As you navigate the Medicare landscape, you may have come across two popular options: Medigap (Medicare Supplement Insurance) and Medicare Advantage. While both aim to provide additional coverage beyond Original Medicare (Parts A and B), they differ significantly in terms of structure, costs, and benefits. In this article, we’ll explore the key distinctions between Medigap and Medicare Advantage to help you make an informed decision.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, is a private insurance policy designed to fill the “gaps” in Original Medicare coverage. It works in tandem with Parts A and B to help cover out-of-pocket costs, such as deductibles, coinsurance, and copayments.

Medigap plans are standardized by the federal government and offered by private insurance companies. There are currently 10 different plan types available (Plans A, B, D, G, K, L, M, and N), each providing a unique set of benefits. These plans cover expenses that Original Medicare doesn’t, including:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayments

- Blood (first three pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Foreign travel emergency care (Plans C, D, F, G, M, and N)

It’s important to note that Medigap policies do not cover prescription drugs, so you’ll need to enroll in a separate Medicare Part D plan for that coverage.

What is Medicare Advantage?

Medicare Advantage, also known as Part C, is an alternative way to receive your Medicare benefits through private health plans instead of directly from the government. These plans are required to provide at least the same level of coverage as Original Medicare, but many offer additional benefits such as vision, dental, hearing, and prescription drug coverage.

The most common types of Medicare Advantage plans are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Private Fee-For-Service (PFFS) plans. These plans typically have a network of healthcare providers that you must use to receive the highest level of coverage, except in emergencies.

One of the key advantages of Medicare Advantage plans is that they have an annual out-of-pocket maximum, which can help limit your overall healthcare costs. However, you’ll still be responsible for premiums, deductibles, copayments, and coinsurance as defined by your specific plan.

Key Differences

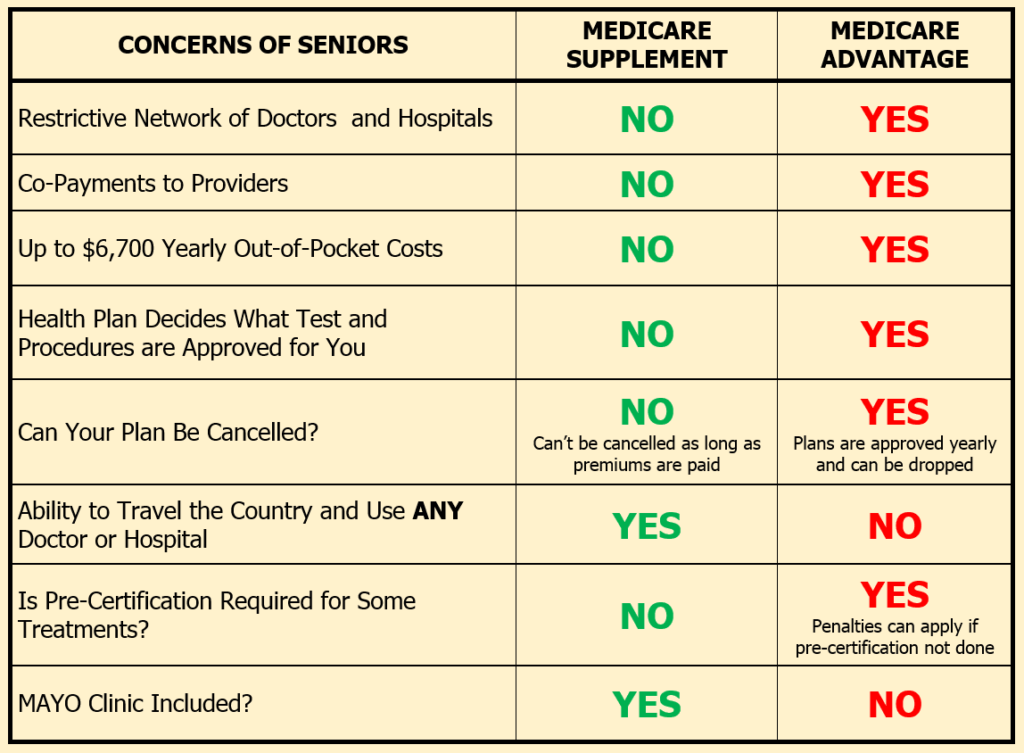

While both Medigap and Medicare Advantage aim to provide additional coverage, there are several key differences to consider:

-

Coverage Structure: Medigap works in conjunction with Original Medicare, while Medicare Advantage replaces it entirely.

-

Enrollment: You can enroll in a Medigap plan during your initial enrollment period or any time afterward, subject to medical underwriting (except in certain states). Medicare Advantage has an annual enrollment period.

-

Provider Networks: Medigap policies allow you to see any healthcare provider that accepts Medicare, while Medicare Advantage plans typically have a defined network of providers.

-

Out-of-Pocket Costs: Medigap plans help cover deductibles, coinsurance, and copayments, reducing your out-of-pocket expenses. Medicare Advantage plans have an annual out-of-pocket maximum, but you’ll still be responsible for premiums, deductibles, and copayments as defined by your plan.

-

Additional Benefits: Medicare Advantage plans often include extra benefits like vision, dental, hearing, and prescription drug coverage. Medigap plans primarily cover gaps in Original Medicare, with some exceptions (e.g., foreign travel emergency care).

-

Prescription Drug Coverage: Medigap policies do not cover prescription drugs, so you’ll need to enroll in a separate Part D plan. Many Medicare Advantage plans include prescription drug coverage.

-

Costs: Medigap premiums can be higher than Medicare Advantage premiums, but out-of-pocket costs may be lower with a Medigap plan depending on your healthcare needs.

Which Option is Right for You?

Choosing between Medigap and Medicare Advantage depends on your individual circumstances, healthcare needs, and budget. Here are some factors to consider:

-

Healthcare Utilization: If you anticipate frequent doctor visits or have chronic conditions, a Medigap plan may be more cost-effective by limiting out-of-pocket expenses.

-

Provider Flexibility: If you prefer the freedom to see any Medicare-approved provider without network restrictions, a Medigap policy may be the better choice.

-

Travel: If you travel frequently outside the United States, a Medigap plan that includes foreign travel emergency coverage (Plans C, D, F, G, M, and N) could be beneficial.

-

Additional Benefits: If you require extra coverage for services like vision, dental, hearing, or prescription drugs, a Medicare Advantage plan that includes these benefits may be more suitable.

-

Budget: Carefully evaluate the premiums, deductibles, copayments, and out-of-pocket maximums for both options to determine which fits your budget and healthcare needs better.

Remember, you cannot have both a Medigap policy and a Medicare Advantage plan at the same time. It’s crucial to review your options during the appropriate enrollment periods and seek guidance from a licensed insurance agent or a representative from your State Health Insurance Assistance Program (SHIP) if needed.

By understanding the differences between Medigap and Medicare Advantage, you can make an informed decision that aligns with your healthcare requirements and financial goals, ensuring you have the coverage you need for a secure and healthy future.

Medigap vs. Medicare Advantage | Which Is Best for You in 2024?

FAQ

Is a Medigap plan better than an Advantage plan?

Why do doctors not like Medicare Advantage plans?

What is the downside of Medicare Advantage?