Getting buried under a mountain of debt is far too common these days. Loans, medical bills, credit card balances, and other types of debt can add up quickly.

When you’re juggling multiple bills every month, it can be tempting to only make the minimum payments But doing so causes debt to hang around for years, accruing interest along the way

The best strategy? Pay your bills in full each month whenever possible Here’s what you need to know about the benefits of paying bills in full and how to make it happen,

What Does It Mean to Pay a Bill In Full?

When you receive a bill for a product or service it will show you the total amount owed – this is your balance due.

You pay the bill in full if you pay the full amount that is due. This means no money is left owing on that particular bill.

For example:

- Your cell phone bill is $75.

- You pay the full $75 owed.

- That cell phone bill is now paid off and shows a $0 balance.

Paying in full is different than making a partial payment, where you only pay a portion of the amount due.

Say that same $75 cell phone bill – you may decide to pay $40 this month and leave $35 still owing. This would be a partial payment.

- Full payment: Paying 100% of the balance due

- Partial payment: Paying some of the balance due, but not all of it

When you pay bills in full each month, you prevent balances from accumulating and avoid interest fees.

The Benefits of Paying Bills In Full

Paying your bills in full each month has a number of advantages:

1. You pay less interest.

Many bills like credit cards and loans charge interest on unpaid balances. When you carry a balance month-to-month, that interest starts adding up.

By paying in full, you avoid interest fees altogether. This saves you money.

2. You establish good credit.

Payment history makes up a large portion of your credit score. When you consistently pay bills on time and in full, it demonstrates that you’re a responsible borrower. This helps raise your credit score.

3. You avoid fees.

Late payment fees, over-limit fees, and other penalties can be assessed when you don’t pay bills in full. Avoid these unnecessary fees by keeping accounts paid off.

4. You reduce stress.

The weight of debt hanging over your head can be stressful. Eliminating balances provides peace of mind.

5. You reach financial goals faster.

When you’re not wasting money on interest and fees, you can allocate those funds towards your savings goals. This allows you to save, invest, and prepare for the future more efficiently.

As you can see, paying bills in full should be a priority whenever possible. Next let’s talk about how to make that happen…

Tips for Paying Bills In Full Each Month

Paying every bill on time and in full takes discipline and planning. Here are some tips:

Create a budget.

Know exactly how much income you have to work with each month, and how much needs to go towards bills versus other expenses like food and entertainment. With a budget, you can plan bill payments appropriately.

Reduce spending.

Cut down on discretionary purchases. Pack lunches instead of eating out. Limit online shopping. Downgrade cable packages. Finding places to trim spending gives you more cash towards bills.

Pay with automatic transfers.

Set up automatic monthly payments through your bank so bill payments are deducted on the due date without you having to remember. This prevents late fees.

Pay down highest interest debt first.

If you can’t pay everything in full, prioritize high-interest debts like credit cards first. This will save you the most money in interest fees.

Seek lower interest rates.

Contact credit card companies, lenders, etc. and request a reduced interest rate. This makes balances more affordable.

Earn extra income.

Bring in additional money through a side gig that can be allocated towards unpaid bills. Every bit helps.

Cut expenses.

Look for unnecessary expenses you can temporarily do without. Suspend gym memberships, cable subscriptions, etc. and redirect those dollars towards debt.

With diligence and commitment, you can reach the point where all bills are paid in full every month. It may take time to get there, but the financial benefits are well worth it.

Potential Risks of Only Making Partial Payments

While paying bills in full should be the end goal, we know it’s not always possible when money is tight. In those cases, making partial payments on bills is better than not paying at all.

However, only making the minimum payment does come with certain risks, such as:

- Interest charges rapidly increasing the amount you owe

- Fees for late payments or exceeding credit limits

- Services potentially being discontinued if unpaid balances remain after multiple months

- Creditors referring unpaid accounts to collection agencies

- Credit score decreasing due to missed payments

The takeaway? Making minimum payments is okay temporarily when needed, but avoid it becoming the norm. Strive to pay balances off in full as soon as realistically possible.

What to Do If You Can’t Pay Bills In Full

Despite your best efforts, you may face months where paying all bills in full just isn’t feasible. Financial struggles happen, and the most important thing is communicating with creditors.

Here are some options if you can’t pay the full balance due:

Partial payment – Pay what you can, even if it’s not the full amount. This shows good faith.

Payment plan – Ask the creditor if they offer installment plans to pay over time.

Deferment – Request a temporary pause on payments until you’re financially able to resume.

Extended due date – Ask for a few extra weeks before the payment is due.

Balance transfer – Transfer credit card balances to a new card offering 0% intro APR.

The key is being upfront about your situation and working with creditors to establish new terms. Avoid sticking your head in the sand.

In Summary

Living debt-free may seem out of reach, but it starts by paying bills in full whenever your budget allows. This saves money on interest, avoids fees, and prevents balances from snowballing.

Use budgeting strategies, reduce spending, earn more income – whatever it takes to pay balances off each month. Stay in communication with creditors if you need to make alternate repayment arrangements.

With commitment and financial discipline, you can take control of your bills and debt. The payoff of being debt-free is well worth the hard work to get there.

Heading to college is an exciting time, but it’s also an important time for your finances.

You’re heading to college and about to take the first steps into your own, independent life. It’s an exciting time — but also an important time, especially when it comes to your finances. Here’s help with how to get started with managing your own bills, and gain more financial freedom when it comes to your bank account.

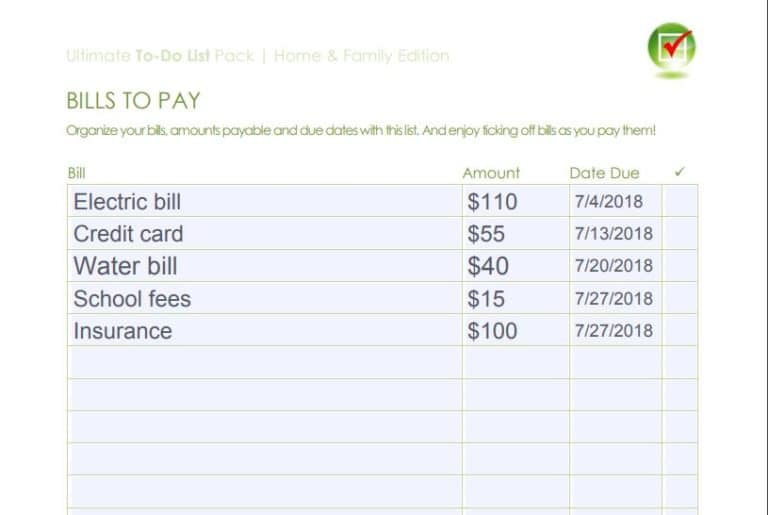

It sounds simple, but the first step to successfully handling your own bill payments is knowing the complete list of all bills you’re responsible for paying. Staying organized allows you to know how much money you need to spend each month — and when. Make a list of your bills and also include:

- The monthly payment amount (if it varies, estimate an average amount so you know what you need to budget for and have available)

- The payment due date

- Contact information for the service provider so you can easily reach out if there’s a question or problem

Decide how to pay

Next, decide how you’ll pay each bill. You can use mail, but that takes more time (and money because you’ll need to buy stamps). It also means running the risk of forgetting to send your payment. You may also have the option to pay your bills over the phone.

A smart way to pay your bills? Online. Wells Fargo Online Bill Pay¹ makes it easy to pay your bills right from your account, especially if you use recurring payments. Doing so means you don’t need to worry about forgetting to pay your bill.