Bill pay checks are a convenient way for companies to pay bills and reimburse expenses But what if you need to turn that piece of paper into cold, hard cash? Thankfully, you have several options

Here is a full guide that will show you how to cash bill pay checks from beginning to end. We’ll also talk about the steps, costs, and places where you can easily get your money.

What is a Bill Pay Check?

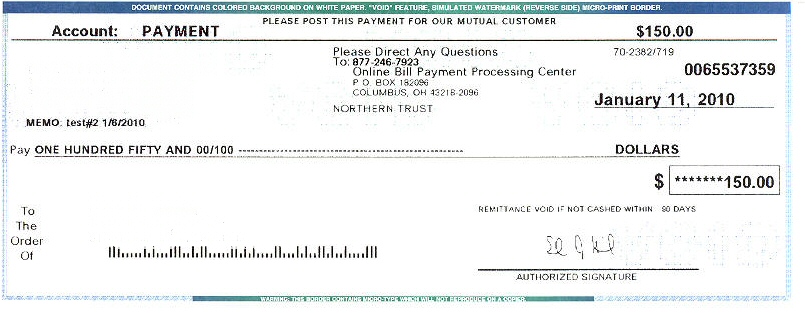

A bill pay check is a check that a business sends to pay a bill or cover an expense. For instance, if you were overcharged, your phone company might send you a check to cover the difference. Or, the insurance company might send a check straight to the doctor or auto shop to pay them.

Bill pay checks can be made out directly to a person or company They can also be left blank for the payee to fill in

Requirements to Cash Bill Pay Checks

Cashing a check is easy as long as it meets a few requirements:

-

The photo ID must be valid. It could be a driver’s license, passport, state ID, or military ID.

-

Check is made out to you: Your name must match the name on the “pay to the order of” line. Some places may require it to exactly match your ID.

-

Check is signed (endorsed): Sign the back of the check where it says “endorse here” in the same name as the front.

-

Check is dated: There must be a date on the “date” line, but it doesn’t have to be current. Checks can be post-dated for the future.

-

Check is not expired: Most checks expire 6 months after the date, but some banks accept older checks.

As long as you have proper ID and an endorsed check, you can cash it at several places. Let’s look at the most common options.

1. Cash it at Your Bank

The easiest place to cash a check is at your own bank, assuming you have a checking account. Simply take the check to a teller or make a mobile deposit.

Pros:

- Convenient if you already do business with the bank

- Immediate access if the check amount is under your bank’s threshold

Cons:

- Funds over the threshold may be held for several days

- Your bank may charge a fee if you don’t have an account

Be sure to call ahead and ask about your bank’s check cashing policy for non-customers. Most banks cash on-us checks made out to their own customers. But they don’t have to cash third-party checks for non-customers.

2. Cash it at the Issuing Bank

You can also cash a check at the bank that originally issued it. Look at the check routing number or logo to identify the issuing bank.

Pros:

- Get cash immediately since the bank can verify funds

- Good option if you don’t have a bank account

Cons:

- Issuing bank may charge a fee

- Some issuing banks won’t cash checks for non-customers

Expect to pay 1-5% of the check amount as a fee at the issuing bank. But you’ll walk away with guaranteed funds since that bank can instantly verify the available balance.

3. Cash a Check at a Retail Store

Many major retailers like Walmart, Kroger, and Albertsons cash checks at customer service desks. The requirements are generally simple: a valid photo ID and a check made out to your name.

Store-branded prepaid debit cards are usually available if you prefer to load the money electronically. Just be aware that retailers have maximum check amounts, often around $5,000.

Pros

- Many locations are open late and on weekends

- Immediate access to cash

- Don’t need a bank account

Cons

- Maximum check amounts under $10,000

- May not cash out-of-state or third-party checks

- Shorter hours than bank locations

Check cashing fees at retailers are usually under $5 per check, making this one of the cheapest options available.

4. Deposit it on a Prepaid Card

Another option is to deposit your check onto a prepaid debit card through the card’s mobile app. Examples include prepaid cards from Visa, Mastercard, PayPal, and American Express.

Depending on the card issuer, funds may be available immediately when you pay a percentage-based fee. This can be especially helpful if you need cash fast and don’t have a bank account.

Pros

- Fast access to money

- Wide ATM availability

- Simple ID verification

Cons

- Prepaid cards have fees for purchases, reloads, withdrawals, etc.

- Limits on how much you can load or withdraw per day

Just make sure to compare prepaid card fees carefully, as they can really eat into your check amount.

5. Cash it at a Check Cashing Store

Check cashing stores and payday lenders are a last resort option if you can’t cash a check anywhere else. They cater to customers without bank accounts and will cash almost any type of check.

The biggest downside is sky-high fees, often 10% or more of the check amount. We only recommend using check cashing stores if you have no other options available.

Pros

- Cash almost any type of check

- Immediate money in hand

- Open outside normal business hours

Cons

- Extremely high fees compared to other options

- Higher fraud risk compared to banks

No matter where you decide to cash your bill pay check, make sure to call ahead and verify their requirements. And pay close attention to any fees so you walk away with the full check amount.

Key Takeaways

-

Cashing a bill pay check is easy with a valid photo ID and proper endorsement.

-

Your own bank is the fastest and cheapest option if you have an account.

-

Retailers like Walmart offer convenient check cashing for non-customers.

-

Prepaid cards allow you to cash a check through a mobile app.

-

Check cashing stores offer immediate money but charge very high fees.

So next time you need to turn a bill pay check into cash, weigh the options and choose the one that works best based on your needs. The money you save on fees means more cash in your wallet.

Check-Cashing Service

If you don’t have a bank account but have a government-issued ID, you might be able to cash your check at a nearby check-cashing service. These companies are often physical locations where you bring your check and walk out with cash.

You can generally cash a check at a check-cashing service even if you’re younger than 18 with identification. Like other check-cashing services, these companies require a flat-rate fee or fees that range between 1% and 10%, depending on the type of check.

Employer

Depending on where you work, your employer may be able to cash your paycheck for you with certain limitations in place. Additionally, some may limit the value of the checks they will cash.

Pay Bill – Pay Bill by a Check and Keep Reports With You.

FAQ

Does Walmart cash bill pay checks?

Can you deposit a bill pay check?

How can I cash a check without going to the bank?

Where can I cash a check?

The easiest place to cash a check is your own bank, but you can go to the check writer’s bank as well. Beyond banks, you can load prepaid cards, go to major retailers or use a payment service like PayPal or Venmo. Whatever your situation, there’s an option for you. Here are eight places you can cash a check. #1. Your Bank

How do I cash a check?

Another option to cash your check is to use PayPal or Venmo. They work similarly to mobile deposits through your bank account; you take a picture of the front and back of your check and submit it. Accessing your cash is free if you can wait 10 days. If you need it immediately, you can pay a fee to get it expedited.

Where can I get cash if I don’t have a bank account?

The bank listed on the check used to be the cheapest option to get your cash. Now, most of the big banks have started implementing fees to get your check cashed if you do not have an account with them. Most charge a flat rate or a percentage of the check amount up to a certain maximum.

Where can I cash a check if I have an older check?

It’s worth asking if you have an older check. The easiest place to cash a check is your own bank, but you can go to the check writer’s bank as well. Beyond banks, you can load prepaid cards, go to major retailers or use a payment service like PayPal or Venmo. Whatever your situation, there’s an option for you.