If you’re a Medicare beneficiary considering your supplemental coverage options, you’ve likely come across the question: “Is Medigap Plan G being phased out?” With so much confusion surrounding the changes to Medicare Supplement plans, it’s understandable to have concerns. However, we’re here to provide you with the truth and put your worries to rest.

The Short Answer: No, Plan G is Not Going Away

Plan G, one of the most popular and comprehensive Medigap plans, is not being phased out or discontinued. It remains an available and viable option for anyone eligible for Medicare Supplement insurance. Despite the uncertainty surrounding some other Medigap plans, you can rest assured that Plan G will continue to be offered to new and existing Medicare beneficiaries.

Understanding the Changes to Medicare Supplement Plans

The confusion regarding Plan G’s availability stems from the recent changes to Medicare Supplement plans. Here’s what you need to know:

-

Plan F is Being Phased Out for New Enrollees: Starting in 2020, Medicare Supplement Plan F, which provided the most comprehensive coverage by paying the Part B deductible, is no longer available for individuals who are newly eligible for Medicare.

-

Plan G Offers an Alternative: With Plan F no longer an option for new enrollees, Plan G has emerged as a popular alternative, offering nearly identical coverage but requiring beneficiaries to pay the Part B deductible.

So, while Plan F is being phased out for new Medicare beneficiaries, Plan G remains an excellent choice for those seeking comprehensive coverage at a potentially lower premium cost.

Why Choose Medigap Plan G?

Medigap Plan G offers several advantages that make it an attractive option for many Medicare beneficiaries:

-

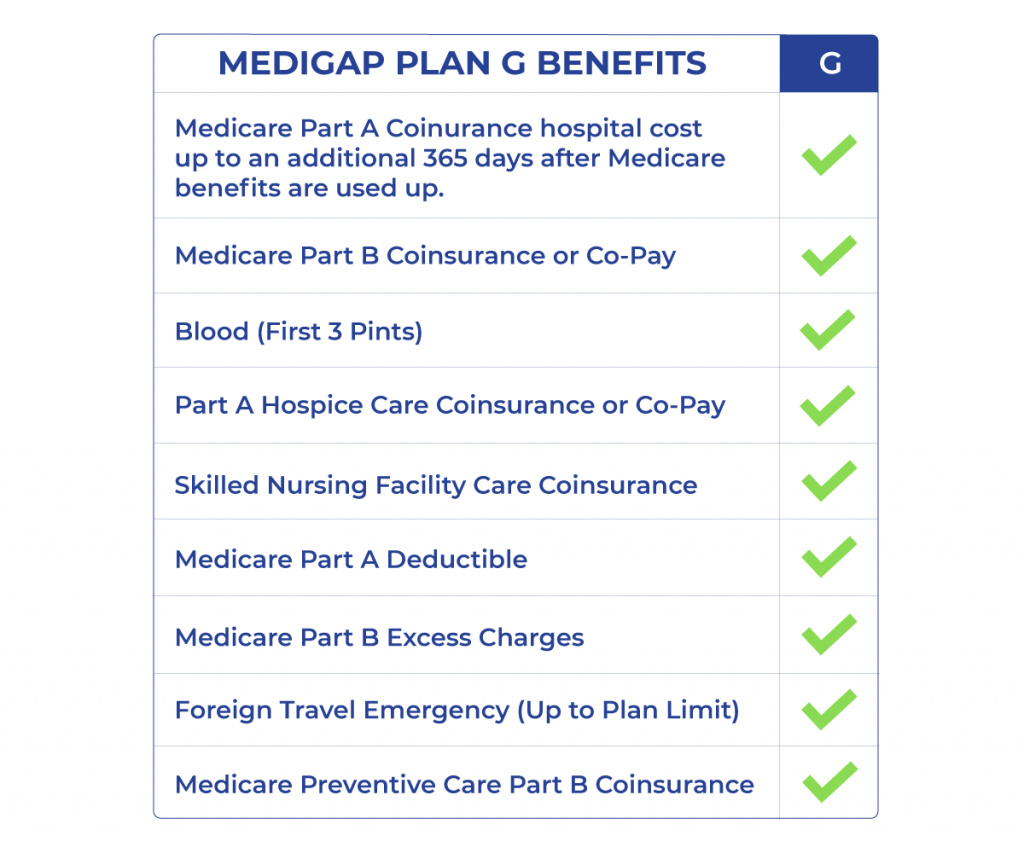

Comprehensive Coverage: Plan G covers a wide range of out-of-pocket costs, including the Medicare Part A deductible, coinsurance for skilled nursing facility care, and foreign travel emergency care.

-

Lower Premiums: Since Plan G requires you to pay the Part B deductible, its premiums are typically lower than those of Plan F, making it a more cost-effective choice for many individuals.

-

Nationwide Acceptance: Like all Medigap plans, Plan G is accepted by any healthcare provider that accepts Medicare, ensuring you have coverage wherever you go within the United States.

Enrolling in Medigap Plan G

If you’re interested in enrolling in Medigap Plan G, the process is straightforward:

-

Enroll in Medicare Parts A and B: Plan G is designed to supplement Original Medicare, so you must first be enrolled in both Part A (hospital insurance) and Part B (medical insurance).

-

Research Insurance Companies: Different insurance companies offer Plan G at varying rates and with different additional benefits. Compare options to find the best fit for your needs and budget.

-

Enroll During Your Medigap Open Enrollment Period: This is the six-month period that begins when you turn 65 and enroll in Part B. During this time, you can enroll in any Medigap plan, including Plan G, without medical underwriting or facing higher premiums due to pre-existing conditions.

Top Providers Offering Medigap Plan G

While numerous insurance companies offer Medigap Plan G, some of the top providers include:

- Mutual of Omaha

- Aetna

- Humana

- AARP (through UnitedHealthcare)

- Cigna

Each provider offers unique benefits and pricing structures, so it’s essential to compare options and choose the one that best suits your needs and budget.

Additional Benefits and Considerations

When selecting a Medigap Plan G provider, keep in mind that some companies may offer additional benefits beyond the standard coverage. These can include:

- Discounts on dental, vision, or prescription drug coverage

- Access to nurse hotlines or wellness programs

- Fitness club memberships

- Vision or hearing discounts

It’s also important to consider factors like customer service, financial stability, and the provider’s reputation when making your choice.

The Bottom Line

Medigap Plan G is not being phased out or discontinued. It remains a readily available and comprehensive option for Medicare beneficiaries seeking supplemental coverage. By understanding the recent changes to Medicare Supplement plans and the advantages of Plan G, you can make an informed decision that best suits your healthcare needs and financial circumstances.

Remember, it’s always advisable to consult with a licensed insurance agent or Medicare expert to ensure you have the most up-to-date information and guidance when navigating your Medicare coverage options.

5 Reasons NOT to Get a Medicare Supplemental Plan?

FAQ

Is Medicare plan G going away?

Which Medigap plan is being discontinued?

Why is Plan G better than Plan F?

What are the disadvantages of Medicare Part G?