In this comprehensive guide, we’ll demystify the income requirements for homeownership, empowering you to make an informed decision and take the first step towards your dream home.

Breaking the Myth: No Definitive Minimum Income Threshold

Contrary to popular belief, there is no universal minimum income requirement for mortgage approval. Home buyers at any income level can potentially qualify for a mortgage loan, provided they meet certain criteria set forth by lenders. The most crucial factor isn’t the numerical value of your income but rather its stability, consistency, and your ability to manage financial obligations.

Lenders assess your overall financial health, taking into account various aspects beyond just your paycheck. Their primary concern is your capacity to make timely mortgage payments while managing your existing debts and living expenses.

Key Requirements for Mortgage Eligibility

While there is no hard-and-fast rule regarding the lowest income to buy a house, lenders typically consider the following factors when evaluating your mortgage application:

-

Debt-to-Income Ratio (DTI): This ratio compares your monthly debt obligations (including the prospective mortgage payment) to your gross monthly income. Lenders generally prefer a DTI below 50%, although some may consider ratios up to 43% for conventional loans and higher for government-backed loans like FHA or VA loans.

-

Credit Score: Your credit score is a numerical representation of your creditworthiness. A higher score indicates responsible credit management and increases your chances of qualifying for better interest rates and loan terms.

-

Down Payment: The amount you can contribute as a down payment plays a significant role in determining your mortgage eligibility. While a 20% down payment is ideal, many loan programs allow lower down payments, sometimes as low as 3% or even 0% for certain borrowers.

-

Employment History and Income Stability: Lenders prefer borrowers with a consistent employment history and a steady income stream. They may request documentation such as pay stubs, tax returns, and bank statements to verify your income sources and stability.

-

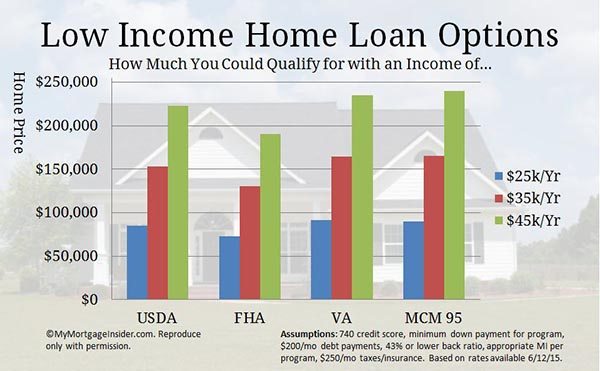

Loan Program Requirements: Different loan programs (conventional, FHA, VA, USDA) have varying income requirements and eligibility criteria. Some programs cater to borrowers with lower incomes or specific circumstances, such as first-time homebuyers or those in certain professions.

Strategies for Homeownership with a Lower Income

If your income falls on the lower end of the spectrum, fear not! There are several strategies you can employ to increase your chances of qualifying for a mortgage:

-

Explore Government-Backed Loan Programs: Programs like FHA, VA, and USDA loans often have more flexible income requirements and lower down payment thresholds, making them an attractive option for lower-income borrowers.

-

Consider a Co-Borrower or Co-Signer: By involving a co-borrower or co-signer with a stable income, you can improve your overall financial profile and increase your borrowing power.

-

Improve Your Credit Score: A higher credit score can compensate for a lower income and potentially qualify you for better loan terms. Focus on paying down debts, correcting errors on your credit report, and maintaining a positive credit history.

-

Save for a Larger Down Payment: While not always feasible, a larger down payment can reduce your monthly mortgage payments, making them more manageable on a lower income.

-

Seek Down Payment Assistance Programs: Many state and local governments, as well as non-profit organizations, offer down payment assistance programs to help lower-income individuals achieve homeownership.

The Bottom Line: Income Alone Doesn’t Determine Homeownership

Contrary to popular belief, there is no definitive lowest income threshold that disqualifies you from buying a house. Lenders evaluate your overall financial picture, taking into account factors such as your debt-to-income ratio, credit score, down payment, employment history, and the specific loan program requirements.

While a higher income certainly provides more borrowing power and flexibility, even those with lower incomes can achieve the dream of homeownership by exploring alternative loan programs, improving their credit profiles, and seeking assistance where available.

Remember, the path to homeownership is not a one-size-fits-all journey. By understanding the nuances of mortgage qualification and employing the right strategies, you can navigate the process with confidence and unlock the door to your dream home, regardless of your income level.

How Much Home You Can ACTUALLY Afford (By Salary)

FAQ

Can I afford a house on 40k a year?

How much house can I afford if I make $36,000 a year?

How much income should you make to buy a house?

Can I buy a house if I make 60k a year?