Having a Discover credit card provides great benefits like cashback rewards, fraud protection and building your credit. However, to reap the full advantages, it’s essential to pay your bill on time each month. This comprehensive guide will overview when your Discover card payment is due and provide tips for paying on time.

When is the Discover Card Payment Due?

Your Discover card payment due date is at least 21 days after your statement closing date The closing date is when your monthly statement is generated, summarizing all your account activity and fees for that billing period

As an example, if the 15th of the month is the end of your statement period, your next payment will not be due until at least the 6th of the following month.

Discover clearly prints the exact due date on each monthly statement So always refer to your statement for the precise calendar day your payment is due that month

Payment Due Date vs. Statement Balance

Know the difference between when your payment is due and how much money is left on your account:

-

Payment Due Date – The deadline for making at least the minimum payment to avoid late fees,

-

Statement Balance – The total balance owed for the previous statement period. Paying this amount in full helps avoid interest charges.

Ideally you should aim to pay your statement balance in full by the monthly due date. This takes advantage of your grace period and earns maximum rewards.

How the Discover Card Grace Period Works

Discover cards have an interest-free grace period. This gives you over 3 weeks to pay your statement balance before interest kicks in.

As long as you pay your previous statement balance in full by the due date, you won’t owe any interest on those purchases. New charges won’t start accruing interest as long as you continue paying in full each month.

However, if you only make the minimum payment, carry a balance, or miss a payment, interest gets charged on purchases starting the day you make them. This makes your balance grow faster.

Minimum Payment vs. Statement Balance

Every month, Discover requires you to pay at least the minimum payment printed on your statement. This is usually around 2% to 5% of your total balance.

While paying the minimum keeps your account active and avoids late fees, it’s not ideal for a few reasons:

-

You’ll accrue interest charges on your balance.

-

Your balance will take longer to pay off.

-

It increases your credit utilization ratio which can lower your credit score.

Paying just the minimum results in more interest fees over time compared to paying in full. To maximize your rewards and finance charges, always try to pay the full statement balance by the due date when possible.

Can I Pay Before My Due Date?

Yes, Discover allows you to pay your bill early, even right after your statement closes. This can provide several advantages:

-

Lower interest – Paying early reduces the average daily balance used to calculate your interest owed. This minimizes the interest fees charged for that month.

-

Improve utilization – Paying ahead of time lowers your credit utilization, which can boost your credit score.

-

Earn rewards – Paying early allows you to use your card more throughout the month while avoiding interest. This helps maximize the rewards you earn.

Just be sure to pay the most recent statement balance to take full advantage of the grace period. Don’t just pay your current balance.

Setting Up Automatic Payments

For ultimate convenience and ensuring you never miss a payment, enroll in automatic payments through your Discover online account. This automatically deducts your payment from a bank account each billing cycle.

You control how much gets paid – minimum, statement balance, set dollar amount, etc. Set it and forget it for peace of mind.

Avoiding Late Fees and Penalties

To avoid late fees and credit score damage, be sure to pay at least the minimum payment by your due date each month. Discover has a $40 late fee penalty.

If an emergency prevents you from paying on time, call Discover ASAP before your due date. You may be able to get a short-term payment extension.

When Is the Best Day to Pay?

For the most flexibility, pay your Discover card earlier in your billing cycle, ideally right after your statement closes. This gives purchases more time to process and lowers your daily balance.

Paying on the actual due date also works, but you lose a bit of control. Online or automatic payments give a nice buffer as funds can take 1-2 business days to process from your bank. Consider scheduling payments 3-4 business days before your due date as a precaution.

How to manage credit card payments

Consider these tips to help ensure you make monthly payments on time and keep your credit in good standing.

Paying your credit card balance in full

Credit cards allow members to spend money now and pay it off later. For some, this means carrying a balance from month to month and usually paying interest. But paying your card balance in full is ideal, especially in the following cases.

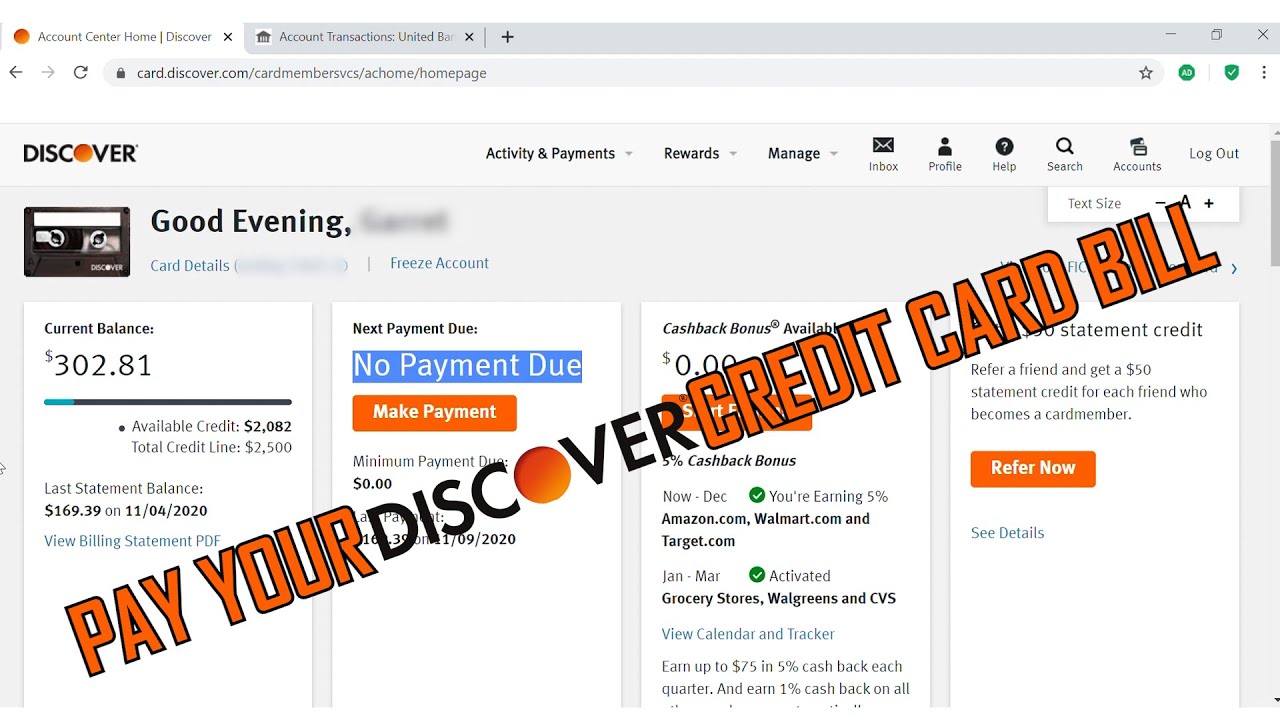

How to pay off your Discover credit card bill on the Discover App| 2021

FAQ

How do I know when my Discover card payment is due?

What is Discover’s billing cycle?

Does a Discover card have to be paid in full every month?

How do I find my Discover statement date?