08%

- This appears on your bill as “Late Fee for invoice“.

- T-Mobile charges a $15 fee to change your phone number.

- This appears on your bill as “One time charge for MSICHG“.

- Check Change your phone number for more details.

You will be charged a non-refundable fee of up to $500 if:

- You do not mail the device within 7 days.

- You mail us a different device.

- The device has physical or liquid damage.

- This appears on your bill as “Warranty Non-Return Fee“.