As you approach your golden years, securing a life insurance policy might seem like a daunting task. However, the good news is that even at the age of 72, you can still obtain life insurance coverage to protect your loved ones and provide financial security. In this article, we’ll explore the various life insurance options available for seniors and guide you through the process of finding the right policy for your needs.

Life Insurance for Seniors: Why It Matters

Life insurance can play a crucial role in retirement planning, even for those in their 70s. Here are some compelling reasons why seniors should consider obtaining life insurance coverage:

-

Cover Final Expenses: Funerals, medical bills, and outstanding debts can add up quickly, leaving your family with a significant financial burden. Life insurance can help cover these expenses, ensuring your loved ones are not left with a hefty financial burden.

-

Provide for Dependents: If you have dependents, such as a spouse or children who rely on your income, life insurance can help replace that lost income and provide financial support for them.

-

Leave a Legacy: Life insurance can be a valuable tool in your legacy planning, allowing you to leave an inheritance or support a charitable cause that is dear to your heart.

-

Supplement Retirement Income: Some life insurance policies, such as whole life or universal life, can build cash value over time, providing you with a source of supplemental retirement income.

Life Insurance Options for 72-Year-Olds

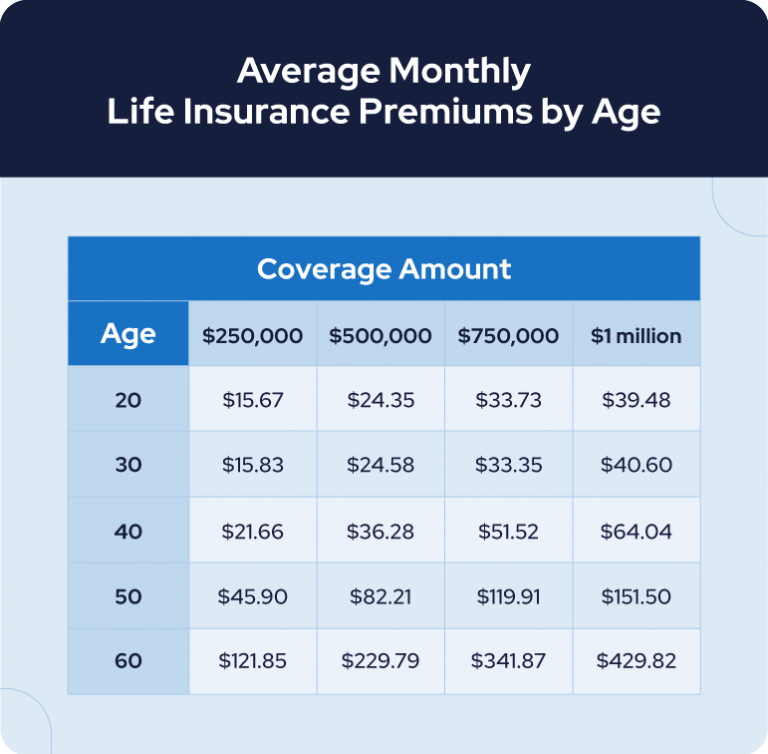

While life insurance premiums typically increase with age, there are still various options available for seniors at the age of 72. Here are some of the most common choices:

1. Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Although it may be challenging to find a traditional term life insurance policy at the age of 72, some insurers offer “guaranteed” or “simplified issue” term life insurance policies that require minimal underwriting.

These policies may have higher premiums and lower coverage amounts compared to traditional term life insurance, but they can still provide valuable protection for a limited period.

2. Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life as long as you continue to pay the premiums. While whole life insurance can be more expensive than term life insurance, it offers several advantages for seniors:

- Guaranteed Death Benefit: The death benefit is guaranteed as long as premiums are paid, providing peace of mind for your beneficiaries.

- Cash Value Accumulation: Whole life insurance policies build cash value over time, which can be accessed through policy loans or withdrawals.

- Level Premiums: Premiums remain constant throughout the life of the policy, making budgeting easier.

3. Final Expense or Burial Insurance

Final expense or burial insurance is designed specifically for seniors to cover end-of-life expenses, such as funeral costs, medical bills, and outstanding debts. These policies typically offer coverage amounts ranging from $5,000 to $25,000 and have simplified underwriting processes, making them accessible to individuals with pre-existing medical conditions.

The premiums for final expense insurance are generally affordable and remain level for the duration of the policy, making it an attractive option for seniors on a fixed income.

4. Guaranteed Universal Life Insurance

Guaranteed universal life insurance (GUL) is a type of permanent life insurance that provides coverage for your entire life, similar to whole life insurance. However, GUL policies often have lower premiums and more flexible premium payment options compared to traditional whole life insurance.

GUL policies typically require minimal underwriting and may be a viable option for seniors who want permanent coverage at a more affordable cost than whole life insurance.

Factors to Consider When Choosing Life Insurance at 72

When evaluating life insurance options at the age of 72, it’s essential to consider the following factors:

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations, outstanding debts, and desired legacy.

- Premiums: Assess the premiums for different policy types and ensure they fit within your retirement budget.

- Health Status: Your health status may impact your eligibility for certain life insurance policies or the premiums you’ll pay. Be prepared to disclose any pre-existing medical conditions or medications you’re taking.

- Beneficiaries: Carefully consider who you wish to designate as your beneficiaries and ensure your policy aligns with your estate planning goals.

It’s also essential to work with a reputable life insurance agent or broker who can guide you through the process and help you find the best policy for your specific needs and circumstances.

Making the Right Choice

Obtaining life insurance at the age of 72 may require some extra effort and consideration, but it is certainly possible. By carefully evaluating your needs, exploring the available options, and working with a knowledgeable insurance professional, you can secure the right life insurance policy to provide financial protection and peace of mind for you and your loved ones.

Remember, life insurance is not just about the coverage itself; it’s about ensuring your legacy and protecting those who matter most to you. With the right policy in place, you can enjoy your golden years with the confidence that your loved ones will be taken care of, even after you’re gone.

Best Life Insurance Options For Seniors 65 & Older!

FAQ

What is the oldest age you can get life insurance?

What is the cheapest life insurance for seniors over 70?

Does it make sense to buy life insurance at age 70?