As a Medicare beneficiary, it’s essential to understand the various costs associated with your coverage, including the yearly deductibles for both Medicare Part B and Medicare Part D (prescription drug coverage). These deductibles can significantly impact your out-of-pocket expenses, making it crucial to be well-informed and prepared.

In this article, we’ll dive deep into the concept of the yearly deductible for Medicare, explaining what it is, how it works, and the current deductible amounts for 2024. We’ll also provide tips on how to plan and manage these costs effectively.

What is a Deductible?

Before diving into the specifics of Medicare deductibles, let’s first understand what a deductible is in general terms.

A deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance plan begins to pay its share. It’s essentially the cost you bear upfront before your coverage kicks in.

Medicare Part B Deductible

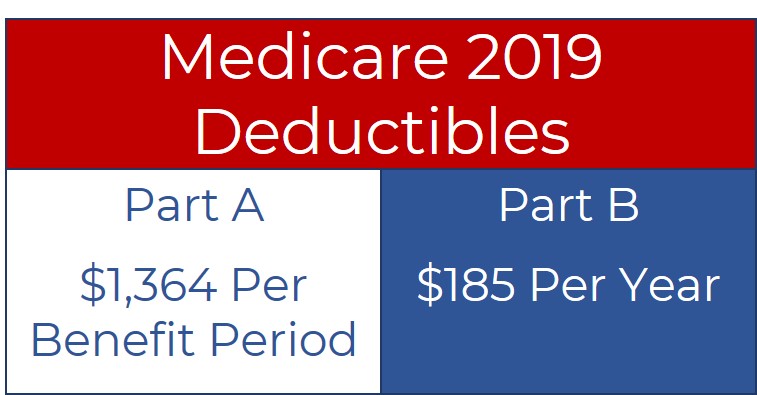

Medicare Part B covers a wide range of outpatient medical services, including doctor visits, preventive care, and durable medical equipment. For 2024, the annual deductible for all Medicare Part B beneficiaries will be $240, an increase of $14 from the annual deductible of $226 in 2023.

This deductible applies to most Part B services, meaning you’ll need to pay the first $240 of covered expenses out-of-pocket before Medicare starts paying its share. Once you’ve met the deductible, Medicare Part B will typically cover 80% of the approved amount for covered services, while you’ll be responsible for the remaining 20% coinsurance.

Medicare Part D Deductible

Medicare Part D provides prescription drug coverage for Medicare beneficiaries. Unlike Part B, which has a standardized deductible, Part D deductibles can vary depending on the specific plan you choose.

In 2024, no Medicare Part D plan may have a deductible higher than $545. However, some plans may offer lower deductibles or even no deductible at all. It’s essential to review the details of each plan carefully to understand the deductible amount and how it applies to your prescription drug coverage.

Additionally, it’s worth noting that some Part D plans may cover certain drugs on specific tiers before you meet the deductible. This can be beneficial if you take medications that fall into those tiers, as you won’t have to pay the full cost of those drugs before your coverage kicks in.

Planning for Medicare Deductibles

Knowing the deductible amounts for Medicare Part B and Part D can help you budget and plan for your healthcare expenses more effectively. Here are some tips to consider:

-

Evaluate your healthcare needs: Assess your expected medical and prescription drug needs for the year. If you anticipate higher healthcare expenses, you may want to consider a plan with a lower deductible to minimize your upfront costs.

-

Consider a Medigap plan: If you’re enrolled in Original Medicare (Parts A and B), you may want to explore purchasing a Medicare Supplement Insurance (Medigap) plan. Medigap plans can help cover some or all of the out-of-pocket costs associated with Medicare Part B, including the deductible.

-

Plan for the coverage gap: Once you’ve met your Part D deductible, you’ll enter the initial coverage phase. During this phase, you’ll be responsible for copayments or coinsurance for your prescription drugs. Be prepared to budget for these ongoing costs as well.

-

Take advantage of preventive services: Many preventive services, such as annual wellness visits and certain screenings, are covered by Medicare Part B with no deductible or coinsurance. Staying on top of these preventive measures can help you maintain your health and potentially avoid more costly treatments down the line.

By understanding the yearly deductibles for Medicare and planning accordingly, you can better manage your healthcare expenses and ensure you have the coverage you need without financial strain.

Conclusion

The yearly deductible for Medicare is an important aspect of your healthcare coverage that you should be aware of. For 2024, the Medicare Part B deductible is $240, while Part D deductibles can vary but cannot exceed $545 per plan.

Knowing these deductible amounts and how they apply to your specific situation can help you make informed decisions about your Medicare coverage and budget appropriately for your healthcare needs. By staying informed and proactive, you can navigate the Medicare system with confidence and ensure you have the protection you need for your health and financial well-being.

Medicare Deductibles – How and When Do You Pay Them (Our Pro Tips)

FAQ

What is the Medicare annual deductible?

What is the yearly out-of-pocket for Medicare?

What is the 2024 Medicare deductible?

Is Medicare Part A free at age 65?